Locator: 45203ECON

Updates

August 4, 2023: this is an old presentation but it provides a definition of "savings." The presentation here, see slide 11. "Savings = income - spending."

Original Post

I posted this, July 4, 2023 (and I have posted the "area under the curve" graphic several times in the past three months).

US household "savings" collapsing: "area under the curve" ... graph. Link here.

Mainstream media and armchair analysts are misreading and mis-interpreting the chart above but I can't articulate the problem. You are on your own here.

However, today the updated MMF chart was released:

Same question for two different audiences:

- for those looking at the overall health of the US economy, which of the two graphs is better?

- for long-term investors (or maybe even all investors), which of the two graphs is better?

No answer is wrong.

But, wow, as a long-term investor, I love the second graph.

It was reported elsewhere that the most recent MMF data showed a slight decline. Obviously not the case based on the graph above.

The second graph might not mean as much if the securities market was collapsing and folks were pulling their money out of the stock market and investing in much safer money market funds. But, in fact, the stock market has been on a 12-day rally, the longest in six or more years, and yet more money is flowing into MMFs.

Bonds? I don't follow bonds, but it's my impression a lot of money is also flowing into bonds because of their great rates.

Where is that money coming from? Which by the way, is one of my favorite lines from a Colombo episode, "just where is that money coming from?"

Savings:

As mentioned some time ago, I don't understand where / how the US government measures savings rate. The well-to-do, I imagine consider a lot of their investments in MMFs, shot-term bonds, and even some securities as "savings" and don't really have much in their bank "savings accounts.“

Elderly widows pulling money out of savings accounts to put in MMFs is not exactly a real decrease in their savings.

So, unless I'm missing something, we have a lot of "new" money coming into the market, into MMFs, and into bonds. Again, from where is that money coming? And how far down into the general economy does it trickle? It's just hard for me to believe if folks are able to put this much money in MMFs, securities, and bonds, they don’t also have money to spend on consumer goods.

Maybe I'm wrong, naive. Whatever.

But they are fascinating graphs.

****************************

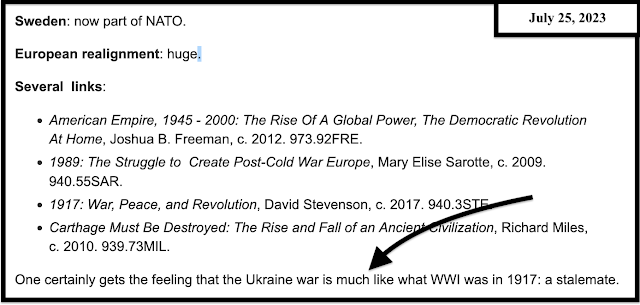

The Book Club

The Custer Companion: A Comprehensive Guide to the Life of George Armstrong Custer and the Plains Indians Wars, Thom Hatch, c. 2002. 973.8HAT.

Notes.