Locator: 48734TECH.

Thursday, November 7, 2024

Wow -- This Never Quits! -- Now, It's Nissan -- November 7, 2024

Locator: 48733AUTOS.

Wait until they start selling EVs. LOL.

Car manufacturers are in deep doo-doo! The dots are easy to connect.

President-Elect Selects Susie Wiles For Chief Of Staff -- Another First -- Second Most Powerful Position In The World? November 7, 2024

Locator: 48731B.

Counterintuitive: the best thing with regard to the Trump phenomenon? That "gap year." Or rather, the "four-year-gap." It gave him four years to prepare for his second term. This will turn out to be huge for him and his administration.

Still the most fun I'm having: Sky News.com.au, lefties losing it. Gutfeld!

Thursday Night Football! Amazon Prime. TNF comes with the subscription; no extra charge.

US Senate, is it now 53 - 45? With two uncalled -- Nevada and Arizona? Link here.

White House, US president's chief of staff: first female for this post ever in the history of the US; appointed by President-elect Trump. Susie Wiles with an incredible resume. Probably the second most important position in the US, after POTUS.

"Fed chair": can only be removed "for cause." A bit unclear who can remove the "Fed chair" "for cause." So, already that's an issue for the press. Current "Fed chair" was originally appointed by President-elect Trump.

The first "influencer" election: won by Trump. Perhaps most powerful, Joe Rogan. As folks may remember, Kamala Harris unable to fit a 3-hour podcast into her busy schedule. Link here.

At least there's one adult in Hollywood:

Parting shot, link here:

Megyn Kelly: Trump supporter and Blackout Coffee --

*****************************

Back to the Bakken

WTI: $72.17.

Active rigs: 38.

One new permits:

- Operator: Phoenix Operating

- Field: Green Lake (Divide County)

- Comments:

- Phoenix Operating has a permit for a Ferrari well, SESW 34-160-100,

- to be sited 325 FSL and 2024 FWL

Three permits renewed:

- Hunt (2): two Halliday permits, Werner oil field, Dunn County;

- Enerplus: a Hall permit, Phaelens Butte, McKenzie County.

Two producing wells (DUCs) reported as completed:

- 40273, 146, Empire North Dakota, Nuthatch 299-12 1H, Bottineau County;

- 40593, 1,070, CLR, Doe 2-23HSL, Dunn County

Rivian -- A Loss Of $38K On Each Vehicle Delivered -- The Company That Can't Shoot Straight -- 3Q24

Locator: 48730RIVIAN.

Updates

November 10, 2024:

Original Post

Just reported, three minutes ago.

- a miss on the top and bottom lines.

- 3Q24 revenue, a huge miss: $874 million vs $990 million forecast.

- a loss of $39,130 per vehicle

- that's $9,000 worse than 3Q224 (last year)

- a loss off 99 cents vs a loss of 92 cents expected

- guidance: wider loss for full year than originally forecast -- trending in wrong direction

- in interview with CNBC: CEO blames everything, including supply change shortages (plural; below, it was singular)

- to me, sounds like incredibly poor execution

- CEO calls it "noise."

- avoids answering finance questions; pivots back to building a better truck; focused on customer;

Revenue drops for first time since IPO, link here:

- due to short supply of a part, Rivian last month slashed its full-year production forecast to between 47,000 and 49,000 vehicles, from its earlier projection of 57,000 units;

- 50,000 vehicles x $39,000 = 50 x 40 x 10^6 = 50 x 40 x million = 2,000 million = $2 billion

**************************

Lucid

Analysis: Kamala Harris Loss -- WSJ -- In Michigan, Jill Stein Was A Spoiler -- Ensured Trump's Win -- NYT -- November 7, 2024

This is the oft-repeated meme in every analysis of Ms Harris losing the race: "having raised $1 billion she lost to a convicted felon."

Wow! How in the world does that happen? A billion dollars and she loses to a convicted felon.

The other meme: having only 107 days to campaign did not give her enough time to introduce herself to the American public. Say what? She ran for the Democratic presidential nomination back in 2019 / 2020 and has been the nation's vice president for four years. And now ... now ... her apologists tell us she didn't have enough time to introduce herself. As czar of immigration she didn't even visit the southern border -- a great place to have introduced herself -- except on one occasion, late in the game.

Go to YouTube and google Kamala Sky News.

Where Trump Won

From The New York Times:

- Florida: Trump won Miami-Dade County, which has many Latino voters. It is the first time a Republican presidential candidate has done so since 1988.

- Texas: Support for Trump in the border counties of South Texas helped him win the state by 14 percentage points, based on the latest count. He won by only six points in 2020. Starr County went to a Republican for the first time since 1896.

- New York City: The city has moved right each time Trump has run — by 26 percentage points overall since 2016. The shift was pronounced in parts of the Bronx, Queens and southern Brooklyn.

- Michigan: In Dearborn, Michigan, a majority-Arab American city, frustration with the war in Gaza helped Trump win with 42 percent of the vote.

- Harris received 36 percent, while Jill Stein of the Green Party received 18 percent.

- Did Jill Stein prevent Harris from winning? Yes, probably, most likely. Those who voted for the Green Party certainly weren't going to vote for Trump.

In this list, The New York Times conveniently ignored Wisconsin, Pennsylvania, North Carolina, and Georgia.

The NYT says Trump did not win in a landslide. Well, that's some consolation for the elites.

If the GOP takes the US House, yes, I would call it a landslide.

But at the end of the day, Kamala Harris was lousy at campaigning, and unable to articulate a message.

***********************************

Back to the Bakken

WTI: $71.26.

Friday, November 8, 2024: 9 for the month; 69 for the quarter, 583 for the year

- None.

Thursday, November 7, 2024: 9 for the month; 69 for the quarter, 583 for the year

- None.

RBN Energy: Trident Pipeline would be a game-changer for Gulf Coast LNG terminals.

One of the most prevalent stories in the U.S. natural gas market over the past decade has been soaring associated gas production in the Permian Basin and the question of what to do with it. Numerous pipelines have been built over the years connecting Permian gas to demand regions, and more are in the works.

Also from RBN Energy: ONEOK Completes Acquisition of Medallion MidstreamThe largest source of incremental demand is LNG exports, mostly from the Sabine River area at the Texas/Louisiana border. The catch is, getting Permian gas past Houston to the banks of the Sabine presents significant challenges. In today’s RBN blog, we’ll discuss Kinder Morgan’s proposed Trident Pipeline — an attempt to overcome those challenges — and explain why this new outlet would alter gas pricing and flow dynamics in the broader Gulf Coast region.

We at RBN have written about existing and planned gas pipelines out of the Permian many times in the past, recently cataloguing a number of proposed lines in Come Dancing. While that piece primarily covered projects that originate in West Texas, we also snuck in WhiteWater Midstream’s Blackfin Pipeline, which was to be constructed entirely in the eastern half of Texas, bringing gas from Colorado County (near one terminus of the four-year-old Permian Highway Pipeline) north around Houston, ending in the area just north of Beaumont, where other lines would bring gas to LNG terminals in the Sabine River area. Also on the list from that blog was Energy Transfer’s proposed Warrior Pipeline, which would bring gas from the Permian to the area just south of Dallas-Fort Worth. Gas could then move toward the Sabine River through existing intrastate systems (and potentially new ones).

ONEOK has finalized its previously announced acquisition of Medallion Midstream from Global Infrastructure Partners (GIP) for approximately $2.6 billion in cash.

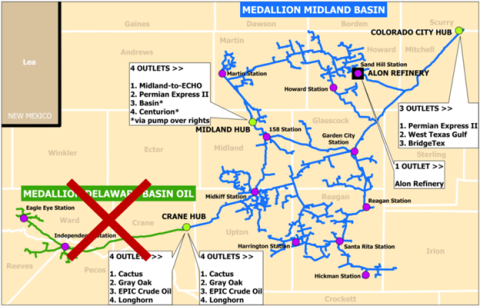

Medallion was previously the largest privately held crude oil gathering and transportation system in the Permian’s Midland Basin, featuring more than 1,200 miles of crude oil gathering pipelines (blue lines in below map) with a capacity of approximately 1.3 MMb/d and crude oil storage of around 1.5 MMbbl. (The Medallion Delaware Basin system — green lines covered by red X in below map — is owned by Energy & Minerals Group and is not included in this acquisition).

The transaction significantly expands ONEOK’s crude oil footprint in the Permian. The Medallion Midland Basin system feeds crude oil to hubs in Midland, Colorado City and Crane. In our Crude Oil Permian Report, we track these receipts, which feed ONEOK’s long-haul Permian-to-Houston pipelines — BridgeTex and Longhorn — as well as other third party pipelines.

This deal by ONEOK complements its $18.8 billion acquisition of Magellan Midstream, which we covered in Tulsa Time.

That deal created the second-largest U.S. midstream company by market capitalization and the fifth-largest by enterprise value.

In addition, as of October 15, ONEOK is the managing member of EnLink after acquiring GIP’s controlling interest for approximately $3.3 billion.

QCOM -- Pre-Market -- November 7, 2024

Locator: 48728QCOM.

**********************************

Disclaimer

Brief

Reminder

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia.

- Longer version here.