Locator: 44410B.

US energy:

Apple: launches high-yield savings account.

Market looks "healthy" today.

- MRNA.

- BofA.

- JNJ. Link here. And, here.

- up 1.56%, up $2.58 in pre-market trading.

- could announce an increase in the quarterly dividend

- adjusted earnings came to $2.68 a share, topping the $2.50 a share expected by Wall Street analysts. Sales rose to $24.75 billion in the first quarter, above the $23.60 billion expected by analysts, according to FactSet.

- J&J, whose financial results are considered a bellwether for many health sectors, also raised its full-year guidance, saying it expects sales to rise about 6% to between $97.9 billion and $98.9 billion. In January, the company guided for sales to rise about 5% to between $96.9 billion and $97.9 billion in 2023.

- The company raised its full-year outlook for adjusted earnings to a

range of $10.60 a share to $10.70 a share, up from $10.45 a share to

$10.65 a share.

***************************

Back to the Bakken

The Oasis Rey Federal wells are starting to report. These are some very, very nice wells.

Active rigs: 44.

Peter Zeihan newsletter.

WTI: $80.53.

Natural gas: $2.233.

Wednesday, April 19, 2023: 35 for the month; 35 for the quarter, 290 for the year

38868, conf, Lime Rock Resources, Twist 4-4-9H-143-95,

38373, conf, Oasis, Rey Federal 5201 32-11 4B,

37476, conf, Petro-Hunt, Watterud 160-95-14B-23-1HS,

39217, conf, SOGC (Sinclair), Grasslands Federal 14-15-5H,

RBN Energy: to replace Russian products, Europe turns to Asis, Mideast, part 2. Archived.

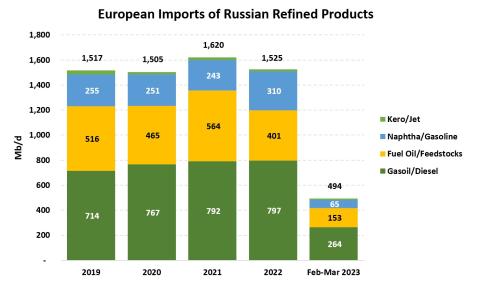

Russia has long been a significant supplier of refined intermediates and finished products to Europe, just as it has been of crude oil. That changed, however, in the wake of Russia’s invasion of Ukraine in February 2022 as the European Union (EU) implemented a formal embargo on imports of Russian crude oil in December 2022, followed by refined products in February 2023. In today’s RBN blog, we review the reduction in imports of Russian refined products and intermediates into Europe and the specific replacement sources.As we described in Part 1 of this series, Russia supplied about 25% of all crude oil and refined products to Europe and accounted for about 38% of EU imports before the embargo. The total volume was about 4.7 MMb/d, of which crude oil comprised more than 3 MMb/d. Total refined products supplied by Russia to Europe were around 1.5-1.6 MMb/d before February 2023, when the volume slumped to less than 500 Mb/d (multicolored bar to far right in Figure 1).

The EU ban on Russian refined products took effect on February 5, 2023, leading to significant reductions in diesel/gasoil, fuel oil/refinery feedstocks, and naphtha/gasoline. Diesel and gasoil (dark-green bar segments) contributed about one-half of Russian refined products imported by the EU with just under 800 Mb/d in 2021 and 2022, declining to 264 Mb/d in February-March 2023 (time period represents the 40 days after the embargo came into effect). Fuel oil and refinery feedstocks (yellow segments) had been trending in the 400-500 Mb/d range before falling to 153 Mb/d. Finally, naphtha and gasoline (blue segments) declined from 310 Mb/d to 65 Mb/d.

Figure 1. European Imports of Russian Refined Products. Sources: Baker & O’Brien, KPLER

Before we get going, it is worth putting the ~1 MMb/d fall in European imports of Russian products into some context. European refining capacity was approximately 15 MMb/d at the beginning of 2022. In recent years, refining throughput ranged from a low of 11.2 MMb/d (during the Covid nadir in 2020) to as high as 12.7 MMb/d (2019). European refinery utilization (~80% in non-Covid years) is typically less than in the U.S. (~90%), reflecting some non-competitive capacity. In 2019, European refined products demand was about 14.8 MMb/d. So, the decline in Russian supplies was in the order of 7% and 8% of demand and refining throughput, respectively. Europe’s relatively low historical refinery utilization suggests that European refineries had some potential to make up for the shortfall from Russian supplies, provided profit margins could support the increased run rates. Alternatively, Europe can tap into the global refining industry and vast waterborne supply options for other sources of refined products.