Locator: 48742ORACLE.

Locator: 48742B.

Locator: 48742BOEING.

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- I've now added Oracle to the disclaimer. I am also inappropriately exuberant about all things Oracle.

- Longer version here.

***************************************************

Mid-morning trading: after a huge drop at the opening -- due to Boeing / India earlier this morning; some concerns about tariffs; concerns about Iran -- the market has pivoted and all three major indices could move into the green before the close.

Nvidia: in mid-morning trading, ticks higher, trending toward new all-time record highs. I believe the record close for NVDA was $148 back in November, 2024. It's trading at $144 today, up about 1%.

Oracle: immediately after the open, Thursday morning opening; Oracle CEO comments are absolutely incredible; up 10% at the open on a down day for the Dow.

Boeing: Boeing 787 Dreamliner, Air India, 242 on board, crashed after takeoff in India; at least 100 fatalities -- early reports; now NYTimes reporting "over 200 dead"; Ahmedabad. The Guardian.

- Boeing weighs on the Dow today; could open down 5% (based on futures)

- Boeing 787 Dreamliner: generally a great track record, along with the engines having a strong track record

- no one has mentioned "foul play"

- Ahmedabad: huge economic center; western India;

- 2012: named India's best city to live in

- second-largest producer of cotton; city known as the "Manchester of India"; has emerged as important and industrial hub in India;

- one of a few cities in India that has hosted leaders of major global economies, including US, China, and Canada

- February 24, 2020: President Trump became first US president to visit the city; earlier had been visited by Xi of Chia and Trudeau of Canada

- apparently occurred "five minutes after takeoff"

- reports: landing gear had not yet been retracted

- reports of "mayday call engine failure" before crash

- "landing gear on Boeing 787 Dreamliner is typically retracted within ten seconds after takeoff

- in the event of engine failure after V1, retract landing gear after takeoff -- US DOT FAA MMEL Boeing 787 all models page 127 and page 186; link here.

- most common reason to delay gear retraction: to allow brake cooling to minimize risk of fire hazard in the gear bays.

********************************

Other News

Economic numbers:

- PPI: 0.1% vs 0.2% estimate

- Feds big concern: tariffs would cause inflation; didn't happen (at least not so far)

Tariffs: Japan agrees to buy US LNG to rebalance supply portfolio away from Australia. Link here.

Gary Cohn: IBM Vice Chairman. I had forgotten that / or was completely unaware. Born, 1960.

- Goldman Sachs, for 25 years --> president and COO of GS

- 11th director of the National Economic Council and chief economic advisor for President Trump, first term, 2017 - 2018

- advisor and venture capital investor for various companies: cybersecurity, blockchain, medical technology;

- Board of Advisors for Hoyos Integrity, a startup company employing biometric blockchain technology for secure commuications and digital payments

- 2021: appointed vice-chairman of IBM

- fascinating bio, absolutely fascinating (see link)

*********************************

Back to the Bakken

WTI: $67.11.

New wells:

Friday, June 13, 2025: 44 for the month, 197 for the quarter, 411 for the year,

- 40604, conf, Enerplus, Danielle 145-97-12-1-7H,

- 40555, conf, Enerplus, Danielle 145-97-12-1-6H,

- 40347, conf, Neset Consulting Service, Vision 1,

- 41177, conf, CLR, Kenneth 4-17H1,

- 41120, conf, Oasis, Sawtooth Federal 5202 24-20 6B,

- 39979, conf, Zavanna, Collie 13-25 1H,

RBN Energy: E&P Q1 earnings rise before price drop darkens Q2 outlook.

Buoyed in part by early optimism about the Trump administration’s potentially positive impact on the economy and the oil and gas industry, the WTI spot oil price reached a five-month high of nearly $76/bbl in January. But the optimism and oil prices have steadily eroded due to the impact of tariffs, trade wars and stubborn oilfield service inflation. In today’s RBN blog, we’ll look at the impact of the January price spike on Q1 2025 earnings and analyze the potential impact of a much lower price scenario in Q2 2025.

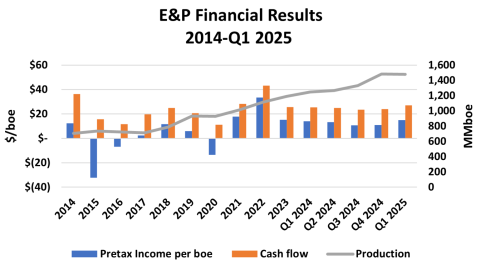

The strong January spot price drove the Q1 2025 average to $71.83/bbl, up 2% from a three-year low of $70.32/bbl in Q4 2024. However, a nearly 70% increase in natural gas prices during the quarter drove a 9% increase in the average oil and gas price to $38.91/boe, the highest since Q1 2023. As a result, the earnings for the 40 E&Ps we cover totaled $22.1 billion in Q1 2025, up 37% to $14.96/boe (blue bar to far right and left axis in Figure 1 below), up from $10.89/boe in Q4 2024. Cash flow grew to $40.1 billion, increasing 13% to $27.15/boe (orange bar and left axis) over the same time period.

Figure 1. E&P Financial Results and Production, 2014-Q1 2025.

Source: Oil & Gas Financial Analytics, LLCThe quarter-over-quarter increase in performance appears less impressive when viewed from a broader historical perspective. Average commodity prices for the quarter most closely parallel the results in Q3 2021, when the WTI spot price was just under $71/bbl and the average Henry Hub spot price was within $0.20 of the Q1 2025 price at $4.35/MMBtu. While the average realization in Q3 2021 was just $1.83/boe higher, the pre-tax operating income was $20.42/boe, 36% higher than the recently completed quarter. A major factor is a $2/boe increase in production costs over the last three years, driven by significant post-pandemic oilfield equipment and services inflation. Depreciation, depletion and amortization (DD&A) costs were also more than $1/boe higher, reflecting the higher costs of finding and acquiring reserves. Persistently higher costs are likely to exacerbate the impact of lower commodity prices in Q2 2025 and beyond.

The comparison of costs for Q1 2025 over the previous quarter is more positive. Lifting costs grew 2% to $11.77/boe as production costs increased 2% to $9.86/boe and production taxes rose 7% to $1.90/boe. DD&A expenses declined 3% to $10.92/boe, while impairment charges fell 40% to $0.96/boe. Exploration outlays were down 9% to $0.30/boe.