EVs: update. It's a six-minute read, so it's a long article. At the end of the day, it looks more and more like it's coming down to Tesla and Waymo (Jaguar i-PACE) for the long term, with niche players all across the board. Rivian-, Tesla-, Lucid-type investors are willing to "trade" (not invest) in EVs, live with quarterly losses; looking at the long term. The question is whether long-term investors are willing to do wait that long (GM, F). EVs are tracked here. Archived.

Rivian Automotive and Lucid Motors racked up billions in losses last year amid modest sales numbers, rising factory incentives and growing uncertainty in the U.S. electric vehicle market following the November election of President Donald Trump.

Rivian, which launched its first model in late 2021, posted a $4.7 billion net loss in 2024, according to the company’s February 20, 2025, earnings report. That was a moderate improvement over its $5.4 billion net loss in 2023.

Lucid, which also sold its first model in late 2021, reported a $2.7 billion net loss last year, the company said February 25, 2025. A year earlier, Lucid posted a net loss of $2.8 billion.

Surprise, surprise: energy is 2025's biggest stock market winner. Barron's. Link here. Most surprising, CVX. Favorite? Enbridge. See disclaimer. Enbridge, for me, is an "emotional" favorite.

Calcasieu: Venture Global ready for official launch of Calcasieu Pass LNG. Link here. The key word is "official."

TSMC: US-made chips might not be that expensive. Link here.

This is the big question: if the US no longer needs "chips" from Taiwan, will the current president or any future president consider it worth the risk to protect Taiwan from a Chinese military incursion? That's the real question.

Right, wrong, indifferent -- Biden's folks appear to have known what they were doing when they passed the CHIPS act. If nothing else, it gave Trump some breathing room in that arena. To what degree can "Taiwan Silicon" move to "Silicon Valley"? Five percent? Ten percent? Fifty percent? Where is the real innovation coming from? Stanford or Taipei?

Israel: with backing of US, Israel takes over UN mission inside Syria. Link here. Tag: Mount Hermon. Etymology: harem.

Around the clock, no let-up: my hunch -- with the "debacle" behind them, Trump's military-intel community will keep the pressure on Yemen -- US Navy pilots logging a lot of combat time. It appears the one thing Yemen doesn't have -- and won't get -- SAMs.

California budget:

Los Angeles: looking at a $1-billion deficit next fiscal year; asking for $2 billion from cash-strapped Newsom.

Moving from DEI to NPSG -- non-profit security grants.

The nation's largest public 4-year university system - enrolling more than 460,000 students -- CAL STATE -- is looking at a 8% cut in state funding. Nothing to suggest Governor Newsom will cut back on funding for the Bullet Train. The other "bullet train" -- Bullet Train Lite -- from LA to Las Vegas is to begin construction any time now.

*************************************

Back to the Bakken

WTI: $69.62.

New wells:

- Thursday, March 27, 2025: 75 for the month, 190 for the quarter, 190 for the year,

- 41073, conf, BR, Tilton Diamond Forest 2A ULW,

- 40219, conf, Hunt, Halliday 146-92-18-1H 1,

- 40218, conf, Hunt, Halliday 146-92-19-36H 1,

- 39319, conf, Grayson Operating, Marilyn 31-33 3H,

- Wednesday, March 26, 2025: 71 for the month, 186 for the quarter, 186 for the year,

- 41089, conf, Neset Consulting Service, Roughrider 1,

- 40841, conf, Formentera, LAR1 26-2 161-94 BMB,

- 40839, conf, Formentera, LAR1 26-2 161-94 ATF,

- 40406, conf, Phoenix Operating, Nate 27-340-3 5H,

- 39735, conf, CLR, Lielan 3-15H,

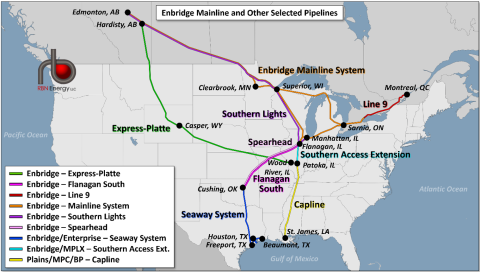

RBN Energy: despite trade frictions, Enbridge forges ahead with pipeline expansion. Archived.

It might seem crazy to talk about expanding crude oil and diluent pipeline systems between Canada and the U.S. amid what could escalate into an all-out trade war between the two nations. However, Enbridge, one of the largest pipeline operators in the world, is doing just that — actively planning and investing in pipeline expansions for its Mainline, Express-Platte and Southern Lights systems that would help move an ever-rising tide of Canada’s oil sands crude to market in the years ahead. We examine Enbridge’s plans in today’s RBN blog.

Unless you have been hiding under a rock for the past few months, you are probably all too familiar with trade frictions that have arisen between the U.S. and Canada as a result of the on-again, off-again imposition of tariffs on U.S. imports of goods from Canada, including vital supplies of energy (see Everybody Hurts). With the potential for a tariff rate of 10% on U.S. energy imports from its northern neighbor (and a 25% rate on other imported goods), the war of words and potential counter-tariffs imposed by Canada have served to upend what is the most successful bilateral trading relationship in the world. It has also led to not-so-veiled threats by Canada that its exports of crude oil, natural gas and electricity could be curtailed or cut off in retaliation.

With trade relations frayed and tensions still unresolved, you might wonder why any Canadian company might be considering — let alone actively pursuing — an expansion of pipeline capacity between the two nations for the movement of crude oil south to the U.S. and diluent north from the U.S. for use in Alberta’s oil sands. Nevertheless, one of the largest pipeline companies in the world, Calgary, AB-based Enbridge, is pursuing just such a strategy, betting that the long-term fundamentals of Western Canada’s crude oil supply growth will fully justify additional pipeline capacity across several of its systems that move crude oil and diluent between the two nations.

Let’s first take a quick tour of several Enbridge pipeline systems, which we will explore in this blog. The array of pipelines known collectively as the Enbridge Mainline (orange lines in Figure 1 below) handles about 70% of all the crude oil shipped from Western Canada by pipeline into the U.S. Midwest. The system’s parallel Lines 1, 2, 3, 4 and 67 transport a variety of heavy and light crude oil and NGLs from Edmonton and Hardisty, AB, to Clearbrook, MN, and Superior, WI. From there, other Mainline pipes move crude to the Flanagan hub in north-central Illinois (Line 61), the Chicago area (Lines 6, 14 and 64), Michigan (Lines 5 and 78) and Ontario (Lines 5, 7, 11 and 78). The U.S. side of the Mainline is often referred to as the Lakehead System.

Figure 1: Enbridge Mainline and Other Selected Pipelines. Source: RBN