WTI: surges 10% on Boxing Day.

Peak oil? Maybe for Saudi Arabia? One of my themes over at "

the big stories" is the growing gap between Europe and the US when it comes to being energy sufficient. Major sub-themes include:

- US energy centers of gravity

- natural gas and coal in the post-nuclear world

- the Saudi - OPEC myth

- Japan's energy crunch

But one of the sub-themes I follow often is "

Europe at a tipping point."

I was reminded of that when I came across

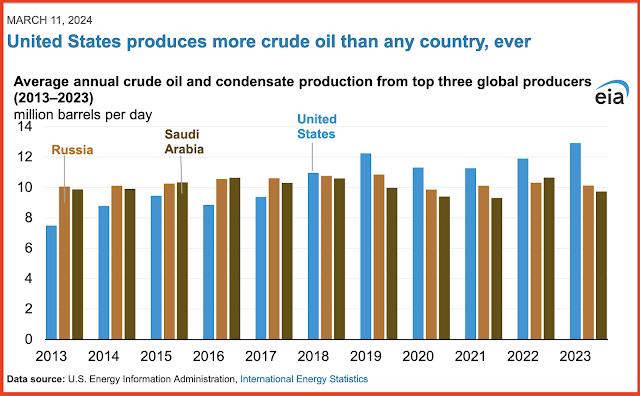

this oilprice headline: US oil output will nearly equal Saudi and Russian production

combined by 2025.

2025?

Are you kidding?

As far as politics go, it's already 2020.

2025 is only five years from 2020.

That means that I will (most likely) live to see that milestone.

The prediction is from the IEA chief.

My hunch is that it is "fake news." The IEA chief is beating the drum to increase CAPEX spending on conventional oil -- or in other words, increase spending in the Mideast and Russia, and not the US. This is another shout-out to the Saudis and the Russians that they need to accelerate oil activity in their own backyards if they don't want to be over-shadowed by the US.

But if he's accurate ... wow!