Locator: 48441RECESSION.

JPow: the ball is in your court.

Locator: 48440B.

Seasonal "flu": "flu season" is over. Link here.

*************************************

Back to the Bakken

WTI: $69.76.

Active rigs: 32.

Eight new permits, #41656 - #41663, inclusive:

One producing well (a DUC) reported as completed, February 28, 2025:

Locator: 48438PEMEX.

Pemex: more bad news. Link here.

"Come back when you're ready to make a deal," Trump to Z. "Make a deal or we're out."

Better "red" than dead? Was that Trump's real message?

US equity markets: up strongly. Rounded up at the close:

Other market indicators:

Pocahontas takes an arrow for the consumer: link to The Wall Street Journal.

Long overdue:

BRK-B: hits another 52-week high today.

Pemex: more bad news. Link here.

Skype: another Microsoft product gone.

Illegal immigration: comes to a stop.

Inflation: Goldilocks numbers.

******************************

Back to the Bakken

WTI: $69.45.

New wells:

RBN Energy: logistical challenges, price tag complicate Trump's goal of refilling SPR.

Strategic Petroleum Reserve (SPR) inventories have been climbing for more than a year, but they could go much higher if President Trump has his way, as one of his major campaign promises was to refill the SPR “to the very top,” a goal he has repeated since his return to the Oval Office. Current inventories sit just below 400 MMbbl, leaving the SPR about 320 MMbbl shy of maximum capacity. But the refilling process may not be as straightforward as one might think, as three of the four SPR storage sites have experienced construction upgrades in the last year — which means things could go slower than anticipated. In today’s RBN blog, we’ll discuss the challenges of filling up the SPR and detail four scenarios for how the process might play out.

Locator: 48436CHORD.

See disclaimer. This is not an investment site.

There are only a handful of companies operating in the Bakken in which I would invest. Chord Energy is one of them. I recently pivoted out of energy into tech (over the past three years) and I do not know if I still own any Chord Energy shares.

Prior to the dividend hike, CHRD is paying 7.21%.

From today:

Elsewhere, holy mackerel, link here:

Washington, DC; February 27, 2025—Total money market fund assets increased by $60.54 billion to $6.97 trillion for the week ended Wednesday, February 26, the Investment Company Institute reported today. Among taxable money market funds, government funds2 increased by $52.97 billion and prime funds increased by $5.84 billion. Tax-exempt money market funds increased by $1.72 billion.

Also, link here.

**********************

Outbreak: Congo

Being reported by the WHO over the last couple of days, and I can't make this up:

The WHO said in a statement Thursday that, along with Congo health officials, it was "carrying out further investigations to determine the cause of another cluster of illness and community deaths" in the Equateur province, marking the third time this year disease surveillance teams have identified an increase in illness and deaths in the region.

"The most recent cluster occurred in the Basankusu health zone, where last week 141 additional people fell ill, with no deaths reported," the United Nations' global health agency said. "In the same health zone, 158 cases and 58 deaths were reported in the same health zone (sic) earlier in February. In January, Bolamba health zone reported 12 people who fell ill including 8 deaths."

The WHO's Africa office said earlier this week that the first outbreak was among several children who ate a bat and then died within 48 hours after experiencing hemorrhagic fever symptoms, similar to those caused by the Ebola or Marburg viruses.["Several": the exact number was unspecified.]

Population of Congo:

Apparently it is time for USAID to send a $100 million video to Congo on angers of eating bats.

And perhaps while we're at it, a $100 million video to a certain community in Texas on the importance of measles vaccination.

I'm getting so tired of this crap.

Reading the AP story on General Brown's replacement is just as shameful.

By the way, quick! Tell me General Brown's birth date. Not just the year he was born, but the month and day (and the year).

*******************************

The Woman I Most Admire This Evening

Ms Rachel Powell, Venango County, Pennsylvania.

Locator: 48434AMAZON.

Alexa:

If the story is accurate -- it's a bit confusing -- this is a $20/month benefit for Amazon Prime subscribers. Again.

***************************

California Bullet Train

Victor Davis Hanson, in his podcast that streamed on YouTube February 27, 2025, said that the California Bullet Train would eventually cost $300 billion, and has spent $20 billion today. Referenced the Tulare Lake (one of many links here) fiasco. "If you could build the Bullet Train" it would still not make enough money through ticket sales to maintain operations. The host questioned the veracity of that figure of $300 billion and VDH confirmed that was the number he was hearing: $300 billion.

***************************

Pacific Palisades Fire

Things must not be going well. The Los Angeles mayor has just fired the lesbian fire chief. Having said that, I knew her days were numbered from the beginning.

Locator: 48433EPSTEIN.

Epstein list, phase 1: was released today. Over-promised, under-delivered.

**************************

Soros-Funded Networks

I'm not a conspiracy theorist but ....

.... link here.

Along that same line? Bluesky will fade away.

I've never seen such a lame knock-off as Bluesky.

********************************

Trump Administration

From the diary:

February 27, 2025: holds first full cabinet meeting with all cabinet members, yesterday, February 26, 2025. Absolutely steady, rock-solid.

Through yesterday, the first five weeks of his administration, Trump concentrated on a) his cabinet; and on b) general policy executive orders. Now it appears Trump has moved into the second leg of his first 100 days. He is a) concentrating on holding his cabinet members accountable; almost holding first full Cabinet meeting as his "Apprentice" reality show, playing Cabinet members off each other; and, b) concentrating on ending bloodshed in Ukraine and in Gaza. And there are actually folks against Trump on this issue.

The photo optic: SecState - POTUS - SecDefense aligned at the base with VP JD Vance at the apex of that power triangle at the Cabinet table. But the real guest: Elon Musk. One wonders how that makes cabinet members feel? Doesn't matter? That's who their boss likes and one better get on board if one still has any doubts. Trump is not looking for action / decisions / governing through committee and focus groups. He wants to see individual leadership. Kristi Noem seems to understand.

Trump is a whirling dervish at 78 rpm whereas Barack Obama spun at 33 rpm. Biden? A broken record.

Locator: 48432NVDA.

See disclaimer.

This is not an investment site.

Drops 8%. Drops out of the $3-trillion club.

Whether one is an investor or a trader: margins matter.

Most amazing graph ever. Okay, two most amazing graphs ever.

LDC growth, link here:

The size of these arms, link here:

NVDA revenue:

The key to trading: FOMO, YOLO, SA.

The key to investing (perhaps in reverse order):

The importance of diversification:

***************************************

Apple

Locator: 48431B.

Burgum: "we're not in an 'energy transition’ environment; we're in an 'energy addition' environment.”

Mexican cartels:

Saskatchewan: pre-approves all pipelines through its territory.

Italy: plans $3 billion aid package due to high energy prices.

Tariffs: to take effect as planned, March 4, 2025 -- President Trump.

WTI: $70.35.

Active rigs: 33.

Three new permits:

One permit renewed:

Four producing wells (DUCs) reported as completed:

Locator: 48430B.

Keeping promises: Trump terminates Chevron's agreement with Venezuela. Great move. Keeping promises.

EU/Europe - Ukraine: FAFO. Best example ever.

RFK, Jr: remains cool, calm, and collected. A refreshing change. Link here.

Tulsi Gabbord: cleaning house.

Trans: Trump administration bans trans from military. That's the headline. Some exceptions.

Gene Hackman, wife, dog: dead in Santa Fe home. He was 95 years old. No foul play suspected.

***********************************

Back to the Bakken

WTI: $69.40.

New wells:

RBN Energy: acquisition of Colex Terminal, Sinco Network, open up possibilities for Edgewater. Archived.

Edgewater Midstream, a relatively new player in the refined products storage and delivery space, acquired a pair of potentially valuable assets from Shell in the Deer Park, TX, area in December, 2024. It now owns the Colex terminal, starting point of the all-important Colonial Pipeline system, and the Sinco products pipe network, which could offer another pathway to Desert Southwest markets served by a dwindling number of California refineries. In today’s RBN blog, we will examine Edgewater’s new assets and the market opportunities they may open up.

Let’s start with a short primer on Edgewater Midstream, which private equity firm EnCap Flatrock Midstream owns. The Houston-based company was created in 2019, just before the pandemic. Throughout that period, the company sought potential assets to buy, including those focused on crude oil and refined products, to underpin its business. Negotiations for Shell’s Colex terminal and Sinco pipeline system began in Q2 2024, culminating in a deal that would give Edgewater its first physical assets. The Colex terminal on the Houston Ship Channel (HSC) and the Sinco system were historically operated in conjunction with the 340-Mb/d Deer Park refinery, once a joint venture (JV) between Shell (operator) and P.M.I. Comercio Internacional S.A. de C.V. (PMI), a subsidiary of Mexico’s state-owned PEMEX. That changed in 2022 when Shell sold its 50% stake in the refinery to PMI for $596 million, although it retained the Colex and Sinco assets.

Let’s look next at Edgewater’s new acquisitions, starting with the Colex complex (see Figure 1 below), which includes both an East and West terminal. The complex is the starting point of the 1.5-MMb/d Colonial product pipeline system (blue lines), which transports products from Gulf Coast refineries to markets across the Southeast and East Coast. The Colonial network culminates at New York Harbor, a major market for refined products and delivery point of the NYMEX RBOB gasoline and ultra-low-sulfur diesel (ULSD) futures contracts.

A ransomware attack on the Colonial system nearly four years ago disrupted supply for retail businesses, for weeks in some states, and triggered panic buying across the Eastern Seaboard, underscoring how important the network is for the region’s fuel needs. Besides Colonial, the Colex site feeds directly into the Explorer system (pink lines), which serves the Midwest products market. An interesting tidbit: The facility got its name from cobbling together the first three letters of Colonial (Col) Pipeline and the first two letters of Explorer (Ex) Pipeline. The Colex site is also directly connected to the ITC Pasadena terminal (blue tank icon) along the HSC, which handles waterborne, railed, trucked and piped supplies of petroleum products, NGLs, LPG and liquid chemicals.

Figure 1. Colonial Pipeline, Explorer Pipeline and Related Infrastructure. Source: RBN

Locator: 48429EPA.

EPA reports to the President.

The EPA provides technical support for the DOI on environmental issues.

The chain of command is not all that long.

News today:

Under Trump, the EPA finished phase 1 ahead of schedule in southern California following the historic fires earlier this year. I didn't think it could happen.

Locator: 48428B.

Book for the day: The Penguin Atlas of D-Day, John Man, c. 1994. I visited the beaches with my family to include two middle-school daughters, while assigned to Europe back in the 1980s. What great memories when I came across this book in the Bat Cave.

George:

Movie short: here.

****************************************

Back to the Bakken

WTI: $68.62.

Active rigs: 31.

Seven new permits, #41644, 41646 - #31650, inclusive, and #41652:

Locator: 48427B.

Eggs, Walmart, north Texas, DFW area -- I didn't buy any because I didn't need any today, but $3.98 / dozen LARGE eggs:

Meanwhile, Louisville, KY, link here:

X: if you don't follow X, today might be a great day to start.

Holy mackerel: trending --

******************************

Back to the Bakken

WTI: $68.80.

New wells:

RBN Energy: top-tier midstreamers double down on expanding Permian-to-Gulf infrastructure. Archived.

In their first earnings calls of 2025, the handful of large midstream companies that provide the gamut of “wellhead-to-water” services in Texas laid out plans for yet another round of projects — everything from gas processing plants and takeaway pipelines to fractionators and export terminal expansions. At the same time, many of these same midstreamers expressed a degree of caution about overbuilding. They sought to reassure Wall Street that they were only approving plans underpinned by strong commercial support. In today’s RBN blog, we discuss the latest capital spending plans of this select, upper tier of midstream service providers.

Over the past few years, a small but gradually growing group of midstreamers have seen the benefits of owning and operating the infrastructure that processes, transports and, in many cases, exports the increasing volumes of crude oil, natural gas and NGLs emerging from wells in the Permian Basin. As we said in Get Ready, our late-2023 Drill Down Report on gas-and-NGL-focused “networks” in the Lone Star State, offering a full range of midstream services “provides a number of important benefits — chief among them, the ability to operate with extraordinary efficiency, collect fees from shippers each step of the way, and feed pipelines, fractionators, storage and export terminals along the network’s value chain.”

In the report, we focused on the four companies with the most comprehensive sets of midstream assets in that space — Enterprise Products Partners, Energy Transfer, Targa Resources and Phillips 66. More recently, in At Last, we blogged about MPLX and ONEOK joining that august club with their plans (some joint and some solo) to build out NGL pipeline, fractionation and LPG export capacity in the Texas City, TX, area.

A few midstreamers also provide wellhead-to-water services for crude oil, including Enbridge, which holds significant ownership interests in the Gray Oak and Cactus II pipelines as well as 100% of the U.S.’s #1 crude export terminal, the Enbridge Ingleside Energy Center (EIEC) near Corpus Christi. Similarly, Enterprise owns, among other things, the South Texas Crude Oil Pipeline System, stakes in elements of the Midland-to-ECHO system, and a host of oil storage and export terminals, including the ECHO terminal and Enterprise Hydrocarbons Terminal (EHT) in the Houston area.

In today’s blog, we’ll begin a review of what the largest midstream network owners in Texas have committed to adding to their portfolios this year and in 2026. As you’ll see, most of these companies continue to expand their Permian-to-Gulf capabilities at a full-throttle pace, though — as we noted up top — at least a few of them have sought to assure Wall Street analysts (and investors in general) that they will not get over their skis.

Enterprise is a case in point. The midstream giant recently made headlines when, during its February 4 earnings call, it acknowledged that the company had so far “not gotten enough traction” in commercializing its long-planned Sea Port Oil Terminal (SPOT) and would not proceed with the project unless market dynamics shift and long-term volume commitments materialize. Co-CEO Jim Teague said that while the economics behind SPOT — a deepwater crude oil export facility off Freeport, TX, that would be capable of fully loading Very Large Crude Carriers (VLCCs) — continue to compare favorably to onshore terminals that can only partially load VLCCs, there have been at least a couple of notable changes in the market since the project was proposed six years ago.

Figure 1. Enterprise Projects in Texas. Source: RBN

Locator: 48426B.

Victor Davis Hanson: Maine pulls a South Carolina. Link here. Get out the popcorn.

White House daily briefing: much-watch television.

Investing: not for the timid. But, wow, what incredible opportunities if one stays cool, calm, and collected. I wish I could say more; not tonight. Maybe some other day.

Amazon: is amazing.

This afternoon, about 2:00 p.m. I ordered a Seagate external drive; it arrived at my doorstep at 8:00 p.m. this evening.

Apple products: are amazing. They simply work.

By the way, in today's Oval Office visit with the White House Press Corps, President Trump mentioned only one US company and one CEO by name -- Tim Cook -- and he spent quite some time talking about Tim Cook and Apple. Tim Cook has earned every penny of his salary this year.

The Atlantic: of all the mainstream media I read, and I read a lot, The Atlantic has changed the most. It's amazing. Its political slant is fascinating. I assume I will renew my subscription, but the magazine is becoming more and more irrelevant.

************************************

Music Interlude

*********************************

Back to the Bakken

WTI: $69.11.

Active rigs: 32.

Two new permits, #41642 - #41643, inclusive:

***************************

Technology

*************************

Medical Note

A most interesting phenomenon earlier this evening.

About 7:30 p.m. CT this evening, I may have suffered a very, very minor neurological event -- all of a sudden I lost all ability to recall where I posted information on my hard drive and on my blog. It was incredibly "scary" but also very, very interesting. I honestly lost all ability to find files on my hard drive, and I certainly couldn't blog. In addition, my vision was became an issue. For about an hour I was unable to focus. I didn't have double vision or blurred vision, it was as if each eye worked independently but used together it was almost impossible to read. It was if the left half of the page was shifted up a half line and the right half of the page was shifted down a half line, if that makes sense.

I was interrupted by a phone call from my daughter and one of my granddaughters. Both phone calls went very, very well. And after about thirty minutes on the phone (two different conversations; one of which was "FaceTime") everything seemed back to normal. And now, blogging and updating files on the hard drive -- everything seems back to normal.

********************************

Reminiscing

Going through some old memorabilia tonight, my wife stumbled across this e-mail note from some fifteen years ago, recalling a conversation with our old granddaughter who was about eight years old at the time.

The screenshot:

Locator: 48425BUZZ.

Predictable: after AP sues to get back into the White House press pool, the Trump administration will change the "unwritten" rules:

Stacey Abrams: billionaire! Link here.

A climate group linked to high-profile Democrat Stacey Abrams was granted $2 billion by the Biden administration in a "scheme" of "wasteful" spending.

The Environmental Protection Agency (EPA) recently made a revelation that the Biden administration was allowing just eight entities to distribute $20 billion of taxpayer dollars "at their discretion."

Stacey Abrams was in charge of the "clearing house" to manage $2 billion of that $20 billion: included in the funds was a $2 billion grant to Power Forward Communities, a nonprofit with ties to former Democratic gubernatorial candidate Stacey Abrams that seeks to "reduce our impact on the climate" by financing the replacement of household appliances in lower-income communities with green alternatives.

Warren Buffett: annual letter.

Apple: one-half trillion dollars to be spend in the US over the next four years -- and Apple will start with $500 million (?) for Houston. Link here.

Apple: TSMC.

X-35B: link here.

Locator: 48424B.

Victor Davis Hanson: the truth and troubles of left politics. Tuesday, February 25, 2025. Must-watch. Ukraine: biggest disaster for Russian since Stalingrad. Starts with Joy Reid. Great, great video. Analysts who scoff at Trump's "rare earths" negotiations with Zelenskyy simply don't get it. VDH explains it; fascinating,

Reports Q4 revenue $3.76 billion, consensus $4.73 billion [ouch]. Sempra Energy cuts FY25 EPS view to $4.30-$4.70 from $4.90-$5.25[double ouch].

“With the reset of our guidance in 2025, we are setting a new foundation for a decisive decade of growth,” said Jeffrey W. Martin, chairman and CEO of Sempra. “We are also announcing a record five-year capital plan of $56 billion and raising the company’s long-term EPS growth rate to 7%-9%.

Over half of planned capital expenditures are earmarked for Texas, where significant new investments are needed to expand and modernize the energy grid. This is consistent with Sempra’s 2030 aspirations of producing over 50% of its earnings from the State of Texas.

Starbucks’ sales have slipped for four straight quarters, the longest decline in years.

Some customers stopped going to Starbucks because of high prices for drinks and long wait times, and hundreds of its stores have voted to unionize in protest of pay, benefits and working conditions.

More than 30% of Starbucks’ orders now come from customers ordering off their phones and picking them up. This influx of mobile orders has sometimes strained Starbucks workers during rush hours.

**********************************

Back to the Bakken

WTI: $70.33. Barely holding above $70.

New wells:

RBN Energy: Mexico's energy strategy may rest on fate of natural gas pipelines.

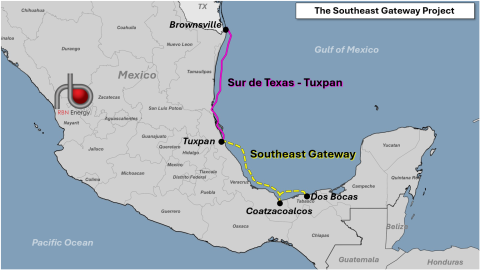

A significant shift is underway within Mexico’s energy landscape, reflected by the development of large-scale oil and gas infrastructure projects in the country, particularly the Southeast Gateway and Sierra Madre gas pipelines that would move U.S.-sourced natural gas across Mexico. These projects — the first an undersea pipe in the Gulf of Mexico and the second a pipe across the country’s northern tier — would enhance Mexico’s gas transport capacity while supporting power generation and industrial development. Mexico, which is already heavily reliant on imports of U.S. gas, is forecast to see gas demand rise in the coming years as domestic production drops. In today’s RBN blog, we look at those two pipelines, their challenges, and how the potential for U.S. tariffs on Mexican imports might complicate the future of both projects.The Southeast Gateway Pipeline (dashed yellow line in Figure 1 below), also known as Gasoducto Puerta al Sureste, is a $3.9 billion (79 billion Mexican Peso) project led by TC Energy in partnership with Mexico’s state-owned Comisión Federal de Electricidad (CFE) that is slated to come online in May. (Allseas, a U.S. contractor, said in January that it had completed laying the offshore sections of the pipeline.) The conduit extends TC Energy’s existing 2.6-Bcf/d Sur de Texas-Tuxpan undersea pipeline (magenta line), which runs from Brownsville, TX, to Tuxpan. (As we noted in Southern Cross, Sur de Texas-Tuxpan connects with Enbridge’s Valley Crossing pipeline at the border. The gas for Southeast Gateway would be sourced from the Agua Dulce hub in South Texas.)

Figure 1. The Southeast Gateway Project. Source: RBNThe 444-mile (715-km), 1.3-Bcf/d undersea pipeline would link three key ports — Tuxpan and Coatzacoalcos in Veracruz state and Dos Bocas in Tabasco state. Its end users would likely include existing (about 240 MMcf/d) and future CFE power plants on Mexico’s Yucatán Peninsula that should begin service this year. (CFE, one of Mexico’s largest state-owned enterprises, provides transmission services and distributes electricity; generates and sells electricity; and imports, exports, transports, stores, purchases and sells natural gas, coal and other fuels. It also develops and executes engineering projects, research, and geological and geophysical activities; and oversees the development and implementation of energy sources.)

Locator: 48422B.

Back on December 10, 2022, I suggested one of these wells might be the first Bakken well to hit 2 million bbls of oil cumulative and the spacing is only one section:

Locator: 10010USA2D.

The two wells:

The first well: noteworthy that it may be the first Bakken well to hit two million bbls crude oil cumulative.

- 16059, 729, Petro-Hunt, USA 2D-3-1H, Charlson field, single section, t10/06; cum 1.870044 million bbls 10/21; still producing 6,000 bbls/month, 11/19; update at this post; off line 5/20; remains off line 6/20; two days in 7/20; to be lengthened; confidential noted 11/20; still confidential but now producing again after being lengthened; update here; update here; cum 1.870044 million bbls 10/21; re-entry; cum 1.945212 million bbls 5/22; cum 1.966330 million bbls 10/22; cum 2.020875 million bbls 12/24;

- 16424, 700, Petro-Hunt, USA 11B-2-2H, Charlson, single section, t7/07; cum 673K 4/20; off line 5/20; remains off line 12/20; two days in 7/20; significant decline beginning 4/20; cum 805K 10/21; see this post; cum 1.002055 million bbls 5/22; see recent production here; cum 1.105512 millioon bbls 10/22; producing 20,000 bbls/month; 1.311227 million bbls 12/24; now producing 5,000 bbls oil per month;

The map:

Locator: 48421B.

Wow, a great day. The forecast was for 71° and it hit a high of 73°. Sunny and no wind. Whoo-hoo! Spring is here, the best time of the year, here in north Texas.

The NASDAQ pulled back today and I had one of my better days in the market.

I may say something about Apple later, but wow, BRK was incredible. I remember two years ago, or was it last year, that GEICO was struggling and now it's had a great turnaround. That GEICO gecko can take all the credit. It was also noteworthy that BRK had minimal losses due to fires in California. Pretty amazing. Ticker BRK-B was up almost 5%; up almost $20; and traded at a 52-week high. This was not on my bingo card today.

Okay, back to the Bakken.

Transfer Energy vs Greenpeace: finally in court. DAPL. Link to NYT. I probably won't follow the court action or post updates unless major updates. There's been a lot of talk that Greenpeace could lose this case. My hunch: framed as a "free speech" case, Greenpeace will prevail.

Greenpeace went on trial on Monday in North Dakota in a bombshell lawsuit that, if successful, could bankrupt the storied group.

The Dallas-based company Energy Transfer sued Greenpeace in 2017, accusing it of masterminding raucous protests over the construction of the Dakota Access Pipeline near the Standing Rock Sioux Reservation nearly a decade ago. The activists say the lawsuit is a thinly veiled tactic to suppress free speech and set a chilling precedent for protest groups, and that Greenpeace played only a supporting role in demonstrations that were led by Native Americans.

“This trial is a critical test of the future of the First Amendment, both freedom of speech and peaceful protest under the Trump administration and beyond,” Greenpeace’s interim director, Sushma Raman, said in public remarks on Thursday.

Energy Transfer declined to comment in advance of the trial. In a statement in August, it said the lawsuit against Greenpeace was “not about free speech as they are trying to claim. It is about them not following the law.”

******************************

End-Of-Day Report

WTI: $70.99.

Active rigs: 31.

One new permit, #41641:

The buzz -- headline and some links. It doesn't take a weatherman to know which way the wind is blowing.

Joann: to shutter all 800 locations; unable to find a buyer.

Jamie Dimon: supports Elon Musk and DOGE.

TCM: All The President's Men -- must watch. In current context of national politics.

BRK: not on my bingo card today -- BRK-B up 5% today; up $24 / share. Much could be said.

North Dakota connection: The Secret Service agent who leaped onto the back of President John F. Kennedy's limousine after the president was shot has died. North Dakota native Clint Hill was 93.

Delta: another Delta a/c with emergency landing at Atlanta. Smoke, or fire, or something.

Roberta Flack dead at 88.

Chevron: will lay off 15 - 20% of its global workforce and reorganize its business structure. My hunch: DEI disappears from the organizational chart. Human resources downsized.

Bullet train: Will miss more deadlines. Link here. Tea leaves suggest bullet train will not be completed this century. Three generations of construction workers will have had lifetime job security with this boondoggle.

Lester Holt "let go." Perhaps he wants to spend more time with his family. I don't know.

Joy Reid sacked: her staff is angry. Bluesky social media blows up.

RFK, Jr, to the rescue? Texas measles outbreak surges to 90 cases.

ICE: Amazon.com selling fake ICE jackets.

New world order:

New world order:

Ukraine: major developments starting to show up on radar scope. This is where strategic thinking makes a difference.

Middle East countries: starting to pivot from oil to tech -- investing outside of the Middle East.

Geiger Capital: one of my favorites over at x.

Theranos / Elizabeth Holmes: loses appeal to overturn conviction. I may be missing something but she seems really, really delusional. Just a private, personal opinion.

Apple: moving at the speed of light … Apple light … to build $500 billion AI chip factory in .... Houston! Where did that come from? Link here.

… the servers will be equipped with TSMC's high-end M5 chips, which are set to enter mass production as soon as the second half of 2025.

Foxconn already has a facility in Houston, and it bought additional land for new projects last year. Servers will be produced at existing facilities starting in the second half of 2025, with assembly expanding to the new facility when it launches in 2026.

Aging protein: AP2A1.

Eggs: Denny’s puts surcharge on eggs. Market-by-market.

Prices for white eggs rose to $8.07 per dozen last week, a 33-cent increase or 4.7%. Inventories fell 2% overall and were off 3.5% for cage-free products and 12.5% for nutritionally enhanced eggs.

FBI deputy director named:

X-37B: launched back in late 2023. Still orbiting. Hasn't set any records, yet.

Locator: 48419BUSES.

Electric school buses.

One can do a word search on the blog for EV school buses, Proterra. Here's one link.

Update regarding Proterra, maker of electric school buses:

So, now what. From a reader, link here: https://www.breitbart.com/tech/2025/02/24/ev-fiasco-epa-investigates-maines-faulty-electric-school-buses-built-by-canadian-company/.

Now, let's see what company this is. I haven't read the article, until now, reading it with you:

The EPA visited schools in Winthrop, Maine, late last month as part of an investigation into electric buses supplied to the schools through federal grants.

The probe comes after it was discovered that the buses built by a Canadian company have proven faulty. Federal agents visited the Maine schools in late January while probing electric school buses built by the Quebec-based Lion Electric Coompany.

... four electric buses that have been plagued with problems ever since they arrived in Winthrop from Lion Electric in late 2023 (Biden administration).

Lion Electric, headquartered in Saint-Jérôme, Canada, has recently filed for credit protection and was the first company to provide Maine with electric buses through a federal program seeking to replace gasoline-powered buses with EVs ...