Locator: 48319ARCHIVES.

Re-posting to add several items. New items in bold red.

These are the stories that interest me most right now; links may eventually follow.

Buffett:

- news and commentary -- August 4, 2024

- selling stock; "overnight" slashed 50% of his AAPL holdings; sold off most of his BofA holdings

- raising record amounts of cash -- and I mean record amounts of cash; and, no, he's not going to declare a special dividend, which some folks are suggesting. LOL.

- no one knows why; thinking back on financial crisis of 2008

EVs:

- by now, "we" should be much farther along the S-shaped curve;

- VW looking to close an EV manufacturing plant in Belgium; first auto manufacturing plant to close in Europe; lack of interest in EVs in Europe

- American car companies can't afford to keep making EVs

- Tesla talking a big story, but failing to meet milestones

Chips:

- US computer chip manufacturing; loss of Intel could be catastrophic for US chip program

- all eyes on security of Taiwan, where 95% of all global computer chips actually manufactured

- there was a reason the US Federal government passed the "CHIPS Act."

- Intel: not "too big to fail," but rather, "too important to fail."

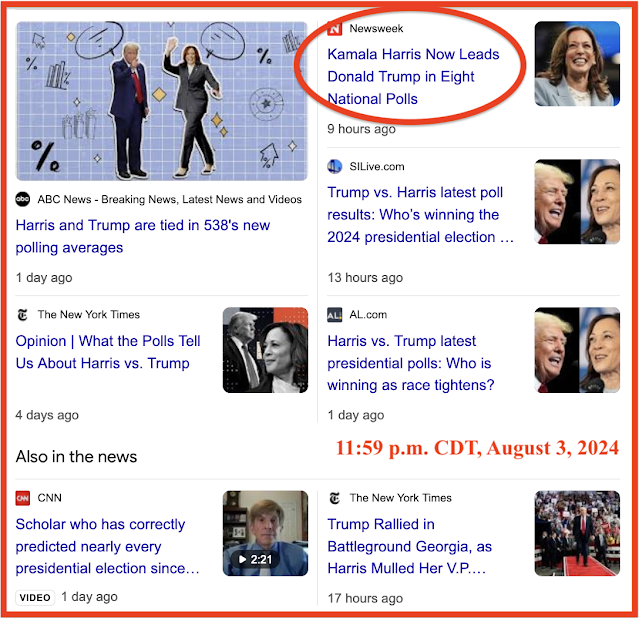

Politics:

- polls absolutely not looking good for Vance/Trump after "cats" and "hostage deal" comments

- presumed bounces before election:

- Trump has none

- Kamala has two: a) after she names her VP; and, b) after the convention

- we

should know a lot more with regard to polling ten days from now, but

right now some polls in swing states show huge lead by Harris

- Kamala doing final interviews for VP this weekend; will announce NLT than next Friday, I'm thinking Monday

- Trump underestimated the multi-racial demographic

- next president will get at least one US Supreme Court pick; possibly two

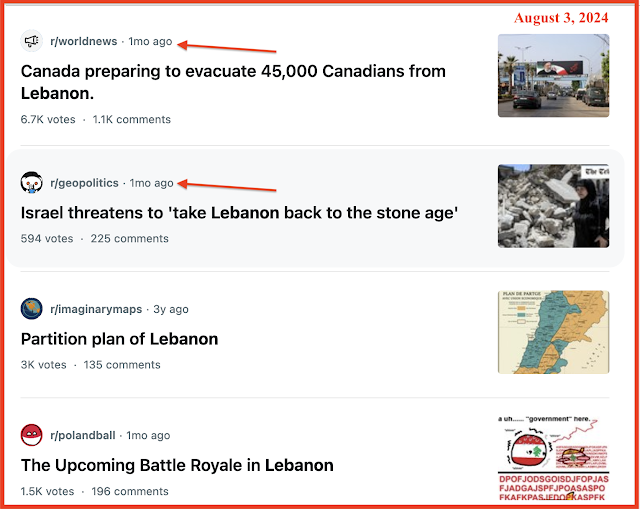

Mideast:

- huge successes for Netanyahu the past two weeks; three top terrorists killed?

- but the story is not yet over

- major regional war about to break out

- US Navy returning in force; occurring in backdrop of US presidential election; Kamala Harris, not particularly strong with regard to Israel has to tread carefully, if not to lose Democrats in Detroit; Democrats in Pennsylvania

- France, Saudi Arabia: have told its citizens to get out of Lebanon now

Investing

- if interested in equities, highly recommend following Evan over at twitter

- market is only going to get more volatile

- great, great buying opportunities for those with long horizons

- investors will stay the course

Chevron

- with regard to Hess / Guyana, Chevron in deep doo-doo

- Chevron / Hess need to find another path

EVs

- the narrative continues

- VW will close first automotive plant in Europe; first ever automobile plant closed in modern era

AI

- follow the money

- follow the data centers

- follow the chips

- investors

- stay focused:

- copper, fiber, chips (CPUs, FPUs, NPUs),

- data centers, hyperscalers, natural gas, utilities

INTC:

- down as much as 20% after hours; lowest in a decade;

- announced two-year warranty on all PCs affected by their fried CPUs;

- will cost INTC huge amounts of money (think Ford, warranty costs)

- still hasn't released a fix for fried CPUs; fix not expected until mid-August

AAPL

- it will take a week to sort out the takeaways from the most recent quarterly earnings

- analysts don't get it: it's an "ecosystem"

- services revenue is now becoming the story;

- Apple, Inc. has more than 2.2 billion active and installed devices

- does average Apple user spend $10 per month on Apple services?

- warranties

- AppleCare+ ($3/month)

- cloud storage (minimum: 99 cents/month; next level, $2.99/month; as much as $69.99/month)

- TV+ ($9.99 / month)

- ads

- Apple Music ($10.99 / month)

- Apple's total net sales run about $400 billion annually

- new record set this last quarter but Tim won't release actual numbers

- Apple ecosystem, Apple users:

- at a minimum: two mobile devices -- an iPhone and laptop

- most common: three mobile devices -- an iPhone, laptop, and tablet or watch

- rare, but not unusual: three mobile devices and a desktop computer

- perhaps not as rare as folks think: four mobile devices and a desktop computer

- each member older than ten years of age in a family has two mobile devices

- need for speed

- NVDA/AMD: moving at freeway speeds

- AAPL: taking the frontage roads

- INTC: in the ditch

- Apple's installed user base:

The Fed:

- panelists on CNBC fit to be tied that JPow and Fed "lied." Not following the data;

- had they stayed true to their word, would have announced a cut by now.

- anger / frustration will soon be forgotten; eager to see how long the buying opportunity lasts;

- September is a huge month for dividends; many folks hope buying opportunities last through the autumn;

Mad Money (CNBC): reruns --

- current episode: S18 E731 -- trying to find the date -- sounds like yesterday -- Thursday, August 1, 2024

- this is important because I missed today's episode; want to see the rerun tomorrow; eager to see what Cramer had to say about the debacle in today's (August 1, 2024) market

- cutting retail prices may drive foot traffic (think McDonald's) but it will hit margins --> will hit earnings --> will hit Wall Street; this is not rocket science

- Diageao YTD: -14.36% despite huge sales volume

Never quit reading.

************************

Polls

******************************

From Reddit Tonight