Updates

Later, 7:34 p.m. CT: with regard to LNG / natural gas and US dominance, a reader replied to the note below --

Minimal data presentation ...

- Update: December 15, 2024: Plaquemines up and running. Link here.

- 10 mtpa Calcasieu Pass is now in test phase and will export LNG within a few week's time.

- Plaquemines Parish is identical to Calcasieu Pass but twice the size. (Essentially building 2 Calcasieu Pass on one site).

- CP2 is identical to Plaquemines Parish and adjacent to Calcasieu Pass.

- Cumulative output from these 3 projects will be ~50 mtpa, which surpasses the much ballyhooed expansion from Qatar which is ~49 mtpa.

Original Post

I occasionally update "the big stories." I started writing about "the North American energy revolution" in 2013. An early observation: the center of gravity for fossil fuel has clearly moved from the Mideast and Russia to North America, June 26, 2016.

Now this, these two stories this past weekend. First, from The [London] Express: EU revolt as France and Germany go head-to-head over energy crisis.

Cracks are starting to show in the European Union's united front as Germany and France go head-to-head over the bloc's deepening energy crisis.

Member states including France and Spain have called on the European Union to reform its energy market in a bid to save it from collapse.

The global energy crunch has already caused gas prices to rise more than 600 percent this year and experts fear the EU will experience a full-blown crisis this winter.

However, European ministers clashed on Thursday when a coalition of member states, including Germany, opposed calls to reform the bloc's market rules.The crisis has also touched the UK where nearly 30 energy suppliers have gone bust, leaving millions of customers in a state of uncertainty.

We may hear a lot of horror stories this winter with regard to the US, including my fascination with ISO NE, but none of that will compare to those horror stories in Europe (but those horror stories, regardless where they come from, will come from the same source -- faux environmentalists).

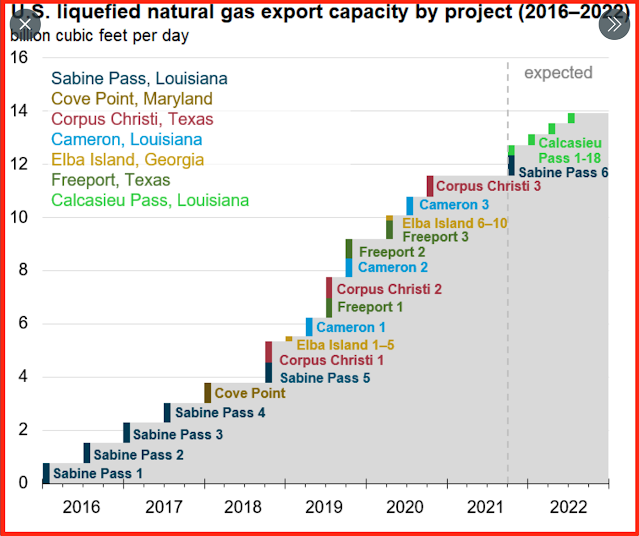

Meanwhile, from twitter, "the US is surging to become the global leader in natural gas exports." Global leader. The US is expected to become the world's largest LNG exporter once Sabine Pass LNG Train 6 and all 18 mid-scale trains at Calcawieu Pass LNG are in service.

And, of course, if Brandon doesn't interfere. Which is not even beyond him.

I track LNG export terminals here.