Amazon: is tracked here. From a reader, this link, "Amazon is actually the American worker's champion. Link here.

It's been a terrible year for the American worker, with a notable bright

spot courtesy of one of the tech firms in the crosshairs of regulators

and lawmakers.

If someone had said early in 2020, "A company is going to hire hundreds

of thousands of non-college-educated workers during the pandemic at well

above the minimum wage," you'd think there'd be huzzahs all around.

That's what the online retailer Amazon has done, but it still gets

brickbats for how it pays and treats its workers. Rep. Alexandria

Ocasio-Cortez said the other day that Amazon jobs are a "scam."

If so, a swath of the US workforce is falling for the grift. Since July,

the online retailer has hired 350,000 workers and now employs 1.2

million people globally.

This is a historic hiring binge. According to The New York Times, "the

closest comparisons are the hiring that entire industries carried out in

wartime, such as shipbuilding during the early years of World War II."

On top of this, the company provides work for roughly half a million truck drivers.

[Comment: and a surge in Class 8 truck manufacturing. Previously reported. In fact, one begins to wonder what the US economy would be like if it were not for Amazon.]

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

Schwab: the move is official January 1, 2021. Link here. By the way, long before this move, Schwab operations was located in El Paso, TX. This new headquarters in Denton County is pretty impressive, literally just a few miles down the road from where we live. Can't wait to take a tour. LOL.

Re-locations: from California to Texas, tracked here.

******************************

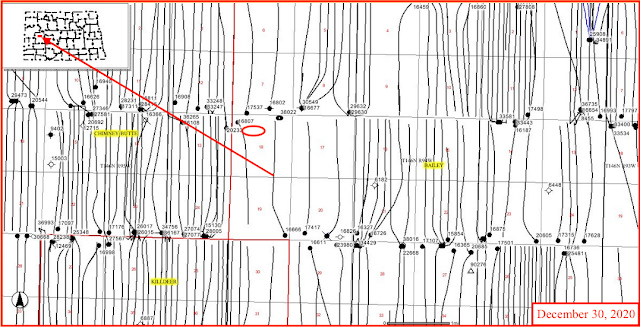

Back to the Bakken

Active rigs:

$48.42

| 12/30/2020 | 12/30/2019 | 12/30/2018 | 12/30/2017 | 12/30/2016 |

|---|

| Active Rigs | 13 | 55 | 66 | 49 | 39 |

One well coming off confidential list --

Wednesday, December 30, 2020:

- 36251, loc/NC, Slawson, Osprey Federal 2-26-29H, Big Bend, no production data,

RBN Energy: Asian supply shortage, spot cargoes lead to record US LNG exports.

Talk about whiplash!

Not that long ago, the global LNG market was

reeling from the effects of the pandemic: stunted demand, severe

oversupply, brimming storage, and record low prices, all of which led to

a squeeze on offtaker margins and mass cancellations of U.S. cargoes.

Within a matter of months, however, the market has done a 180. Global

supply has tightened significantly as cargoes can’t get delivered fast

enough, and international LNG prices are near two-year highs.

U.S. LNG

exports and domestic feedgas demand are at record highs in December, for

the second straight month. That’s not to say U.S. LNG producers and the

domestic gas market are out of the woods.

Cancellations are rearing

their heads again — not because the demand isn’t there, but because of

logistical constraints and a severe vessel shortage, which are injecting

more uncertainty into the market. Today, we provide an update on

domestic LNG exports and the immediate factors driving them.