Locator: 48355B.

Google: yardeni I'm usually bullish and i'm usually right.

Wow, wow, wow: scrolling through my twitter feed -- incredible stories. I won't get them all posted, but some incredible stuff.

Top story of the day: US takes gold / bronze in men's 1500-meter race. YouTube: hocker.

Next up: Walz -- breath of fresh air. I'm having second thoughts -- Vance / Trump may have met their match winning hearts and minds of voters. We'll see.

Aviation: no signs of recession here. Did "we" just get played this past week. If so, not complaining. Great, great buying opportunities.

Pet peeve -- selective reporting. Folks upset with Nancy Pelosi fail to follow through with rest of the story:

Ticker:

*********************************

Back to the Bakken

WTI: $74.55. Up almost 2% overnight.

Thursday, August 8, 2024: 19 for the month; 75 for the quarter, 401 for the year

40236, conf, Iron Oil Operating, Stocke 5-4-9H,

39602, conf, Hess, BL-iverson B-155-95-0807H-7,

Wednesday, August 7, 2024: 17for the month; 73 for the quarter, 399 for the year

None.

RBN Energy: Gulf coast export terminals vie for NGL and crude oil market share. Archived.

Over the past decade, the only significant growth market for U.S. crude

oil and NGLs has been exports, with over 90% departing from the Gulf

Coast. Exports via Gulf of Mexico ports have surged from about 1 MMb/d

in 2016 to over 6 MMb/d last year. Great news for PADD 3 export

facilities, right? Well, it’s not that simple. The distribution of

barrels has been wildly uneven, resulting in significant winners,

forlorn losers, and everything in between. And export volumes are still

ramping up, as is the competition among marine terminals for crude and

NGL export market share, with far-reaching consequences for producers,

midstreamers and exporters. This is one of the core themes at our

upcoming NACON conference, which is all about PADD 3 North American Crude Oil & NGLs

and scheduled for October 24 at the Royal Sonesta Hotel in Houston. In

today’s RBN blog, we’ll delve into the highly competitive liquids export

landscape, consider some of the important factors driving flows one way

or the other, and — fair warning — slip in some subliminal advertising

for the NACON event.

It's a highly competitive market out there. For PADD 3 crude oil

exports, Corpus Christi has dominated the scene for the past five years,

but the Houston area is mounting a strong comeback. In fact, Houston

could reclaim the lead if one of the deepwater offshore projects gets

built. Today, Houston is out front in LPG exports, but Port

Arthur/Nederland has been challenging this position — and Houston’s now

fighting back with the announcement of a new Enterprise expansion on the

Houston Ship Channel. For ethane, it sure looks like Port

Arthur/Nederland is gaining the upper hand, with an Energy Transfer

expansion and the new Enterprise Neches River flex facility in the

works. Meanwhile, new greenfield proposals continue to be confidentially

floated, potentially disrupting the market landscape.

What’s fueling this beehive of competitive activity? To make sense of

what’s going on, let's start at the beginning. What exactly do we mean

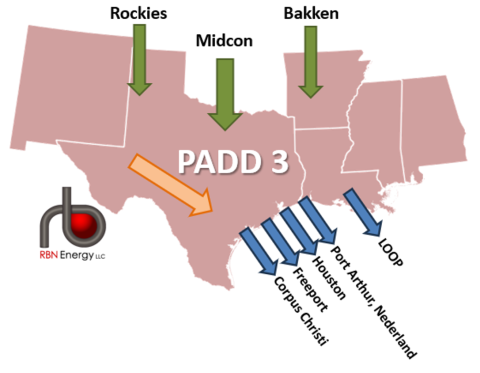

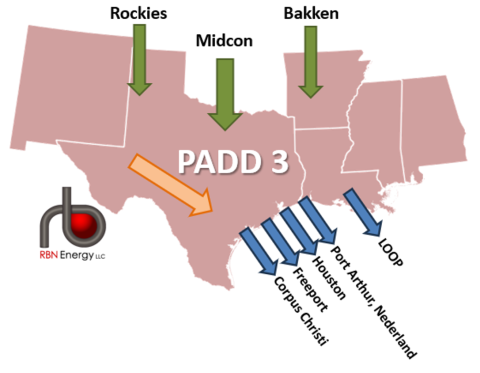

by PADD 3 exports? As shown in the stylized and simplified Figure 1

graphic of our PADD 3 model, crude oil and Y-grade NGLs flow into the

region from the Rockies, the Midcontinent and the Bakken (green arrows).

These barrels merge with PADD 3 production, primarily from the Permian

and Eagle Ford (orange arrow), before being transported to export

markets. About 90% of the growth in U.S. liquids production over the

past decade moves along these corridors and is exported from one of five

port locations: Corpus Christi, Freeport, Houston, Port

Arthur/Nederland, and LOOP (blue arrows). NGLs are exported from the

Texas ports, while crude oil is shipped from all ports except Freeport.

However, there is a significant disparity in the distribution of barrels

among these ports. We’ll get back to the magnitude and reasons for the unequal allocation of export volumes in a minute.

Figure 1. PADD 3 Crude and NGL Inflows/Outflows. Source: RBN