Time's Man of the Year: Elon Musk. Perhaps one of the better picks in a long, long time.

Why the market keeps going higher ... in one chart: link here.

- inflation: highest it's been since 1982

- today: 10-year Treasury -- 1.5% and trending down today;

- 1982: 10-year Treasury -- greater than 10%

- perhaps this is the time to really, really, really add debt to one's financial sheet

- how fast can the TYT move?

From that linked article -- think about this -- how fast a publicly traded company puts together a marketing initiative in response to a television show:

Peloton: Count me as in the minority here, but I kind of like how Peloton's responding to the uproar over its connected bike causing Mr. Big of "Sex and the City" to have a heart attack in the latest reboot of the series.

First, Peloton blamed Mr. Big's lifestyle of partying and red-meat eating for him dying after a 45-minute ride.

Then on Sunday, Peloton put a tweet out saying Mr. Big is alive and is enjoying a romantic evening with his favorite instructor Jess King (Allegra in the show).

Having said all of that, this is still a nightmare for the company right smack in the middle of the holiday shopping season and before New Year's resolution season in January. It will do no favors to a stock that has been clobbered this year for a litany of reasons, as long-time Peloton bear Simeon Siegel of BMO Capital Markets explained.

Market commentary: IBD -- link here. Most noteworthy, Rivian reports today.

No news, yet, regarding AMD / XLNX but both are up in pre-market trading. Overall, semiconductors appear to have a good day ahead of them.

Peak demand: investors now see peak demand (crude oil) moving much farther to the right. Link to Tswvetana Paraskova.

First group "financial / economic" indicators:

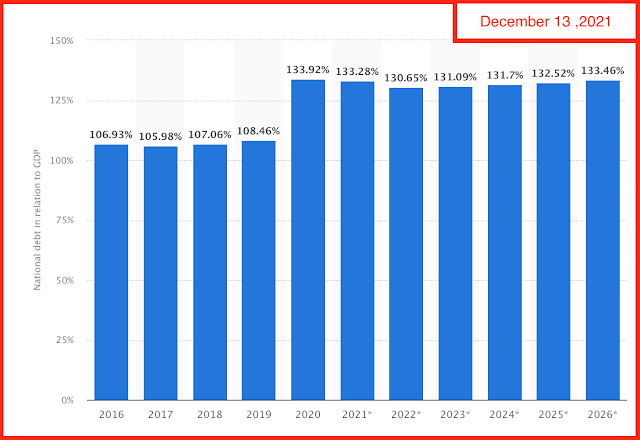

National debt / GDP: link here.

That's an interesting graph: of course the jump is all due to Covid-19 -- well, "almost all." And it probably didn't matter who was president during fiscal years / calendar years (?) 2019 - 2020 but for the record it was Donald Trump. Interestingly enough, assuming recent spending has been factored into the graph above, the ratio will drop every so slightly during the Biden administration. Just trolling. Interesting but not actionable.

US budget deficit, FY2021: link here. A record was not set.

The U.S. incurred the second-largest budget deficit on record in the

fiscal year that ended Sept. 30, reflecting government expenditures tied

to the coronavirus pandemic and adding fuel to congressional debates

about proposed spending.

The $2.8 trillion deficit was the second largest

since 1945 as a share of the nation’s gross domestic product and

trailed only the prior fiscal year’s $3.1 trillion shortfall, when not

adjusting for inflation.

The deficit for the fiscal year was 12.4%

of all economic output, down from 15% the previous year, the Treasury

Department and Office of Management and Budget said Friday. The deficit was 4.6% of GDP in the 2019 fiscal year, before the pandemic began.

The fund rate: incredibly low, according to Steve Liesman. Take out inflation, and the "easy money" gap is widening. The gap between investors and savers continues to widen, favoring the former.

The big story on CNBC this morning: Apple (AAPL) -- closing in on that $3-trillion market cap.

Biggest decision I have all day: whether to watch CNBC. Decision made. Television off. Good luck to everyone.