Locator: 48427B.

Eggs, Walmart, north Texas, DFW area -- I didn't buy any because I didn't need any today, but $3.98 / dozen LARGE eggs:

Meanwhile, Louisville, KY, link here:

X: if you don't follow X, today might be a great day to start.

Holy mackerel: trending --

- Luca

- New Gaza

- Screw JPow

- Trump gets his $4-trillion tax cut

- Dems vote to keep taxes on:

- tips;

- seniors;

- union workers

- GOP votes "no" on taxes on

- social security

- overtime

- tips

- American business is back!

- tariffs: three more business days

- the art of the deal:

- Ukraine / Zelenskyy trades half his nation's mineral resources to Trump:

- I'm not sure Zelenskyy got anything in return;

- Biden: WTF

- Elon Musk attends Cabinet meetings

- left goes nuts

- Jill Biden attends Cabinet meetings

- crickets

- media features Vogue-like photos of the Doctor at the head of the Cabinet table

- Biden: WTF

- Trump like Luca

- was Trump's entire cabinet confirmed in first 30 days?

- NBA: WTF

******************************

Back to the Bakken

WTI: $68.80.

New wells:

- Thursday, February 27, 2025: 53 for the month, 98 for the quarter, 98 for the year,

- 39953, conf, Hess, EN-Heinle-156-94-2536H-4,

- Wednesday, February 26, 2025: 52 for the month, 97 for the quarter, 97 for the year,

- 40495, conf, Hess, GO-Olson-157-98-2536H-3,

RBN Energy: top-tier midstreamers double down on expanding Permian-to-Gulf infrastructure. Archived.

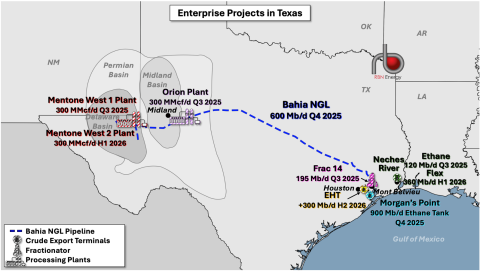

In their first earnings calls of 2025, the handful of large midstream companies that provide the gamut of “wellhead-to-water” services in Texas laid out plans for yet another round of projects — everything from gas processing plants and takeaway pipelines to fractionators and export terminal expansions. At the same time, many of these same midstreamers expressed a degree of caution about overbuilding. They sought to reassure Wall Street that they were only approving plans underpinned by strong commercial support. In today’s RBN blog, we discuss the latest capital spending plans of this select, upper tier of midstream service providers.

Over the past few years, a small but gradually growing group of midstreamers have seen the benefits of owning and operating the infrastructure that processes, transports and, in many cases, exports the increasing volumes of crude oil, natural gas and NGLs emerging from wells in the Permian Basin. As we said in Get Ready, our late-2023 Drill Down Report on gas-and-NGL-focused “networks” in the Lone Star State, offering a full range of midstream services “provides a number of important benefits — chief among them, the ability to operate with extraordinary efficiency, collect fees from shippers each step of the way, and feed pipelines, fractionators, storage and export terminals along the network’s value chain.”

In the report, we focused on the four companies with the most comprehensive sets of midstream assets in that space — Enterprise Products Partners, Energy Transfer, Targa Resources and Phillips 66. More recently, in At Last, we blogged about MPLX and ONEOK joining that august club with their plans (some joint and some solo) to build out NGL pipeline, fractionation and LPG export capacity in the Texas City, TX, area.

A few midstreamers also provide wellhead-to-water services for crude oil, including Enbridge, which holds significant ownership interests in the Gray Oak and Cactus II pipelines as well as 100% of the U.S.’s #1 crude export terminal, the Enbridge Ingleside Energy Center (EIEC) near Corpus Christi. Similarly, Enterprise owns, among other things, the South Texas Crude Oil Pipeline System, stakes in elements of the Midland-to-ECHO system, and a host of oil storage and export terminals, including the ECHO terminal and Enterprise Hydrocarbons Terminal (EHT) in the Houston area.

In today’s blog, we’ll begin a review of what the largest midstream network owners in Texas have committed to adding to their portfolios this year and in 2026. As you’ll see, most of these companies continue to expand their Permian-to-Gulf capabilities at a full-throttle pace, though — as we noted up top — at least a few of them have sought to assure Wall Street analysts (and investors in general) that they will not get over their skis.

Enterprise is a case in point. The midstream giant recently made headlines when, during its February 4 earnings call, it acknowledged that the company had so far “not gotten enough traction” in commercializing its long-planned Sea Port Oil Terminal (SPOT) and would not proceed with the project unless market dynamics shift and long-term volume commitments materialize. Co-CEO Jim Teague said that while the economics behind SPOT — a deepwater crude oil export facility off Freeport, TX, that would be capable of fully loading Very Large Crude Carriers (VLCCs) — continue to compare favorably to onshore terminals that can only partially load VLCCs, there have been at least a couple of notable changes in the market since the project was proposed six years ago.

Figure 1. Enterprise Projects in Texas. Source: RBN