| 11/6/2015 | 11/06/2014 | 11/06/2013 | 11/06/2012 | 11/06/2011 | |

|---|---|---|---|---|---|

| Active Rigs | 67 | 190 | 181 | 187 | 196 |

RBN Energy: An LNG Fix For Stranded North Slope Gas?

There’s been at least some progress the last two years on Alaska’s ambitious plan to pipe huge volumes of North Slope-sourced natural gas to the state’s southern coast, supercool it into liquid form, and ship the resulting LNG to Asia. Over that same period, however, the international LNG market has been rattled by weak demand, rock-bottom prices and an impending supply glut. Alaska is itching to become a major LNG supplier by the mid-2020s, but is anyone willing to buy what it’s selling? Today, we provide an update on Alaska’s LNG plan, including a newly approved state buy-out of TransCanada’s interest in key elements of it.

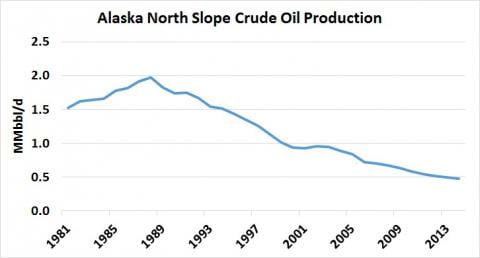

Alaska’s first oil well was drilled in 1898—yes, 117 years ago—but it was not until the mid-1970s that Alaskan oil started making its mark. Then, with the construction of the $7.7 billion Trans-Alaska Pipeline System from 1973 to 1977, oil production at Prudhoe Bay started in earnest in 1978 and quickly ramped up. As shown in Figure #1 below, North Slope oil production peaked at 2.0 MMb/d in 1988 and has been sliding ever since, falling below 1 MMb/d in 2000 and below 500 Mb/d in 2014. By July 2015, North Slope production was down to 431 Mb/d, less than one-third the production rate in the Eagle Ford and barely one-fifth the output of the Permian Basin.

**************************************

California Crude

There's a story making the rounds about Governor Brown of California tasking state workers to determine if there is any oil on / under his land in northern California. I don't care one way or the other; it's a perk of being in office.

For me the bigger story is noting Brown's attitude regarding the oil and gas industry in his home state. He did not ban fracking like the governor of New York has, and considering the opposition to the oil and gas industry in California, one can argue that he has been about as fair as he can be on drilling in his state. I'm sure many will disagree with me. Whatever.

From the AP (same link):

Brown's request to oil regulators points to the complex way that the governor, an internationally known advocate of renewable energy, approaches oil and gas issues in his own state.

While spearheading ambitious programs to curb the use of climate-changing fossil fuels, Brown also has sought to spur oil production in California, the country's No. 3 oil-producing state.Even if his far-left supporters don't want to admit it, the state relies heaving on oil revenue, and Jerry Brown knows it. California's ranking is irrelevant if oil production overall is decreasing.

At its peak, back in 1985, California was producing around 35 million bbls of oil per month (about what North Dakota produces now in a highly choked-back environment). California is now producing less than half that amount, below 17 million bbls of oil per month. Couple that with the huge price decline and California's oil revenue must be cratering. Throw in lost state income tax from oil workers laid off in the state and the situation must look a bit depressing for the governor.

XOM seems to be leaving California -- they sold their refinery in Torrance. OXY spun off its operations in California and moved its headquarters to Texas. Back in 2013, CVX moved 400 employees from its HQ in San Ramon (CA) to Houston; building a new building in Houston; says they are keeping HQ in San Ramon (CA).

The Monterey shale looks like a bust, but even if there is a lot of oil there, it's not going to be produced in this price environment. All of that is probably just the tip of the iceberg.

All of that is upstream.

California remains an "island" when it comes to oil. Midstream, risks of earthquakes minimize opportunities to bring oil into the state via pipeline. And downstream, California has uniquely interesting requirements for gasoline blends. [I would imagine California is VW/Audi's biggest market in the US -- but that's another story for another time.]

Jerry Brown looks at all of that, and then looks at the Alaska crude oil production graph, as seen above. Like most of us, Jerry Brown probably doesn't like movie sequels.

My hunch: before the end of 2016 we are going to see some shocking graphs of California oil production.