Saturday, June 3, 2023

The Electric Company -- June 3, 2023

Locator: 44837MUSK.

Locator: 44837EVS.

Locator: 44837INV.

Updates

June 20, 2023: Hyundai, next? Update. Tesla has won.

Jun 18, 2023: update.

June 8, 2023: GM and Tesla partner.

Locator: 44874TSLA.

Huge story, from the viewpoint of an amateur investor:

- TSLA: one step closer to the "holy grail." Announced today. At this link:

- with the charger partnership between Ford and Tesla, we are one step closer to a universal charger. GM, right now, has a huge, huge, huge problem. The board has to be losing sleep over that Ford-Tesla-supercharging partnership.

- problem solved; one step closer to the "universal supercharger."

June 7, 2023:

June 4, 2023: on top of everything else, Tesla vehicles again qualify for the tax credit.

June 4, 2023: Ford needed this badly and Elon Musk doesn't do things half-ass. This is huge. The Ford-Tesla partnership on the Tesla supercharger.

June 4, 2023: the world reacts to this news.

Original Post

This slide continues to haunt me.

I plan to open a position in TSLA -- that's the lingo they use on CNBC.

In a sidebar discussion with a reader, the reader -- a much, much better investor than I could ever be -- says that for me to invest in TSLA goes against all my rules on investing.

My not-ready-for-prime-time reply:

**********************

Background

I agree completely. It goes completely against my rules. If I were to invest in TSLA -- I'm still sitting on the fence -- it would be my first real exception since I started down this road.

This is going to be a long rambling note, some of it added since I "talked" with the reader.

First, the graphic above. That's a 10-year return. That's not a six-month or even a two-year return.

Second, we've just come out of a two-year lockdown / slowdown / pandemic -- it's hard not to compare this period with what happened in 1946 - 1956 or thereabouts. I can accept the argument that, "true, but on a much lesser scale," but I'm not easily going to roll over on that "on a much lesser scale" qualification. Things move a lot more quickly now and there's a huge amount of "money" activity in the US right now.

Stimulation money continues to work its way through the system and now we have the IRA, which easily could have been drawn up by MAGA policymakers. Yes, it included renewable energy but one needed to get the bill passed.

Third, "everyone" seems to suggest that the US is woefully behind on infrastructure -- in almost all sectors, except perhaps commercial real estate. And, that's not going to change; folks will return to offices sparingly and grudgingly. But I digress. To repeat,"everyone" seems to suggest that the US is woefully behind on infrastructure.

Fourth, the graphic above.

Fifth, the other day (yesterday) I mentioned the three greatest entrepreneurs in my lifetime, and asked readers to name the outlier among the three: Jeff Bezos, Steve Jobs, and Elon Musk.

Sixth, I have no plans to invest in the outlier in this case.

Seventh, the outlier is not Elon Musk.

Eighth, when I get the time, I will post a graphic of the companies of which those three entrepreneurs are associated.

Ninth, philosophy of those three. Which also leads back to the outlier.

Tenth, in a sense each of the three is an outlier.

***********************

Cults

It's interesting how folks talk about Elon Musk and Tesla. Include me in that group. "We're" all idiots thinking we "know" Elon Musk and Tesla. That was the paradigm change for me.

"We're" all in a "cult" when it comes to Elon Musk / Tesla. Some of us are in the "pro-Elon-Musk cult"; others are in the anti-Elon-Musk cult." And it seems those cults are based on "personality" for lack of a better word right now -- but all cults are personality-based so it might be as good a word as any.

By the way, that's also true with regard to AAPL. Some of us are in the "pro-Apple cult"; others are in the anti-Apple cult." [CNBC is definitely in the anti-Apple cult but there's a reason for that. They're in another cult.]

So, let's step back. Leave the cult. Exit "cult-thinking."

************************

Tesla

First, Tesla is so much bigger than "Tesla" now. Tesla isn't just vehicles on four wheels and batteries. I don't know what all falls under "TSLA" for investment purposes, so I'm out of my depth here but that's okay.

Second, Tesla is so much more than "Tesla" now. At the turn of the century -- 19th/20th -- Standard Oil -- or whatever it was called -- controlled vertically and horizontally the entire fuel distribution system for land vehicles in the US. Fact check me on that. Hold that thought.

Third, Elon Musk is the richest man in the world. The [London] Guardian, June 1, 2023. He is the founder, or the CEO, or the product architect, or the chief engineer, or the co-founder, or the angel investor of the following companies:

- Space X (chief engineer, and CEO)

- Tesla (product architect, and CEO)

- Twitter (owner, CEO)

- Boring Company (founder)

- Neuralink (co-founder)

- OpenAI (co-founder)

- Musk Foundation (president)

Fourth, TSLA market cap: $670 billion. #9 on list of largest publicly traded companies by market cap. Link here.

- AAPL: trending toward a 3-handle

- MSFT, Saudi Aramco: 2-handle

- GOOG, AMZN: 1-handle

- NVDA, BRK, META, TSLA: 0.5 trillion handle

and that's it.

Fifth, NVDA is a proxy for AI. ChatGPT is Open IA.

Sixth, EVs have reached the tipping point. No longer are we asking whether EVs replace ICEs within the investing lifetime of Gens X, Y, Z, and A. We're just asking in which "Gen" it happens.

Seventh, Standard Oil didn't make its money in vehicles. The company made its money on supplying fuel for the vehicles.

Eighth, for those who drive EVs, the "holy grail" is a universal charger.

Ninth, with the charger partnership between Ford and Tesla, we are one step closer to a universal charger. GM, right now, has a huge, huge, huge problem. The board has to be losing sleep over that Ford-Tesla-supercharging partnership.

Tenth, CarPlay (AAPL) is in "every" American car except Tesla. Fact-check me here.

Incidentally, quick! Name the semiconductor chip company / card company that is perhaps the primary "manufacturer" of chip / cards needed for autonomous driving, outside of Tesla. Hint: it's on the list above -- tied with with TSLA with a 0.5 trillion handle for market cap. Fact check me on that.

A digression: look at the list above. Eight companies. One outlier. Engineers. The Mind of a Bee. Cross-pollination. Sexual reproduction. Evolution. The Reign of Mammals. The first four billion years. The last 300,000 years.

**************************

Possibilities

It's hard for me to believe that The Electric Company won't be bigger than TSLA some day.

The Electric Company:

- a spin-off of TSLA, 2030

- real-estate: recharging stops along the freeways will each take up many acres of real estate

- batteries: TSLA engineering

- charging stations: TSLA engineering

- universal plugs: TSLA patent / TSLA engineering

- TEC's "play-watch-eat" centers

Quick: who just bought a huge amount of interstate real estate destined to be EV charging centers. Hint: the buyer would have bought the entire company but the seller wanted to keep 20%). The buyer was largest acquirer of US real estate in 2022.

******************************

Supercharging Networks

GM/EVgo at GM website, undated:

GM is helping accelerate infrastructure growth by working alongside EVgo to make available more than 2,700 fast-charging stations by the end of 2025. EVgo’s fast chargers deliver convenient, fast charges to EV drivers on the go. The first GM and EVgo sites are now live, and we’re currently on track to have approximately 500 fast-charging stalls live by the end of the 2021.

GM, EVgo, and Flying J / Pilot:

To accelerate the widespread adoption of EVs, increase access to charging and help enable long-distance electric travel of people and vehicles across the U.S., GM and Pilot Company (Pilot and Flying J) are collaborating on a national DC fast charging network that will be installed, operated and maintained by EVgo through its eXtend offering.

This project demonstrates how public and private entities can come together to build out the nation’s charging infrastructure, particularly along American highways, connecting urban and rural communities, the East and West Coasts and different metropolitan areas. This network of 2,000 charging stalls, co-branded “Pilot Flying J” and “Ultium Charge 360”, will be powered by EVgo eXtend and open to all EV brands at up to 500 Pilot and Flying J travel centers.

GM customers will receive special benefits like exclusive reservations, discounts on charging, a streamlined charging process through Plug and Charge and integration into GM’s vehicle brand apps providing real-time charger availability and help with route planning. This collaboration is expected to enhance America’s EV driving experience.

The Pilot and Flying J travel centers plan to feature numerous fast charging stalls provided by EVgo, including high power fast chargers capable of offering up to 350 kW1. EVgo, which is also working with GM to add more than 3,250 fast chargers in American cities and suburbs by the end of 2025, was chosen as a strategic collaborator due to its expertise in building, operating and maintaining DC fast charging infrastructure.

- With 45,000+ Superchargers, Tesla owns and operates the largest global, fast charging network in the world.

Ford charging network:

Plug into a standard 120V outlet with the Ford Mobile Power Cord or power up at one of over 84,000 public chargers throughout North America with the Blue Oval™ Charge Network. Another EV perk? Access is complimentary for the first three years

**********************

Brand Names

Tesla:

- number one selling car in the world, 2023: Tesla's Model Y

Ford:

- has the number one selling vehicle in the US -- the F-150

- Ford Mustang Mach-E SUV

Disclaimer: this is not an investment

site. Do not make any investment, financial, job, career, travel, or

relationship decisions based on what you read here or think you may have

read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

***********************

Seeking Alpha: Losing The Margin Crown

But Protecting Its Market Share

*****************************

Info War

Ticker

E-Mail Sidebar With A Reader -- June 3, 2023

Locator: 44836B.

A reader who follows the Bakken and the oil sector in general much more than I do sent me this note:

- the two rigs pulled out of the Williston basin included one from North Dakota and one from Montana,

- that was the last rig that had been drilling in Montana

- [for the "longest time" I think Montana Bakken had two rigs]

- this week saw the biggest drop in oil rigs (15) since the same week of 2020 [US rig count, I believe, not global]

My quick reply, not-ready-for-prime-time:

- and this is just the beginning of summer -- drilling should be at an all-time high...

- three things to think about:

- lots of talk about global recession; China slump in oil demand; even OPEC thinking about cutting oil production

- rigs and completion strategies just keeping getting better (more rigs, more drilling / rig)

- still need to post XOM article regarding this

- oil companies focusing on free cash flow; returning cash to investors (cut rigs / cut CAPEX)

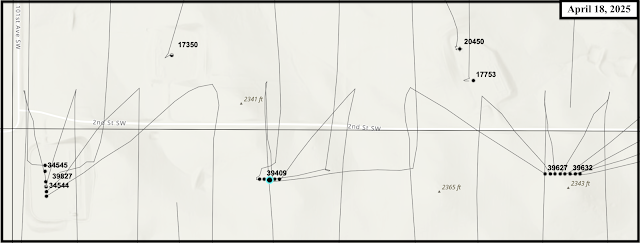

Jump In Production: 8x -- Random Update: MRO Activity, Killdeer Oil Field, Section 17-145-94, Huseby Et Al

Locator: 44835B.

Updates

August 18, 2025: map today --

Well of interest:

- 17753, 553, MRO, Strommen 34-8H, Killdeer, t6/09; cum 660K 2/25; note jump in production --

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 2-2025 | 28 | 1574 | 1569 | 1490 | 616 | 609 | 0 |

| BAKKEN | 1-2025 | 31 | 1588 | 1584 | 1914 | 938 | 927 | 0 |

| BAKKEN | 12-2024 | 31 | 1542 | 1535 | 2316 | 1516 | 1498 | 1 |

| BAKKEN | 11-2024 | 30 | 1565 | 1565 | 2207 | 1590 | 1573 | 1 |

| BAKKEN | 10-2024 | 16 | 1599 | 1632 | 2873 | 1785 | 1727 | 40 |

| BAKKEN | 9-2024 | 27 | 3819 | 3828 | 5992 | 5260 | 5207 | 5 |

| BAKKEN | 8-2024 | 31 | 5136 | 5160 | 3623 | 9855 | 9766 | 1 |

| BAKKEN | 7-2024 | 31 | 6913 | 6931 | 6492 | 14791 | 14104 | 561 |

| BAKKEN | 6-2024 | 30 | 9214 | 9187 | 12750 | 16095 | 15909 | 55 |

| BAKKEN | 5-2024 | 26 | 8222 | 8184 | 14564 | 8985 | 8913 | 7 |

| BAKKEN | 4-2024 | 30 | 5118 | 5143 | 15827 | 1836 | 1792 | 32 |

| BAKKEN | 3-2024 | 27 | 8641 | 8611 | 12982 | 7133 | 6804 | 281 |

| BAKKEN | 2-2024 | 25 | 6364 | 6396 | 9629 | 5503 | 5454 | 16 |

| BAKKEN | 1-2024 | 31 | 14241 | 14513 | 27070 | 11186 | 11072 | 55 |

| BAKKEN | 12-2023 | 31 | 17686 | 17669 | 41309 | 13507 | 13389 | 54 |

| BAKKEN | 11-2023 | 28 | 12555 | 12537 | 43300 | 12370 | 12295 | 15 |

| BAKKEN | 10-2023 | 16 | 5750 | 5731 | 33303 | 2960 | 2926 | 17 |

| BAKKEN | 9-2023 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 8-2023 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 7-2023 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 6-2023 | 7 | 377 | 545 | 312 | 690 | 651 | 0 |

| BAKKEN | 5-2023 | 31 | 2149 | 2295 | 1121 | 3936 | 3555 | 191 |

| BAKKEN | 4-2023 | 30 | 2272 | 2240 | 1007 | 3589 | 3205 | 200 |

Original Post

On my way to looking up something else, I stumbled across this section in Killdeer oil field. Wow, this would be a great time to be driving the back roads of North Dakota, now that winter is winding down.

I may or may not come back to these wells but for the archives, but these are Marathon wells in section 17-145-95, Killdeer oil field. Note three rigs.

Ovintiv Update -- Divests All Of Its Bakken Assets -- $18K / Acre -- $22K / Flowing BOEPD -- Buyer Is Grayson Mill — June 3, 2023

Locator: 44834B.

Ovintiv: to be added to S&P indices. Reminder: EnCana.

Ovintiv's 1Q23 earnings presentation mentions the Permian but that's about it. Its overview includes the Montney, but I didn't see references to the Bakken although I did not spend much time at the site.

Note: I completely missed this or completely forgot all about it. Don't remember. But April 3, 2023 -- Ovintiv divests all of its Bakken assets. Link here. Also here. Finally, the specifics here:

Ovintiv also said Monday as it announced the acquisition from EnCap Investments that it is selling its Bakken assets of 46,000 net acres in the Williston Basin of North Dakota to Grayson Mill Bakken, another portfolio company of funds managed by EnCap, for $825 million cash. Estimated 1Q Bakken production is 37,000 boed (60 percent oil).

Back-of-the-envelope:

- $825 million / 37,000 boed = $22,300 per flowing boepd

- $825 million / 46,000 net acres = $18,000 / acre

****************************

Ovintiv Activity In The Bakken

Random look at activity eleven miles east of Alexander, ND.

Ovintiv wells.

Day 8 Of 101 Days Of Summer -- June 3, 2023

Today, day8:

- biking weather, scale 1 - 10: a ten (12)

- swimming later this afternoon.

Reading:

- The Naked and the Dead, Norman Mailer.

***************************

The Bat Cave -- Up A Notch

Hiring a librarian for the Bat Cave.