Locator: 48586PERMIAN.

RBN Energy: the Permian-focused E%P expands again through M&A. Archived.

We defy you to name an oil and gas producer that’s been on the buying side of more $1-billion-plus M&A than Permian pure play Diamondback Energy, which announced February 18, 2025, that it had agreed to purchase a chunk of Midland Basin assets from Double Eagle IV, one of the Permian’s largest privately held producers, for just under $4.1 billion.

You’d be equally hard-pressed to find a team that’s assembled and flipped more Permian acreage and production than the folks at Double Eagle. In today’s RBN blog, we discuss the newly announced Diamondback/Double Eagle IV deal and what it gives Diamondback, the fourth-largest producer in the Permian after ExxonMobil, Chevron and Occidental Petroleum.Travis Stice, who has served as the company’s CEO for the past 13 years and chairman for the past three, has said that “M&A is as fundamental to Diamondback Energy as the air we breathe.”

No argument there, as evidenced by the E&P’s seemingly insatiable appetite for top-tier Permian acreage and oil-focused production. Midland-based Diamondback started a long string of multibillion-dollar deals in 2017 when it bought assets from Brigham Resources for $2.55 billion. The E&P followed that up in 2018 with agreements to acquire Ajax Resources for $1.25 billion and Energen for a whopping $9.2 billion, thereby increasing Diamondback’s Permian production by 75% and more than doubling its proved reserves. In the months after COVID hit in early 2020, the company bought QEP Resources and Guidon Energy for a total of $3 billion, and in 2022 it shelled out $1.6 billion for FireBird Energy and $1.5 billion for Lario Petroleum.

You’d think that after seven deals totaling more than $19 billion that Diamondback might have finally had its fill. After all, over just a few years it had rocketed to #5 on the list of publicly held Permian producers — and one of the biggest E&Ps in the U.S. for that matter.

But the company was really only getting started.

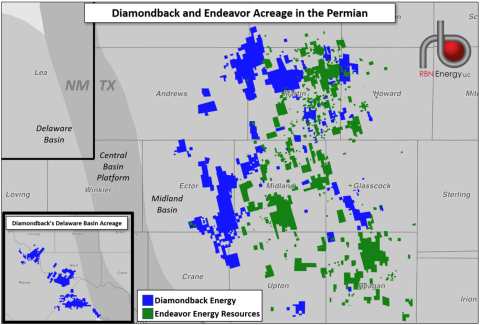

As we discussed in You Belong With Me, Diamondback announced last February that it had entered into its biggest deal ever: a $26 billion, stock-and-cash agreement to acquire privately held Endeavor Energy Resources. The transformational transaction, which closed in September, doubled Diamondback’s net acreage in the Midland to 694,000, increased its total Permian acreage by 70% to 838,000 (see Figure 1 below), and helped Diamondback boost its production by more than 90% year over year — from 463 Mboe/d in Q4 2023 to an estimated 870 Mboe/d in Q4 2024.

[Doing

the math: $45 billion / 838,000 acres = $55K / Permian acre. Assuming

FANG owned some Permian before it went on a buying spree, the $/acre has

to greater.]

Figure 1. Diamondback and Endeavor Acreage in the Permian at Announcement. Source: RBN