Sunday, May 26, 2024

A CLR Cuskelly Well Comes Off Confidential List This Week -- May 26, 2024

Locator: 47189B.

The Cuskelly wells are tracked here.

I haven't seen a new Cuskelly well in a long time -- but this week, a new Cuskelly well comes off the confidential list:

- 40278, conf, CLR, Cuskelly 5-7H, Rattlesnake Point, npd

A lot of the CLR Cuskelly wells are now off line. I expect to see them back on line within the next six months.

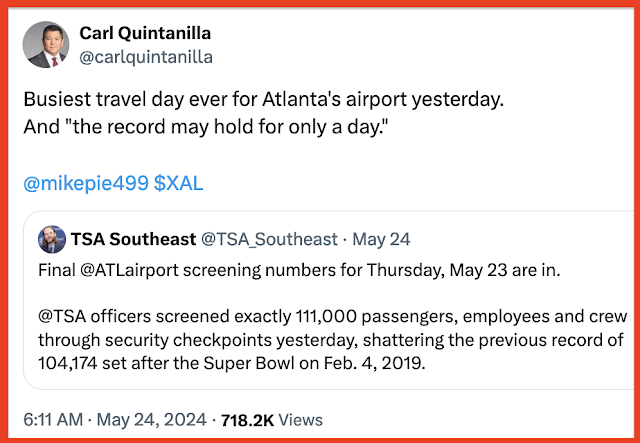

Air Travel -- Memorial Day Weekend -- May 26, 2024

Scheffler Chokes -- Can't Shake Louisville -- May 26, 2024

Locator: 47187PGA.

After the seventeenth:

- Riley remains in first, -14; ranked 250th in the world.

- Bradley, ranked 20th in the world, tied with Scheffler, -9

- Scheffler playing alongside Riley is -9; ranked 1st in the world.

- started the tournament with a triple bogey on opening day, Thursday, first hole

- Jordan Spieth: will finish tied for 37th or thereabouts.

Bing still having issues:

NASCAR starts in the next half-hour or so. Coca-Cola 600.

BUD -- May 26, 2024

Locator: 47186BUD.

Bud Lite, Mulvaney.

Everything you need to know -- August 14, 2023 -- them.

I don't recall if I ever posted my thoughts on the Bud Lite / Mulvaney controversy. Oh, I know I wrote a lot about it and I know I shared some thoughts, but as usual, I flip-flopped but at the end-of-the-day I was pretty sure how to best handle it. But now it's 20-20 hindsight.

But I was curious how the story is being reported now.

This is from about a month ago, Newsweek. When I was reading Newsweek decades ago, I considered it fairly balanced; I guess some folks consider it more liberal now -- whatever that means. The more reading I do, the more problems I have with labels. But, I digress.

So, this is from about a month ago. Link here.

For me, it was only an investment story. Wondering whether I should invest in BUD at the time.

I never did because I have an investing plan and I am sticking to it. BUD was never in my portfolio and there was no special / great opportunity to invest in BUD based on what I read, regardless of the Mulvaney dip.

So, I kept to may plan and did not invest in BUD, though I thought about it when BUD was in the mid-50s.

So, how has BUD done?

I think we will first look at the "5-year" chart; the "max" becomes ancient history for most investors, but the five-year chart gives an investor an idea of where we've been and where we are: the five-year chart for BUD is atrocious. At a high of 100 at the start of the period, dropped to 40 in March, 2020 -- exactly when the lockdowns began.

Look at the graph below, and then I'll ask a question:

Quick: when did the Mulvaney controversy begin?

It looks like it must have happened around August 2, 2019. Nope. February, 2020? Nope. June 4, 2021? Nope. August 12, 2022? Nope. Bottom line. BUD was in trouble long before Mulvaney and however well/bad BUD is doing today is in the eye of the beholder.

However, for investors, when thinking about an equity, I recommend looking at the five-year chart and the one-year chart after one has spent a few hours "looking at the company" from an investment point of view.

So, look at the one-year chart:

At one year, it's done about as well as BRK-B. At three months, it's done way better than BRK-B.

From May, 2023, through October, 2023, one could have bought BUD in the mid-50s. Today, BUD is trading around $65. In one year, the stock has appreciated 20% and pays almost 3%.

I think most of us would be delighted with a 20% return y/y and a 3% dividend.

For Mulvaney, from the linked article:

*********************

The Book Page

The book for the week: Charlie Chaplin vs America: When Art, Sex, and Politics Collided, Scott Eyman, c. 2023.

Background: The Hollywood Reporter, April 2, 2015, link here.

- b. 1889, England

- 1947, age 58, famous and loved by many; sails to England to visit his home

- was unaware of the storm clouds; never, never thought the US would renege on its promise of safe return

- en route on the Queen Elizabeth learns that the US will not allow him to return to the US

- morality issues (politics and sex)

- happily married to Oona, with four children; he was 54 when he married her, age 18

- he would spend the rest of his life with Oona, died in 1991, age 66

- settles in Switzerland

- 1972: the US allows Chaplin to return to the United States to attend the "Oscars" to accept an honorary statuette, age 83

- d. 1977

So, going into the 2024 elections ....

PGA Today -- Scottie Scheffler Four Back -- Will He Be Able To Shake Off Louisville? May 26, 2024

Locator: 47184GOLF.

Leader (are you kidding me?), official world golf ranking, 250th and leading in the Charles Schwab Challenge, Ft Worth, TX. Jordan Spieth's home; Jordan Spieth tied for 35th and that's about where he will finish, I suppose.

His one and only PGA win: Zurich Classic, New Orleans, April, 2023.

Scheffler: four back.

Certainly nice to see all the world's top golfers playing for LIV, letting "second tier" PGA golfers get a chance to win.

Won't be watching. Except maybe at 5:00 p.m. later this afternoon.

Data Centers -- Bloomberg's Take -- May 26, 2024

Locator: 47183TECH.

I have no interest in the commentary or opinion or the writer's two-cents-worth of comments, but the magnitude of these data centers is quite incredible.

I look at these stories through my technology-filter spectacles. Would that be a Vision Pro?

Link here. A Bloomberg product.

Tax breaks for data centers aim to attract jobs to areas of the country with high unemployment. Despite their evident shortcomings, they remain a popular choice for state legislatures—and it seems like a data center tax break arms race is under way. But states should tax data centers more to offset the strain they place on local infrastructure.

Data centers place massive burdens on infrastructure and local resources such as electricity and water, and artificial intelligence is set to increase those burdens exponentially. Exact details on data centers’ resource use can be difficult to find, but the small peeks we’ve had have been astonishing.

Alphabet Inc. data centers (i.e., Google) in The Dalles, Oregon, used 355 million gallons of water in 2022. At an Environmental Protection Agency estimated 82 gallons of water used per day at home, that equates to the water use of nearly 12,000 individuals.

- population, Oregon: 4.3 million; x 82 gallons = 353 million gallons,

- or the data center used almost the exact amount of water over the entire year that Oregonians used in one day.

- hardly seems concerning. And that's why the data center was placed where it was placed: plenty of water. Would one prefer putting that same data center in New Mexico, Arizona, or west Texas?

- we heard the same water concerns with fracking years ago;

In terms of electricity, data centers consume an estimated 1% to 2% of worldwide power usage, and that may rise as high as 4% by the end of this decade.

- again, from an investor's point of view -- wow. By the way, this is why smaller blades are so incredibly important --

- think Nvidia -- smaller blades use less electricity, generate less hear requiring less water -- again, from an investor's point of view.

Evidence that data centers drive job creation simply isn’t there. The data we do have, while several years old, indicates they create few jobs and cost about $2 million for each they do manage to conjure up.

- from an investor's point of view -- awesome -- data centers must have huge, huge profit margins if personnel costs are low.

Data centers are much more energy-intensive than labor-intensive. Their resource usage may drive up resource costs and shift financial burdens to other resident businesses and individuals—both in the tax loss from the data center and the higher costs of electricity and water.

Tax breaks for data centers are a fortunately rare phenomenon (so what's the problem?) —tax policy that is precisely wrong. Tax breaks for data centers represent misguided state fiscal strategy, and the tide must be stemmed before more states succumb to the mistaken notion of “investing” in data centers with taxpayer money.

- this is definitely true -- as we are seeing western North Dakota, and possibly eastern North Dakota as well. Investors? Utilities.

Back to That Columbia River

- 265,000 cubic feet = 2 million gallons

- this is per second

- Alphabet data center: 355 million gallons of water over one year

- 355 million / 2 million (one second) = 178 seconds worth of water from the Columbia that would have otherwise run into the ocean. 178 seconds.

- and, oh, by the way, most of that water was diverted back into the Columbia River after "used" by that Alphabet data center

- in other words, the Columbia River water is simply a revenue generator for its owner.

- so much more could be said but this is enough for now

Disclaimer: I often make simple arithmetic errors. In a long note like this, there will be typographical and content errors.

ERCOT --Wind Will Be The Limiting Factor Later This Evening -- May 26, 2024

Locator: 47182ERCOT.

Generally speaking, as the sun goes down in Texas, the wind picks up, providing the extra "kick" needed to meet demand going into the evening. Tonight, it looks like wind could be a limiting factor. Texas electricity demand won't exceed supply but cost will be exorbitant as the spread narrows in the early evening.

California's Central Valley Bullet Train Update -- May 26, 2024

Locator: 47181THECOMICPAGE.

- tag: bullet train, Tulare Lakebed, Corcoran,

Updates:

Link here. May 5, 2024, so, it's a fairly recent update.

At the link, some great photos and narrative:

The California High Speed Rail Authority shared an update on the Fresno River Viaduct in Madera County last week, proudly saying it was one of the 'first completed high-speed rail structures.'

The tweet did not get the reaction officials were hoping for with Elon Musk and Dogecoin creator Billy Markus piling in to mock the project.

The Viaduct has taken nine years to build and has cost taxpayers $11 billion as part of the state's long-delayed, bullet-train plan attempting to link San Francisco to Los Angeles.

Commenting on photos showing the bridge stopping at only 1,600ft long with either end floating unconnected in the air, Markus tweeted: 'This is the most remarkable human achievement ever.'

Sharing the rail authority's tweet he added: '1600 feet of high speed rail after 9 years and 11 billion dollars it takes about 5 minutes to walk 1600 feet so a high speed rail for that is a really big deal.'

He added: 'Wow so impressive, can’t wait until year 2400 for this to finish for 700 quadrillion dollars.'

Musk then chimed in, adding a crying face emoji.

The high speed railway project has been beset by delays and setbacks. So far $11billion of taxpayer money has been sunk into the scheme which aims to connect Los Angeles to San Francisco. The figure includes work on controversial Fresno bridge and a section which runs from Bakersfield to Merced, which is about 80 miles from the Bay Area.

It will take an estimated $100billion more to finish the project and link San Francisco to Los Angeles with many calling for the project to be scrapped.

The floating viaduct:

What's really cool about this: the disconnect between engineer thinking and banking CEO thinking:

- engineers could / couldn't care less about the cost; it's the engineering feat that marvels

- the banking CEO: are you kidding me? $11 billion for a bridge to nowhere.

See Wes Anderson's Asteroid City for more on this.

*********************************

Re-Posting

One of my better posts on the Bullet Train, California

Locator: 44699CA.

Locator: 44461BT.

Updates

May 20, 2023: California to open relief valves to mitigate Lake Tulare flooding.

The intertie functions like a gated alley connecting two much larger streets. On one side lies a stretch of the Kern River called the Buena Vista Channel, and on the other is the California Aqueduct, a simple name for a complex system of tunnels and pipelines that transports water from Northern California and the Sierra to the state's arid central and southern expanses.

Original Post

I

don't know if folks remember this, but if you do, hold that thought.

This was the huge Red River flood of Grand Forks back in 1997. Photo link here.

Fast forward.

Out in California, The Los Angeles Times

reports on something similar facing Tulare, California, central valley,

northwest of Los Angeles, northwest of Bakersfield. Tulare Lake is

back. See also the blog of June 24, 2017.

This story may or may not be behind a paywall. I was able to access it without difficulty.

The flooding has only recently begun and is expected to last at least two more years,

assuming I read the article correctly, which seems correct because the

state is working on a plan to raise the existing earth dikes another 3.5

feet.

What the flood plain looks like on the map:

Why this story is of interest? Not so much what was reported but what was not reported.

The California Bullet Train.

The map from the state of California:

Going back to the earlier map:

Note:

this is the easy part of the bullet-train-rail -- flat. No tunnels. No

mountains. No major river crossings. Just absolutely flat.

And flooded.

The good news: they can put 12-foot dikes on either side / both sides of the rails.

The bullet train is tracked (no pun intended) here.

***************************

Current Cost / Funding Status

What's In Store -- Today, This Week -- May 26, 2024

Memorial Day Monday

Pending:

- Bud, Mulvaney

- deflation

- air travel

- Lego

The comics, Sunday morning, update here:

A bit farther out, but huge story:

*********************************

Anticipation

Events to watch this week (investing):

- economic calendar

- GDP

- GDPNow, link here: May 24, 2024 -- estimate at 3.5, down from 3.6 on May 16, 2024

- earnings calendar

- COST

- dividend announcements

Initial Production For Wells Coming Off Confidential List This Next Week -- May 26, 2024

Locator: 47179B.

The wells:

- 40278, conf, CLR, Cuskelly 5-7H, Rattlesnake Point, npd,

- 40245, conf, Empire North Dakota, Walleye 32-8 1H, Starbuck, npd,

- 39387, conf, BR, Watchman Peak 2-8-11TFH, Westberg, npd,

- 38057, conf, Oasis, Wood 5498 12-25 4B, Truax,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 3-2024 | 1875 | 6626 |

- 39386, conf, BR, Watchman Peak 3-8-11MBH, Westberg, npd,

- 40186, conf, CLR, Sloan 7-8H, Jim Creek, npd,

- 39654, conf, Hess, GO-Bergstrom-156-98-2734H-2, Wheelock,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 3-2024 | 18719 | 34471 |

| 2-2024 | 12405 | 17295 |

| 1-2024 | 27781 | 33305 |

| 12-2023 | 47052 | 9417 |

- 39385, conf, BR, Watchman Peak 4-8-11TFH, Westberg, npd,

- 40185, conf, CLR, Sloan 6-8H, Jim Creek, npd,

- 39384, conf, BR, Devils Backbone 1B UTFH, Westberg, npd,

- 39327, conf, Hunt Oil, Alexandria 161-100-22-15H 4, Alexandria,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 3-2024 | 10970 | 5326 |

| 2-2024 | 9698 | 3890 |

| 1-2024 | 10566 | 3652 |

| 12-2023 | 9175 | 3456 |

- 39655, conf, Hess, GO-Bergstrom-156-98-2734H-3, Wheelock,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 3-2024 | 16283 | 32970 |

| 2-2024 | 20949 | 47417 |

| 1-2024 | 18384 | 49679 |

| 12-2023 | 33769 | 102278 |

- 40184, conf, CLR, Sloan 5-8H, Jim Creek, npd,

- 39383, conf, BR, Devils Backbone 3A UTFH, Westberg, npd,

- 39326, conf, Hunt, Alexandria 161-100-22-15H3, Alexandria,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 3-2024 | 14507 | 6616 |

| 2-2024 | 13535 | 5120 |

| 1-2024 | 13997 | 4527 |

| 12-2023 | 13477 | 4388 |

| 11-2023 | 0 | 158 |

- 40283, conf, Eagle Operating, Wade 5-11, Feldner Coulee, npd,

- 39382, conf, BR, Devils Backbone 3B MBH, Westberg, npd,

- 39577, conf, Prima Exploration, Elzy Lay 1H, Ft. Buford, npd,

- 39568, conf, Prima Exploration, Elzy Lay 2H, Ft. Buford, npd,

- 39381, conf, BR, Devils Backbone 3C UTFH, Westberg, npd,

Wells Coming Off Confidential List This Next Week -- May 26, 2024

Locator: 47178B.

Wednesday, June 5, 2024: 54 for the month; 118 for the quarter, 317 for the year

40278, conf, CLR, Cuskelly 5-7H,

40245, conf, Empire North Dakota, Walleye 32-8 1H,

39387, conf, BR, Watchman Peak 2-8-11TFH,

38057, conf, Oasis, Wood 5498 12-25 4B,

Tuesday, June 4, 2024: 50 for the month; 114 for the quarter, 313 for the year

39386, conf, BR, Watchman Peak 3-8-11MBH,

Monday, June 3, 2024: 49 for the month; 113 for the quarter, 312 for the year

None.

Sunday, June 2, 2024: 49 for the month; 113 for the quarter, 312 for the year

40186, conf, CLR, Sloan 7-8H,

39654, conf, Hess, GO-Bergstrom-156-98-2734H-2,

39385, conf, BR, Watchman Peak 4-8-11TFH,

Saturday, June 1, 2024: 46 for the month; 110 for the quarter, 309 for the year

40185, conf, CLR, Sloan 6-8H,

39384, conf, BR, Devils Backbone 1B UTFH,

39327, conf, Hunt Oil, Alexandria 161-100-22-15H 4,

Friday, May 31, 2024: 43 for the month; 107 for the quarter, 306 for the year

None.

Thursday, May 30, 2024: 43 for the month; 107 for the quarter, 306 for the year

39655, conf, Hess, GO-Bergstrom-156-98-2734H-3,

Wednesday, May 29, 2024: 42 for the month; 106 for the quarter, 305 for the year

40184, conf, CLR, Sloan 5-8H,

39383, conf, BR, Devils Backbone 3A UTFH,

39326, conf, Hunt, Alexandria 161-100-22-15H3,

Tuesday, May 28, 2024: 39 for the month; 103 for the quarter, 302 for the year

40283, conf, Eagle Operating, Wade 5-11,

Monday, May 27, 2024: 38 for the month; 102 for the quarter, 301 for the year

39382, conf, BR, Devils Backbone 3B MBH,

Sunday, May 26, 2024: 37 for the month; 101 for the quarter, 300 for the year

39577, conf, Prima Exploration, Elzy Lay 1H,

39568, conf, Prima Exploration, Elzy Lay 2H,

39381, conf, BR, Devils Backbone 3C UTFH,