Locator: 45149B.

WTI: $75.27. Up 1.6%; up $1.19.

Wednesday, July 19, 2023: 76 for the month; 184 for the quarter, 439 for the year

39391, conf, Crescent Point Energy, CPEUSC Matilda 4-29-32-158N-100W-MBH,

39358, conf, CLR, Vance 5-14H,

Tuesday, July 18, 2023: 74 for the month; 182 for the quarter, 437 for the year

None.

Monday, July 17, 2023: 74 for the month; 182 for the quarter, 437 for the year

39392, conf, Crescent Point Energy, CPEUSC Ruby 3-20-17-158N-100W-MBH,

Sunday, July 16, 2023: 73 for the month; 181 for the quarter, 436 for the year

39351, conf, CLR, Clyde Hauge 2-13H,

37921, conf, BR, Parrish 2B TFH,

Saturday, July 15, 2023: 71 for the month; 179 for the quarter, 434 for the year

39393,

conf, Crescent Point Energy, CPEUSC Matilda 3-29-17-158N-100W-MBH,

39352,

conf, CLR, Clyde Hauge 3-13H,

38684,

conf, Hess, GO-Ron Viall-156-98-2513H-3,

37922,

conf, BR, Boxstone 1A

TFH-ULW,

RBN Energy: energy industry finds strength, better credit ratings in post-pandemic consolidation.

For years, oil and gas companies struggled to win over investors,

largely because of the energy sector’s notoriously volatile history —

marked by boom-and-bust cycles and sometimes scary levels of

indebtedness. You might think the pandemic and the subsequent upheaval

in energy markets would only make matters worse, but the chaos actually

forced energy companies to get their finances in better order and, in

many cases, to either acquire other companies or be acquired themselves.

Financial discipline and consolidation provided another benefit:

sharply improved credit ratings, which have the knock-on effect of

making companies even more attractive. In today’s RBN blog, we discuss

the forces behind, and the importance of, the improved credit ratings

that resulted from this massive wave of consolidation.

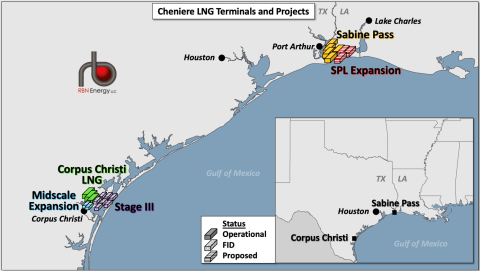

RBN Energy: can anyone challenge Cheniere as the king of US LNG? Archived.

U.S. LNG development has seen a resurgence in the post-COVID world,

with five projects with a combined 61.1 MMtpa (8.1 Bcf/d) of new LNG

export capacity reaching a final investment decision (FID) in the past

18 months and one additional project closing in on that milestone. Five

of these six projects are from the “Big Three” of U.S. LNG — Cheniere,

Sempra and Venture Global — leading some to wonder if there’s room for

anyone else. But while all three companies are big in U.S. LNG and have

projects under development, only one is a behemoth. In today’s RBN blog,

we continue our look at the pre-FID projects under development by the

Big Three, focusing on the king of U.S. LNG, Cheniere.

In Part 1,

we took a closer look at the projects under development by Sempra,

because at the time, Sempra had the project most likely to take FID

next: Cameron Phase 2, a 7-MMtpa (0.93-Bcf/d) expansion of its existing

terminal in Louisiana. The expansion includes a fourth train as well as 1

MMtpa (0.13 Bcf/d) of additional capacity from debottlenecking at the

existing terminal. The project is being developed in conjunction with

existing offtakers, although Sempra has elected to market some of the

capacity itself as well. The project is currently completing front-end

engineering design (FEED) work, which is expected to be complete later

this summer, with an FID following later this year.