Locator: 49799B.

Trump Center For The Performing Arts: new name for the Maduro Center.

CNBC: let's see how long it takes for Becky Quick to mention CVX.

Note: I am limiting myself to ten minutes per day to CNBC, as noted earlier. Today I will add ten minutes to total twenty minutes -- ten minutes with Joe Kernen and ten minutes with Jim Cramer.

- it's already turned political, three minutes into Squawk Box and I'm done with CNBC this morning until Jim Cramer for ten minutes.

- the last two people I need to listen to this morning: Eamon Javers, Andrew ROSS Sorkin.

*********************************

Back to the Bakken

WTI: $57.37 (unchanged from last week).

New wells reporting:

- Tuesday, January 6, 2026: 12 for the month, 12 for the quarter, 12 for the year,

- None.

- Monday, January 5, 2026: 12 for the month, 12 for the quarter, 12 for the year,

- 40620, conf, KODA Resources, Amber 1336-8BH,

- Sunday, January 4, 2026: 11 for the month, 11 for the quarter, 11 for the year,

- None.

- Saturday, January 3, 2026: 11 for the month, 11 for the quarter, 11 for the year,

- 40619, conf, KODA Resources, Amber 1336-7BH,

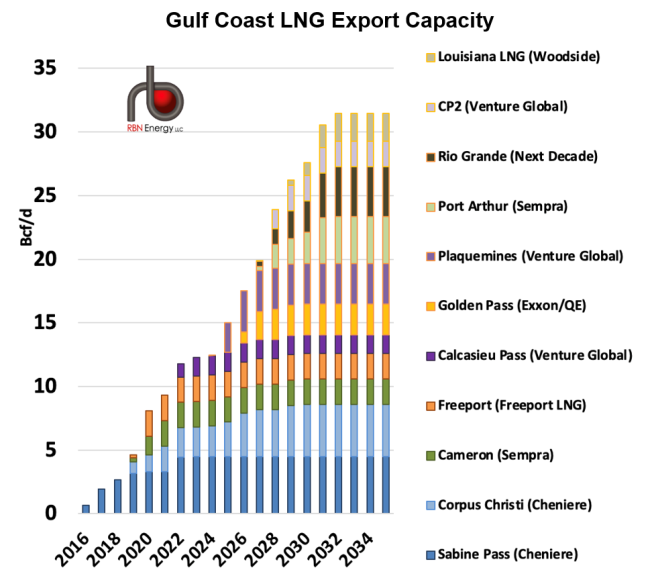

RBN Energy: the broad impacts of the big inflection point for natural gas. Link here. I vividly remember the day some years ago when I posted the projected buildout of the LNG export terminals/facilities along the Texas/Louisiana coast and someone wrote to tell me that not all of them would be built. Archived.

Sure, natural gas markets have experienced plenty of changes over the past few years. Rising associated gas production in the Permian. New pipeline and storage capacity. New LNG demand. Pricing ups and downs. But we’d argue that all this was merely a prelude. That the main event — a veritable transformation of gas markets, especially along the Gulf Coast — is about to begin. A doubling of LNG demand (to 32 Bcf/d!). Another 10 Bcf/d of new pipelines out of West Texas, plus at least 15 Bcf/d more along the coast. Production revivals in the Haynesville and the Eagle Ford. And don’t forget soaring demand for gas-fired power generation. In today’s RBN blog, we discuss the massive, market-transforming changes just ahead — and our upcoming GasCon 2026 conference, which is hyper-focused on this market-shifting inflection point.

With all the announcements in 2022-25 — upstream and midstream consolidation, new pipelines and storage projects, new LNG export terminals, etc. — you’d be tempted to think this has been a period of extraordinary change. And you’d be right. But the fact is, the past few years in the U.S. natural gas market have really been just a teaser, a preview, an appetizer. Now, finally, all the planning and shifting is coalescing. A major, five-year ramp-up in LNG capacity is beginning in earnest. Soaring gas demand along the Gulf Coast will support stronger gas prices and, with that, more drilling and production, not just in the Permian but the Haynesville, the Eagle Ford and, very likely, other basins further afield. And to connect the supply and demand, new multi-Bcf/d pipelines will be coming online and storage projects will be developed.

Let’s begin with the demand angle, because, despite being spurred by natural gas supply pushing out of basins like the Permian, it’s going to be the primary driver behind the upcoming market transformation. RBN’s Arrow Model, which closely monitors the planned addition of new LNG export capacity, projects that feedgas demand from LNG terminals in Texas will soar from “only” 4.5 Bcf/d in 2025 to 8.8 Bcf/d in 2027 and about 16 Bcf/d nine years from now. LNG feedgas demand in Louisiana is projected to rise more gradually, from an already hefty 10.6 Bcf/d in 2025 to 11.7 Bcf/d in 2027 and ~16 Bcf/d in 2035. (Figure 1 below shows the planned additions.) Liquefaction-train commissioning is underway at Plaquemines LNG (already consuming 3.9 Bcf/d on average in December), Golden Pass LNG and Corpus Christi LNG Stage III, with more to follow at these export terminals and others the next couple of years. Still more are on the way: Over the past 12 months, no fewer than six Gulf Coast LNG projects with a combined capacity of 61 MMtpa (8.1 Bcf/d) reached a final investment decision (FID): trains 4 and 5 at Rio Grande LNG, a two-train expansion at Port Arthur LNG, a small expansion at Corpus Christi Stage III, and two entirely new terminals (Venture Global’s CP2 and Woodside’s Louisiana LNG).