Link here.

Tuesday, December 31, 2024

The Bakken: A Trillion-Barrel Reservoir Re-Visited -- December 31, 2024

Before proceeding, read the disclaimer for this blog.

Locator: 44579B.

From June 11, 2016, link here:

- the original Leigh Price paper, Part 1, Part II;

- the Bakken/Three Forks, a trillion-barrel reservoir,

USGS 2013 survey, link here.

The trillion-barrel reservoir, from April 24, 2013, link here.

The trillion-barrel reservoir, from December 3, 2012, link here.

Now today, December 31, 2024, link here.

Graphics for this article / study can be found here.

From the linked article, the summary at this link.

The full article at this link.

From the linked article:

The North Dakota Department of Mineral Resources has announced the discovery of massive untapped oil resources across a portion of western North Dakota.

According to a press release from North Dakota Mineral Resources, oil and gas companies began to implement horizontal wells in the Middle Bakken as far back as 2006, and the process would later branch out into the development of the upper and middle Three Forks from 2008 to 2013.

Throughout 2024, a survey conducted by the department and state geologists evaluated historical and future oil production by looking over 593 horizontal wells in the area. Of the 25 drilling units analyzed that contained middle Three Forks horizontal wells, 17 of them (68%) showed “a clear and volumetric addition of more oil.” These results suggest that when charged, development on this middle reservoir would add 1-2 million barrels of recoverable oil for every 1,280-acre drilling spacing unit, which aids in the goal of adding more development to northeastern McKenzie County.

When the area is developed, the department suggests that over 600 middle wells could produce over 250 million barrels of oil.Spend a few minutes on this paragraph.

Spend a few minutes on this paragraph:

As of 2024, over 360 horizontal wells have been drilled and completed in the middle area — which amounts to roughly 2% of the drilling activity in the Bakken-Three Forks petroleum system, and around 1.7% of total oil production to date. This amounts to over 92 million barrels of oil, and 238 billion cubic feet of gas.

To access the full release, click here. This will not open in Firefox. Use Safari or Chrome, instead.

***********************************

Archived -- October 23, 2013

In an attempt to make the sidebar more manageable, I am winnowing "The

Best: Archived" at the sidebar at the right. Most will be removed from

the sidebar at the right and placed here.

A trillion-barrel reservoir?

Bentek: the Bakken to produce 2.2 million bopd

Archived presentations

Bakken breakout, 2012

Bakken breakout, 2011 (The Bismarck Tribune link for this story is no longer working)

Maximum Bakken production

RBN Energy on flaring in the Bakken -- May 6, 2013

Publications Re: The Williston Basin

Archived commentaries

Staggering statistics, 2009

Crazy numbers

The Lodgepole: Update

Definition: The Bakken Pool

Basic Analysis of the Bakken Boom

World's Largest Microseismic Array

TOC and the Tyler

Snapshot: Data Prior to May 20, 2013

**********************************

Disclaimer

Brief

Reminder

- I am inappropriately exuberant about the Bakken and I am often well out front of my headlights. I am often appropriately accused of hyperbole when it comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And

now, Nvidia, also. I am also inappropriately exuberant about all things

Nvidia. Nvidia is a metonym for AI and/or the sixth industrial

revolution.

- Longer version here.

New Year's Eve -- December 31, 2024

Locator: 44577B.

Oil not dead yet, link here:

EIA October, 2024, data: lots of charts here -- at the link scroll down.

Senator Cramer's son sentenced: link here.

AI jargon: link here.

Little Taiwan: link here. Barron's picks: link here.

Thanks for nothing: 28-y/o on death row, commuted by Biden, is now asking for "early release." January 20th can't get here fast enough.

**************************

Back to the Bakken

WTI: $71.56. Long-term trend or another head-fake?

Wednesday, January 1, 2025: 1 for the month, one for the quarter, one for the year,

- 37665, conf, BR, Kellogg Ranch 1B MBH,

Tuesday, December 31, 2024: 51 for the month; 154 for the quarter, 682 for the year (six months ago, there was no June 31)

- None.

RBN Energy: the top 100 prognostications -- 2024. The scorecard.

Monday, December 30, 2024

Summary Of Bakken Deals -- 2024

Locator: 44575B.

Previously posted. Just the usual, occasional housekeeping.

Bakken deals are tracked at the sidebar at the right.

The deals:

Silver Hill Energy Partners enter(s) the Bakken, January 31, 2024 -- link here.

Chord to merge with Enerplus, February 21, 2024 -- link here.

COP - MRO deal, May 29, 2024 -- link here.

Devon Energy to buy Grayson Mills assets in the Williston Basin, July 8, 2024 -- link here.

Tech Investing; LNG Exports -- Plaquemines -- December 30, 2024

Locator: 44574TECH.

For those with traditional IRAs and turning 73 years of age or older in 2025, tomorrow is a most critical day.

On another note, link here:

In a graphic like this, ticker symbols missing are as important than those on the list.

Intel, Oracle, Dell, QCOM, AVGO, Micron, META, AMZN are not on the list.

**********************************

Disclaimer

Brief

Reminder

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- And

now, Nvidia, also. I am also inappropriately exuberant about all things

Nvidia. Nvidia is a metonym for AI and/or the sixth industrial

revolution.

- Longer version here.

********************

LNG

Micron, ASML, Apple, Boise, Idaho, And All That Jazz -- December 30, 2024

Locator: 44572TECH.

At midnight tonight, if you have time for just one more article, this is it.

Note the byline.

Quick: name the chip company located in Idaho.

I first paid attention to all of this after reading Chip War, c. 2022.

The article begins:

BOISE, Idaho—Brienna Hall has the most valuable role that you’ll never see at the most vital company that you’ve never heard of.

Until she began working at ASML last year, she didn’t know the first thing about the company. She also didn’t know what she would be doing as a customer-support engineer—a “fancy mechanic,” as she calls herself.

And she had absolutely no idea that it would be essential to the global economy.

When she reports for her shift at a chip plant, Hall slips into a bunny suit. She enters a room where the pristine air is 100 times cleaner than a hospital operating room’s. Then she makes her way over to an unfathomably complex machine.

Her job is to know everything about it—so that she can fix it.

“I thought I had the coolest job ever,” Hall says. “I didn’t process the fact that this job is necessary for our entire world to exist as it does.”

The piece of equipment that the entire world has come to rely on—and she is specially trained to handle—is called an extreme ultraviolet lithography machine.

It’s the machine that produces the most advanced microchips on the planet. It was built with scientific technologies that sound more like science fiction—breakthroughs so improbable that they were once dismissed as impossible. And it has transformed wafers of silicon into the engines of modern life.

Even today, there are only a few hundred of these EUV machines in existence—and they are ludicrously expensive. The one that Hall maintains cost $170 million, while the latest models sell for roughly $370 million.

But maybe the most remarkable thing about these invaluable machines is that they’re all made by the same company: ASML.

ASML is the glue holding the chip business together. That’s because this one Dutch company is responsible for all of the EUV lithography systems that help make the chips in so many of your devices. Like your phone. And your computer. And your tablet. And your TV. Maybe even your car, too.

These machines have become indispensable. And they depend on the invisible work of Brienna Hall.

She’s one of the engineers assigned to the fabrication plants—or fabs—where ASML customers manufacture their semiconductors. Hall is based here in Boise, the headquarters of Micron Technology, where I hopped into a bunny suit of my own and followed her inside the chip fab.

Then I got a rare, behind-the-scenes peek at what might just be the most important machine ever made.

Brienna Hall?

Hall, 29, grew up in Seattle as a Girl Scout obsessed with tying the perfect knot. She was president of the Edmonds College rocketry club when she got her associate degree. At Washington State University, she majored in materials science and engineering—and transcribed notes for a professor writing a textbook on quantum mechanics. She loves planning camping trips even though she doesn’t actually like camping. In her spare time, she works with her hands, quilting and piecing together elaborate Ravensburger jigsaw puzzles.

All of which turned out to be excellent preparation for navigating a machine with more than 100,000 parts.

“You’re always problem-solving,” said Alex Jordan, another ASML engineer. “How can I be more efficient? Where can I optimize this? And what if we tried that?”

When the company recruits for customer-support positions, ASML looks for diligent, disciplined and detail-oriented engineers. Hall had the right kind of technical mind and temperament for the job. When one of her professors heard that a semiconductor company was hiring, Hall passed along her résumé and soon received emails from ASML asking her to apply.

American Exceptionalism -- Tech, Semiconductors, AI, Assemble -- December 30, 2024

Locator: 44571TECH.

Tech is tracked here.

Chips: tracked here.

Apple is tracked here.

Updates

What Trump could mean for American exceptionalism, link here to Forbes.

American exceptionalism:

- Austin, TX: the new Silicon Valley; UT-Austin; Taylor, Texas, link here, Samsung;

- Arizona

- Utah

- Idaho

- Washington, Seattle

- Portland, OR: Intel

- Nashville, TN: medical AI.

But that's not all:

Original Post

Holy mackerel. This was posted back in 2021:

One of the blog posts I like best had to do with semiconductor chips.

That was perhaps the best update on chips on any blog that requires no subscription and no password. LOL.

Read that post first, and then read the following:

TSMC -- largest chip maker in the world -- set to "double down" and vastly increase US semiconductor chip investment in Arizona. Link here.

The company had already said it was going to invest $10 billion to $12 billion in Arizona. Now, the company is mulling a more advanced 3 nanometer plant that could cost between $23 billion and $25 billion, sources said. The changes would come over the next 10 to 15 years, as the company builds out its Phoenix campus, the report notes.

The move would put TSMC in direct competition with Intel and Samsung for subsidies from the U.S. government. President Joe Biden has proposed $50 billion in funding for domestic chip manufacturing - a proposal the Senate could act on as soon as this week. Intel has also committed to two new fabs in Arizona and Samsung is planning a $17 billion factory in Austin, Texas.

Note:

- the chip factories are not being built where the end-users are based (California);

- the chip factories are being built in Texas and Arizona

- one thing Texas and Arizona have in common: USAA with mirror operations

- Austin, TX: the new Silicon Valley

- UT-Austin

Five New Permits -- December 30, 2024

Locator: 44571B.

Active rigs: 35.

WTI:

Five new permits, #41461 - #41465, inclusive:

- Operators: Kraken (4); CLR

- Fields: Boxcar Butte (McKenzie); Banks (McKenzie)

- Comments:

- CLR has a permit for a Garfield Federal well, NWNW 8-152-99, to be sited 150 FNL and 704 FWL;

- Kraken has permits for four Boxcar wells, SESW 36-149-102, to be sited 1625 FWL and 525 / 624 FSL

Two permits renewed:

- Cornerstone Natural Resources, Northeast Foothills, #40397, #40402

Two producing wells (DUCs) reported as completed:

- 40612, 2,036, MRO, Betts 24-11H, Duun County;

- 40613, 3,912, MRO, Foss 24-11TFH, Duun County;

*********************************

Pool Time

Best Story Of The Day -- Amazing That It Took This Long -- The Kelly Parcel In Wyoming -- Jackson Hole Valley -- December 30, 2024

Locator: 44570JOY.

Story everywhere. First reported in The New York Times, then everywhere.

This seems to have been a no-brainer.

Wyoming owned it. One square mile. 640 acres.

Sold it for $10 million to the Federal government. The Kelly Parcel is/was the largest piece of unprotected land within the boundaries of Grand Teton National Park.

Google maps: Kelly Wyoming.

Part of the Gros Ventre River drainage immediately into the larger Snake River area.

This simply tickles the cockles of my heart. Serious as a heartbeat.

Definitely Not A Manic Monday -- December 30, 2024

Locator: 44569B.

Some love for Linda Lavin, link here:

LNG update: with Cheniere's 1.4 Bcf/d Corpus Christi III (#8) now on line, what's next:

- QatarEnergy/ExxonMobil’s 2.4-Bcf/d Golden Pass LNG (#9) in Sabine Pass, TX, which will start coming online in the first half of 2025;

- Sempra's 0.43 Bcf/d Energía Costa Azul (ECA) LNG Phase 1 in west Mexico, to start up in spring, 2026 (this is a delay, had been scheduled to go online summer of 2025);

- NextDecade Corp.’s 2.3-Bcf/d Rio Grande LNG (#10) in Brownsville, TX, starting up in 2027; and,

- Sempra and ConocoPhillips’s 2-Bcf/d Port Arthur LNG (#11), coming online in 2027-28.

*********************************

Back to the Bakken

WTI: $71.05.

Tuesday, December 31, 2024: 51 for the month; 154 for the quarter, 682 for the year

- None.

Monday, December 30, 2024: 51 for the month; 154 for the quarter, 682 for the year

- None.

Sunday, December 29, 2024: 51 for the month; 154 for the quarter, 682 for the year

- None.

Saturday, December 28, 2024: 51 for the month; 154 for the quarter, 682 for the year

- 40731, conf, Rockport Energy, Camden 10-3 3H,

- 39499, conf, Enerplus, Brown Bear 158-99-36-25-5H,

- 37664, conf, BR, Kellogg Ranch 1A TFH,

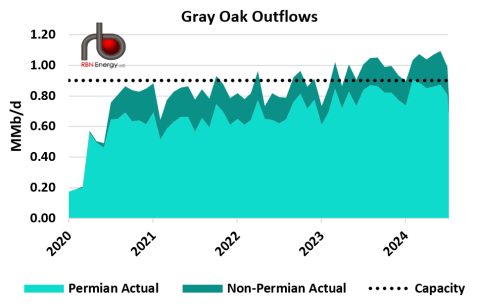

RBN Energy: Gray Oak stands out as the only Permian crude pipeline to greenlight an expansion. Archived.

As crude oil production in the Permian continues to grow and pipelines from West Texas to the Gulf Coast edge closer to full utilization, it’s becoming a challenge for producers and shippers alike. Amid this capacity crunch, one pipeline stands out as the only one with a detailed expansion plan: the 850-mile, 900-Mb/d Gray Oak Pipeline from West Texas to Corpus Christi and Sweeny, TX, which started up in late 2019 and became fully operational in early 2020. In today’s RBN blog — the latest in our series on Permian crude oil pipelines — we discuss Gray Oak Pipeline’s dynamic story, including its shifting ownership, strategic connectivity and expansion plans.

In Part 1 and Part 3 of this series, we looked at Longhorn Pipeline and BridgeTex Pipeline, respectively, and what ONEOK has accomplished with these systems since it acquired Magellan. In Part 2, we looked at EPIC’s Crude Pipeline to the Corpus Christi area, which has been operating at full capacity. Today, we’ll cover Gray Oak.

We’ll begin by noting that Gray Oak started up shortly before crude oil demand cratered as the pandemic hit. In response, Permian producers shut in a significant amount of production during the summer of 2020. Additionally, two other new Permian pipelines — also to Corpus Christi — started up during the second half of 2019: Plains All American’s Cactus II (585 Mb/d) and EPIC Crude (400 Mb/d, expanded in 2020 to 600 Mb/d), resulting in a glut of crude pipeline egress.

Despite these challenges, Gray Oak’s outflows quickly ramped up throughout 2020. As shown in Figure 1 below, Gray Oak has operated near its 900-Mb/d capacity (dotted horizontal black line) for some time now. Earlier this year, Gray Oak Pipeline LLC sanctioned a 120-Mb/d expansion following a successful open season. Contracted volume commitments of 80 Mb/d start in April 2025 and one year later another 40 Mb/d is committed to the pipe. Gray Oak could offer early service for new or existing shippers if capacity is desired sooner.

Figure 1. Gray Oak Outflows. Source: RBN Crude Oil Permian

The ownership journey of Gray Oak Pipeline is complicated, to say the least. When the project was in its planning stage, Phillips 66 (P66) held a 75% stake and refining company Andeavor owned the remaining 25%. In 2018, Marathon Petroleum acquired Andeavor for $23 billion, inheriting its 25% stake in Gray Oak (box #1 in Figure 2 below), along with a similar stake in the South Texas Gateway (STG) export terminal in Ingleside, across the bay from Corpus. (More on that later — spoiler alert: STG’s traded hands a couple of times since then.) We should note that Andeavor and its old Andeavor Logistics master limited partnership (MLP) had its own intricate corporate history with Marathon and its MPLX unit.

Much, much more at the link.

*********************************

Cheniere

December 30, 2024: Cheniere produces first LNG at Corpus Christi, stage III, link here.

April 16, 2024, flashback:

From RBN Energy, today: new JV's focus is moving Permian natural gas to LNG export terminals. Archived here.

Projects already approved / permitted by the US government ... expected to increase U.S. LNG export capacity to about 25 Bcf/d from the current 14 Bcf/d.

Of that 11 Bcf/d of incremental capacity, more than 8 Bcf/d will be sited along the Texas coast.

These projects include Cheniere Energy’s 1.4-Bcf/d Stage III at Corpus Christi LNG, which is scheduled to begin starting up late this year; QatarEnergy/ExxonMobil’s 2.4-Bcf/d Golden Pass LNG in Sabine Pass, TX, which will start coming online in the first half of 2025; NextDecade Corp.’s 2.3-Bcf/d Rio Grande LNG in Brownsville, starting up in 2027; and Sempra and ConocoPhillips’s 2-Bcf/d Port Arthur LNG, coming online in 2027-28.

Sunday, December 29, 2024

Week 51: December 22, 2024 -- December 28, 2024

Locator: 44568TOPSTORIES.

***************************

Hiatus Between November 5, 2024 - January 20, 2025: Twelve Weeks

Biden-Trump Transition

December 22 - December 28, 2024: Week Eight

The transition works this way, this cycle:

- Biden's emphasis is on pardons and commutations;

- setting up Trump for failure; Biden will fade away

- expresses regret that he dropped out of race; says he could have won (he's 82 years old)

- Trump's focus is to look presidential well before inauguration

- putting his administration (and "Shadow Government") in place;

- nominations: the big ones have all been named

- executive orders being drafted

The Florida White House:

- Trump is the president, simply waiting to make it official, January 20th (unchanged from last week)

- surrounding himself with "self-made billionaires"

- those billionaires not named to his administration are making pilgrimages to Mar-a-Lago

- most recent rumor: Bill Gates on his way

**********************************

The Top Stories

Top story of the week:

- Russia shoots down civilian a/c; Putin apologize

Top international non-energy story:

- Trudeau's government likely to fail but as of December 29, 2024, still the prime minister

- Trudeau's top officials race to Mar-A-Lago

Top international energy story:

Top national non-energy story:

Top national energy story:

Focus on fracking: current link here. Generally updated late Sunday night.

Top North Dakota non-energy story:

Top North Dakota energy story:

Geoff Simon's quick connects: no report this week.

Someone Over At X Is Forecasing A Bone-Crushing, Pipe-Bursting Freeze Extending Into The South -- December 29, 2024

Locator: 44566FREEZE.

Beautiful short-sleeve weather this afternoon in the Dallas, Texas, area. Almost reached 70 degrees this afternoon. Will reach 80 degrees tomorrow per forecast below.

Forecast here in north Texas:

**********************

Recipes

BR Activity In The Charlson -- To Include A Re-Entry Well -- December 29, 2024

Locator: 44565B.

This post is update: link here.

The maps:

The wells:

- 37620, conf, BR, Sequoiafill 1A, Hawkeye,

- 37619, conf, BR, Sequoiafill 1B, Hawkeye,

- 37618, conf, BR, Sequoiafill 1C, Hawkeye,

- 37617, conf, BR, Sequoiafill 1D, Hawkeye,

- 37616, conf, BR, Sequoiafill 1E, Hawkeye,

- 37615, conf, BR, Sequoiafill 1F, Hawkeye,

- 37614, conf, BR, Sequoiafill 1G, Hawkeye,

- 17309, conf, BR, Washburn 44-36H, Charlson, last sundry note dated 8/17/23 before well went confidential again; operator requesting TA extension; plans to re-enter on/about 4Q24 in order to bring well back on line; originally drilled back in 2008, IP of 270; open hole frack;

- 40566, conf, BR, Burned Edge 2A-ULW, Charlson,

- 40567, conf, BR, Burned Edge 1A-ULW, Charlson,

Production Data For Wells Coming Off Confidential List This Next Week -- December 29, 2024

Locator: 44564B.

The wells:

- 39999, conf, Hess, GO-State-157-97-2116H-6, Ray,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 14877 | 21955 |

| 9-2024 | 12739 | 11416 |

| 8-2024 | 22776 | 32051 |

| 7-2024 | 30655 | 38221 |

- 40757, conf, Neptune Operating, Skedsvold 20-29-32 6H, Ragged Butte, npd,

- 40453, conf, KODA Resources, Amber 3101-4BH, Fertile Valley,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 25689 | 11459 |

| 9-2024 | 25773 | 13369 |

| 8-2024 | 24540 | 5488 |

| 7-2024 | 825 | 0 |

- 40294, conf, BR, Nordeng 2B TFH, Elidah, npd,

- 40210, conf, KODA Resources, Amber 1301-3BH, Fertile Valley,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 24472 | 10835 |

| 9-2024 | 26106 | 13264 |

| 8-2024 | 25144 | 5583 |

| 7-2024 | 42 | 0 |

- 39998, conf, Hess, GO-State-157-97-2116H-5, Ray,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 17476 | 32062 |

| 9-2024 | 9975 | 19310 |

| 8-2024 | 16760 | 23279 |

| 7-2024 | 33189 | 47268 |

- 40756, conf, Neptune Operating, Skedsvold 20-29-32 6H, Ragged Butte, npd,

- 40081, conf, Hess, EN-Trout-157-93-3130H-2, Big Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 19291 | 26339 |

| 9-2024 | 16409 | 19782 |

| 8-2024 | 25047 | 30620 |

| 7-2024 | 39576 | 64917 |

40080, conf, Hess, EN-Trout-157-93-3130H-3, Big Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 23672 | 35100 |

| 9-2024 | 25058 | 32972 |

| 8-2024 | 25107 | 32708 |

| 7-2024 | 39853 | 51912 |

- 17309, conf, BR, Washburn 44-36H, Charlson, last sundry note dated 8/17/23 before well went confidential again; operator requesting TA extension; plans to re-enter on/about 4Q24 in order to bring well back on line; originally drilled back in 2008, IP of 270; open hole frack;

- 37665, conf, BR, Kellogg Ranch 1B MBH, Elidah, npd,

- 40731, conf, Rockport Energy, Camden 10-3 3H, Ranch Coulee,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 14766 | 0 |

- 39499, conf, Enerplus, Brown Bear 158-99-36-25-5H, Ellisville,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 10-2024 | 12419 | 15509 |

| 9-2024 | 17128 | 17336 |

| 8-2024 | 20856 | 20550 |

| 7-2024 | 30106 | 21334 |

| 6-2024 | 2877 | 1315 |

- 37664, conf, BR, Kellogg Ranch 1A TFH, Elidah, npd,

Wells Coming Off Confidential List This Next Week -- December 29, 2024

Locator: 44563B.

The wells:

Wednesday, January 8, 2025: 12 for the month, 12 for the quarter, 12 for the year,

39999, conf, Hess, GO-State-157-97-2116H-6,

Tuesday, January 7, 2025: 10 for the month, 10 for the quarter,10 for the year,

40757, conf, Neptune Operating, Skedsvold 20-29-32 6H,

40453, conf, KODA Resources, Amber 3101-4BH,

40294, conf, BR, Nordeng 2B TFH,

40210, conf, KODA Resources, Amber 1301-3BH,

39998, conf, Hess, GO-State-157-97-2116H-5,

Monday, January 6, 2025: 5 for the month, 5 for the quarter, 5 for the year,

40756, conf, Neptune Operating, Skedsvold 20-29-32 6H,

Sunday, January 5, 2025: 4 for the month, 4 for the quarter, 4 for the year,

None.

Saturday, January 4, 2025: 4 for the month, 4 for the quarter, 4 for the year,

None.

Friday, January 3, 2025: 4 for the month, 4 for the quarter, 4 for the year,

40081, conf, Hess, EN-Trout-157-93-3130H-2,

40080, conf, Hess, EN-Trout-157-93-3130H-3,

Thursday, January 2, 2025: 2 for the month, two for the quarter, two for the year,

17309, conf, BR, Washburn 44-36H,

Wednesday, January 1, 2025: 1 for the month, one for the quarter, one for the year,

37665, conf, BR, Kellogg Ranch 1B MBH,

Tuesday, December 31, 2024: 51 for the month; 154 for the quarter, 682 for the year

None.

Monday, December 30, 2024: 51 for the month; 154 for the quarter, 682 for the year

None.

Sunday, December 29, 2024: 51 for the month; 154 for the quarter, 682 for the year

None.

40731, conf, Rockport Energy, Camden 10-3 3H,

39499, conf, Enerplus, Brown Bear 158-99-36-25-5H,

37664, conf, BR, Kellogg Ranch 1A TFH,

Themes 2025 -- Update -- December 29, 2024

Locator: 44561ARCHIVES.

One of the major themes for the blog for 2025 will be "woke."

Most recent example: University of Iowa announces plans to close Gender, Women's and Sexuality studies department.

Playboy Magazine: the original gender, men's and sexuality studies magazine.

Recap: Companies Moving To Texas -- December 29, 2024

Locator: 44560TEXAS.

September 13, 2024: every company moving to Texas, 2020 - 2024. Build Remote, Henry O'Loughlin. Location of companies before they moved to Texas.

Interactive relocation chart is here.

Not-California companies that re-located to Texas:

TIAA, Colorado, August 9, 2024, downtown Denver office in 2026 to Frisco, TX (not a HQ move).

Fisher Investments, March 28, 2023, from Camas, Washington, to Texas after the Washington State Supreme Court ruled that a capital gains tax is constitutional.

Frontier, August 25, 2023, from Connecticut to Dallas, a HQ move.

Caterpillar, June 15, 2022, from Illinois.

EV Shakeout In 2025 -- December 29, 2024

This is one of several themes for 2025.

December25, 2024: preview of EVs for 2025. Driving.

December 11, 2024: future EVs. Car and Driver. They're all luxury cars, toys for millionaires and billionaires.

Exhibit A:

Cadillac wants to return to the days when the company could call itself the Standard of the World without getting scoffed at.

At least that's the plan with the upcoming Celestiq, an extravagant EV that will be built by hand and cost upward of $300K.

That price puts it out of reach for all but the wealthiest people, but Cadillac envisions the Celestiq as aspirational rather than attainable.

For the one percent who can afford one of these avant-garde 600-hp electric hatchbacks, each example can be uniquely tailored to the customer's whims. Will it be enough to vault GM's luxury brand into the discussion with Bentley and Rolls-Royce? Production of the Celestiq has begun, but it's unclear when deliveries will start. —Eric Stafford

Built by hand? No way was GM/Cadillac going to build a factory to build this car.

Really?

Built for the same guys who can still afford Mad Magazine.

Saturday, December 28, 2024

The Book Page -- The 100th Anniversary -- The Most Popular Books Published In 1925 -- Posted December 28, 2024

Locator: 44558BOOKS.

Before we do the books, let's take a look at what Beth has for us:

Note which $4-trillion company is not on the list.

With regard to Tencent, see wiki and Tom's Hardware.

Now, the books.

These are the ones that caught my eye:

- #1, The Great Gatsby, F. Scott Fitzgerald

- #2, Mrs Dalloway, Virginia Woolf

- #3, The Trial, Franz Kafka

- #11, The Everlasting Man, G.K. Chesterton (going down another rabbit hole)

- #19, Giants in the Earth, O.E. Rølvaag

- #22, The Common Reader, Virginia Woolf

- #30, The Making of Americans, Gertrude Stein

- #40, Big Two-Hearted River, Ernest Hemingway

- #44, My First Thirty Years, Gertrude Beasley, wiki entry.

I've read all but three of them, but I read them years ago.

Back in the early 2000s -- maybe 2004, or thereabouts -- I typed out the entire Mrs Dalloway in free verse. It took me about six months, typing at most one or two hours four or five days each week. A valuable, valuable exercise. I made an interesting literary discovery, posted it on the web, something that had never been posted before to the best of my knowledge.

I was blown away by the titles listed above all came out in one year.

What was the best year ever for English literature?

From AI:

I think one could argue 1925 competes well with the year 1922.

For the 1922 list, link here.

********************************

Virginia Woolf, Character-Reading, And Merve Emre

Going Down More Rabbit Holes

Wow, this is a biggie. Virginia Woolf "bridged the gap" between character-reading in literature and character-reading in everyday life -- an important survival skill.

I had not heard of "character-reading" re-reading Merve Emre's introduction to The Annotated Mrs Dalloway, Virginia Woolf, c. 2021.

From The New Yorker, August 28, 2021 -- aha -- written by none other than ... drum roll ... wait for it .. Ms Merve Emre. Wow, wow, wow. At wiki, Merve Emre.

So stimulated, the reader learns how to be the writer’s accomplice in what Woolf called the art of “character-reading”: a practice of observing, of speculating about, people, both in life and in fiction.

The adept character-reader was one who fixed people with a powerful, sympathetic, and searching gaze; who seized on their unobtrusive moments—their small habits, their humble memories, their incessant chatter—to grasp the full force of their being.

Character-reading was an everyday talent, eminently useful and even necessary.

“Indeed it would be impossible to live for a year without disaster unless one practised character-reading and had some skill in the art,” Woolf wrote. “Our marriages, our friendships depend on it; our business largely depends on it; every day questions arise which can only be solved by its help.”

Though character-reading could smooth the social tribulations of adult life, Woolf held it to be, first and foremost, the art of the young. They drew on it for “friendships and other adventures and experiments” that were less frequently embarked on in middle or old age, when character-reading retreated from its inventiveness, its candid curiosity, and became a dutiful, pragmatic exercise, a way to avoid misunderstandings and arguments.

I've often stated

that military brats (children of active military personnel) become

very, very good at character-reading. I'm certainly no Virginia Woolf

but ... wow ... how unexpected.

But there's more to the story.

The Merve Emre-wiki entry is fascinating.

[An an aside, Merve Emre, Turkish, was born in Adana, Turkey. I was stationed, along with my family, in Adana for two years -- 1992 - 1994.]

Merve Emre "wrote the book" on the Myers-Briggs personality test. I just ordered it. Whoo-hoo.

Speaking of the 100th anniversary of some of the greatest books in literature ever written (see above), the Myers-Briggs personality test was developed in the 1920s.

Merve Emre:

Emre was born in Adana, Turkey. She graduated in 2003 from Paul D. Schreiber Senior High School in Port Washington, New York. [Assuming she was 18 years old when she graduated from high school, she was born in 1985.]

[My question: how did Merve get from Adana, Turkey, to the Paul D. Schreiber Senior High School in Port Washington, New York -- located on "West Egg" just down the street from where Jay Gatsby lived? See The Great Gatsby. My hunch: she was a military brat. Had her father been in the "foreign service," she would have been more likely to have been born in Ankara.]

After graduating in 2007 from Harvard, where she concentrated in government, Emre worked for six months as an assistant marketing consultant at Bain & Company. [Observation: another Harvard graduate that stands out. What is it about Harvard? The old chicken and the egg question?]

Emre says that she was a "terrible consultant" and spent most of her time at Bain studying for the literature Graduate Record Examinations under her desk.

However, Chris Bierly, her mentor at Bain, called her "other-level intelligent" and said "Of all the people I've recruited to Bain in the 30 years, and this is in the thousands, she is one of the brightest".

It was at Bain that Emre first took the Myers–Briggs Type Indicator, which would later be the subject of her second work of nonfiction, The Personality Brokers.

Emre earned her PhD in English literature from Yale University and thereafter joined the English department faculty at McGill University in Montreal, Canada.

In 2018, she was appointed an associate professor of American literature at Oxford University.

****************************

A Music Link

Geoff. 181 music videos.