Locator: 45150LNG.

RBN Energy: can anyone challenge Cheniere as the king of US LNG? Archived.

U.S. LNG development has seen a resurgence in the post-COVID world, with five projects with a combined 61.1 MMtpa (8.1 Bcf/d) of new LNG export capacity reaching a final investment decision (FID) in the past 18 months and one additional project closing in on that milestone. Five of these six projects are from the “Big Three” of U.S. LNG — Cheniere, Sempra and Venture Global — leading some to wonder if there’s room for anyone else. But while all three companies are big in U.S. LNG and have projects under development, only one is a behemoth. In today’s RBN blog, we continue our look at the pre-FID projects under development by the Big Three, focusing on the king of U.S. LNG, Cheniere.

In Part 1, we took a closer look at the projects under development by Sempra, because at the time, Sempra had the project most likely to take FID next: Cameron Phase 2, a 7-MMtpa (0.93-Bcf/d) expansion of its existing terminal in Louisiana. The expansion includes a fourth train as well as 1 MMtpa (0.13 Bcf/d) of additional capacity from debottlenecking at the existing terminal. The project is being developed in conjunction with existing offtakers, although Sempra has elected to market some of the capacity itself as well. The project is currently completing front-end engineering design (FEED) work, which is expected to be complete later this summer, with an FID following later this year.

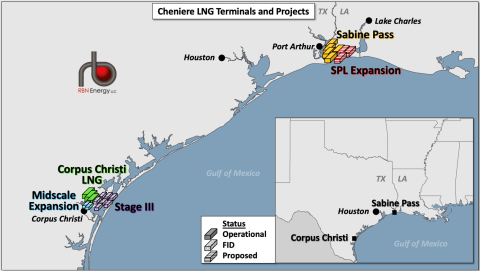

Cheniere currently operates 45 MMtpa (6 Bcf/d) of LNG export capacity at its two terminals — Sabine Pass (yellow boxes in Figure 1) and Corpus Christi (green boxes) — and is by far the largest U.S. producer. Globally, Cheniere ranks as the second-largest LNG producer, behind only QatarEnergy. Cheniere has an additional 10 MMtpa (1.3 Bcf/d) of capacity under construction at Corpus Christi with its Stage III expansion (purple-dotted boxes). As that project was closing in on FID, Cheniere began to sell offtake capacity from an as-yet-unnamed Corpus Christi expansion. It quickly announced three deals totaling 2.8 MMtpa (0.37 Bcf/d) of LNG, then later announced that this would be an expansion of Stage III, adding an additional two mid-scale trains (8 and 9, blue-striped boxes) for a total of 2.9 MMtpa (0.38 Bcf/d) of capacity. The expansion was sold out before it even had a name or had filed any regulatory applications. In March, Cheniere made its formal application with FERC and Cheniere will likely take FID on the project once it receives its regulatory approvals. Cheniere has said it is planning a continuous construction process, basically tacking the expansion onto the end of the initial Stage III construction, which began last year.

Figure 1. Cheniere LNG Terminals and Projects. Source: RBN