Locator: 48541B.

WTI: $67.95.

New wells:

- Sunday, March 23, 2025: 55 for the month, 170 for the quarter, 170 for the year,

- 41018, conf, WGO Resources, Koon Harkins 1-26,

- 40943, conf, Murex, LA-Lily Anne 25-36H MB,

- 39318, conf, Grayson Mill, Marilyn 31-33 2H ,

- Saturday, March 22, 2025: 52 for the month, 167 for the quarter, 167 for the year,

- None.

- Friday, March 21, 2025: 52 for the month, 167 for the quarter, 167 for the year,

- None.

RBN Energy: Enbridge, PAA offer full range of Permian-to-gulf infrastructure.

A half dozen large midstream companies provide the full gamut of “wellhead-to-water” services for Permian-sourced natural gas and/or NGLs, and a couple of those offer the same for crude oil as well. For Enbridge and Plains All American, the clear focus has been on crude — pipelines, storage and marine terminals — though Enbridge has been rapidly expanding its portfolio of Permian-to-Gulf gas assets too. In today’s RBN blog, we look at what Enbridge and Plains have and what they are planning.

This is the fourth and final blog in our series on the handful of companies that offer soup-to-nuts midstream services and thereby reap the benefits of operating with extraordinary efficiency, collecting fees from shippers each step of the way and feeding pipelines, fractionators, storage and export terminals along the network’s value chain. In Part 1, we detailed the assets and plans of Enterprise Products Partners and Energy Transfer; Part 2 discussed what Targa Resources and Phillips 66 are up to; and Part 3 focused on ONEOK and MPLX.

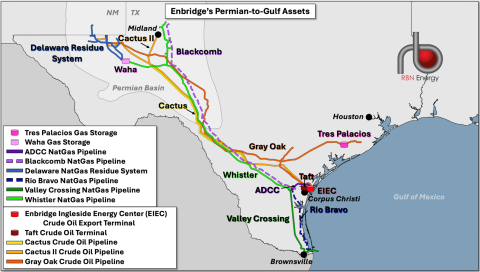

In today’s blog, we turn our attention to Enbridge and Plains All American, both of which have extensive crude-oil-focused infrastructure between the Permian and the Gulf Coast — and, as we noted earlier, Enbridge has been expanding into natural gas infrastructure. We’ll start with the crude oil side of Enbridge, the core of which involves the company’s 30% ownership interest in the 670-Mb/d Cactus II Pipeline (light-orange line in Figure 1) from West Texas to Ingleside, TX; its 68.5% stake in the 900-Mb/d Gray Oak Pipeline (dark-orange line) from West Texas to Ingleside and Freeport; and its fully owned Enbridge Ingleside Energy Center (EIEC; red tank icon), the U.S.’s largest crude oil export facility. Enbridge also owns the 350-Mbbl Taft Terminal (just inland from Ingleside; purple tank icon) and the 300-Mb/d Viola Pipeline (not shown), which runs from the Corpus Christi terminus of Plains and Enterprise’s 600-Mb/d Eagle Ford JV Pipeline to Taft and from Taft to EIEC.

Figure 1. Enbridge’s Permian-to-Gulf Assets. Source: RBN