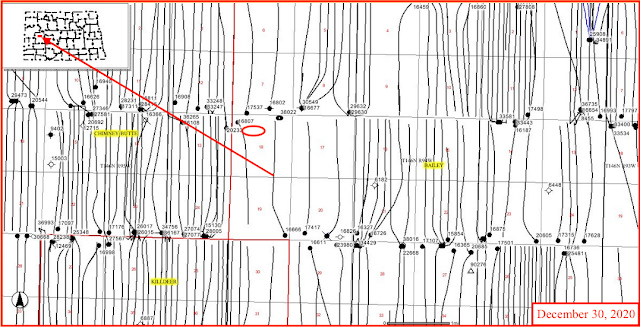

Permits, #37296 - #38059

- 14 of them were salt water disposal wells

- three carbon capture and storage

- 746 gas and oil permits

Counties:

- Dunn: 148

- McKenzie: 272

- Mountrail: 150

- Williams: 134

Field (top ten):

- Alkali Creek: 14

- Antelope: 56

- Bailey: 18

- Beaver Lodge: 10

- Big Bend: 29

- Cedar Coulee: 23

- Dimmick Lake: 16

- East Fork: 10

- East Tioga: 21

- Elidah: 17

- Elm Tree: 27

- Hofflund: 21

- Little Knife: 17

- Mandaree: 18

- Moccasin Creek: 19

- North Fork: 23

- Oliver: 16

- Pershing: 28

- Reunion Bay: 39

- Sanish: 39

- Stony Creek: 15

- Westberg: 14

Not on the list above:

- Grail

- Haystack Butte

- Hawkeye

- Oakdale

- Parshall

- Truax

- Van Hook

Operators: number of permits:

- CLR: 125

- BR: 110

- MRO: 99

- Hess: 50

- Whiting: 50

- XTO: 46

- Enerplus: 45

- Petro-Hunt: 38

- Slawson: 29

- WPX: 28

- Kraken: 24

- Zavanna: 20

- Crescent Point: 17

- Petroshale: 15

- Oasis: 13

- Sinclair: 9

- KODA Resources: 8

- Lime Rock: 6

- Equinor: 5

- Iron Oil: 4

- Nine Point Energy: 3

- Liberty Resources: 3

- Bruin: 1

- EOG: 1

- Red Tail Energy: 1

- SHD: 1

- True Oil: 1

- Rimrock: 1

Note: in a long note like this, there will be content and typographical errors. If this information is important to you, go to the source.

Number of new permits by year:

2008: 944 permits

- first permit: 17002

- last permit: 17945

- first permit: 17946

- last permit: 18570

- first permit: 18571

- last permit: 20246

- first permit: 20247

- last permit: 22170

- first permit: 22171

- last permit: 24692

- first permit: 24693

- last permit: 27359

- first permit: 27360

- last permit: 30369

- first permit: 30370

- last permit: 32424

- first permit: 32425

- last permit: 33242

- first permit: 33243

- last permit: 34431

- first permit: 34432

- last permit: 35898

2019: 1,397 permits

- first permit: 35899

- last permit: 37295

2020: 751 gas and oil permits

- permits, #37296 - #38059 (first year in which permit numbers included O&G; CCS; SWD)

- nine of them were salt water disposal wells

- three carbon capture and storage

- 751 gas and oil permits