Locator: 10010JERSEY.

Updates

February 11, 2024: maps and production updated.

July 30, 2022: see updated map at this post. Production has been updated.

March 23 2021: production numbers updated.

March 24, 2020: CLR announces changes in well names (targets changed in some cases); see daily report dated March 24, 2020. Would the name suggest that the field has been unitized?

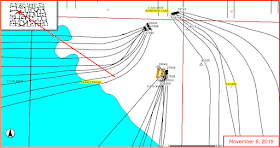

November 6, 2019: compare current graphic with graphic at original post --

July 23, 2019: production updated; some well files updated; names and targets have been changed for some wells; graphic updated; see this post;

July 13, 2018: update here. See this post, also, for some great graphics.

August 9, 2014: there is now a rig on site at one of the Jersey wells, #27828. It appears there will be three to five pads in this section, all in the northeast quadrant: two smaller pads (5-well, 3-well) and then perhaps one mega pad or three linear, parallel pads (I think one large mega-pad). This three linear lines of wells will have 7, 7, and 7 wells running southwest-to-northeast. The only spacing in this area is 2560-acre spacing: section 1, 6, 7, and 12 in T153N-R93W. There are 30 Jersey/Jersey Federal permits in my database, but one of the wells is dry (#27832).

The Jersey/Jersey Federal pads are not listed as a CLR increased density pilot project.

Original Post

Comments: All fourteen (14) CLR permits will be on the same pad (or very nearly same pad) in SENE 6-153-93; these are Jersey and Jersey Federal permits that appear to replace the Linbeck permits that were canceled a few days ago; there were seven additional Jersey Federal permits at that time; 7 then + 14 now = 21 wells on that one pad (or closely neighboring pads) [Disclaimer: I did this quickly and have not had a chance to confirm this; this may be all wrong. I will check it later. If it is accurate, it makes me think that regardless of how the CLR Atlanta wells have turned out, CLR is pressing ahead with targeting all Bakken formations with multiple horizontals from one pad. These would be the first wells in this section, and perhaps the first wells in this drilling unit, depending on where the horizontals go; probably under the water.]Now CLR has added eight (8) more permits for section six: 21 + 8 = 29 wells on this pad (or closely neighboring pads).

The Jersey wells are located in the Alkali Creek oil field.

28333, 945, CLR, Jersey 29-6XH, Alkali Creek, off line 1/5; back on-line 5/15; cum 351K 9/20; cum 353K 1/21; cum 359K 6/22; cum 363K 12/23; flat at 500 bbls/month;

28002, 1,359, CLR, Jersey 4-6H2, four sections; Alkali Creek, t9/17; cum 365K 9/20; permitted as a "B3"; drilled as an "H2"; cum 376K 1/21; cum 414K 6/22; cum 434K 12/23;

28001, 1,564, CLR, Jersey 5-6H, four sections; Alkali Creek, t10/17; cum 323K 1/21; cum 343K 6/22; cum 359K 12/23;

28000, 1,108, CLR, Jersey 6-6H1/Jersey 6-6H2, four sections; Alkali Creek, t10/17; cum 245K 1/21; cum 270K 6/22; name change and target change; cum 279K 12/23;

27999, 1,212, CLR, Jersey 7-6H/Jersey 7-6H1, four sections; Alkali Creek, t10/17; cum 283K 1/21; cum 308K 6/22; name change; target change; cum 322K 12/23;

27998, 1,059, CLR, Jersey 8-6H1/Jersey 8-6H3, four sections; Alkali Creek, t12/18; cum 328K 1/21; name change and target change to Three Forks B1; cum 381K 6/22; cum 402K 12/23;

27997, 1,944, CLR, Jersey 1-6H, four sections; Alkali Creek, t9/17; cum 476K 1/21; cum 536K 6/22; cum 573K 12/23;

27996, 1,384, CLR, Jersey 2-6H2, four sections; Alkali Creek, t9/17; cum 301K 1/21; cum 330K 6/22; cum 347K 12/23;

27995, 1,344, CLR, Jersey 3-6H1, four sections; Alkali Creek, t9/17; cum 350K 1/21; cum 393K 6/22; cum 418K 12/23;

27898, conf-->PNC-->A, CLR, Jersey FIU 15-6H, Alkali Creek, t9/23; cum 17K one month;

27897, conf-->PNC-->A, CLR, Jersey FIU 13-6H2, Alkali Creek, t9/23; cum 25K 12/23;

27896, conf-->PNC-->A, CLR, Jersey FIU 13-6H, Alkali Creek, t9/23; cum 51K 12/23;

27895, conf-->PNC-->A, CLR, Jersey FIU 12-6H1/Jersey 12-6H3, Alkali Creek, name change and target change; t9/23; cum 84K 12/23;

27894, conf-->PNC-->A, , conf-->PNC-->A, CLR, Jersey FIU 11-6H, Alkali Creek, t9/23; cum 90K 12/23;

27893, conf-->PNC-->A, CLR, Jersey FIU 10-6H2, Alkali Creek, t9/23; cum 84K 12/23;

27892, conf-->PNC-->A, CLR, Jersey 9-6H, Alkali Creek, t9/23; cum 86K 12/23;

27884, PNC, CLR, Jersey Federal 22-6H2, Alkali Creek,

27883, conf-->PNC-->A, CLR, Jersey Federal 21-6H, Alkali Creek, t9/23; cum 50K 12/23;

27882, conf-->PNC-->A, CLR, Jersey Federal 20-6H2/Jersey Federal 20-6H3, Alkali Creek, name change and target change; t--; cum 73K 12/23;

*27881, 3,105, CLR, Jersey 19-6H1, four sections; Alkali Creek, Three Forks 1, 74 stages; 13.3 million lbs, t6/18; cum 365K 1/21; cum 435K 6/22; cum 463K 12/23;

27880, conf-->PNC-->A, CLR, Jersey Federal 18-6H/Jersey Federal 20-6H2, Alkali Creek, name change and target change; t9/23; cum 80K 12/23;

27879, PNC/loc-->conf, CLR, Jersey FIU 17-6H, Alkali Creek, t9/23; cum 76K 12/23;

27878, PNC/loc-->conf, CLR, Jersety FIU 16-6H1, Alkali Creek, t9/23; cum 74K 12/23;

27832, dry, CLR, Jersey 29-6H, Alkali Creek,

27831, 918, CLR, Jersey 28-6H3, four sections; Alkali Creek, off-line 1/15; back on-line 5/15, t5/15; cum 165K 9/19; jump in production 12/18; see note here; cum 208K 1/21; cum 235K 6/22; cum 249K 12/23;

27830, 903, CLR, Jersey 27-6H1, four sections; Alkali Creek, off-line 1/15; back on-line 5/15; t6/15; cum 296K 9/20; jump in production in 12/18; cum 309K 1/21; cum 342K 6/22; cum 368K 12/23;

27829, 791, CLR, Jersey 26-6H2, four sections, Alkali Creek, off-line 1/15; back on-line 5/15; t5/15; cum 283K 1/21; cum 308K 6/22;

27828, 1,221, CLR, Jersey 25-6H, four sections; Alkali Creek, t5/15; cum 311K 1/21; cum 329K 6/22; cum 321K 12/23;

27827, 927, CLR, Jersey 24-6H3, four sections; Alkali Creek, t5/15; off-line 1/15; back on-line 5/15; cum 253K 1/21; cum 271K 6/22; cum 284K 12/23;

27826, 963, CLR, Jersey 23-6H1, four sections; Alkali Creek, t5/15; off-line 1/15; back on-line 5/15; cum 436K 1/21; cum 471K 6/22; cum 490K 12;23;

The Jersey wells sited in section 6-153-93, Alkali Creek:

Zooming in (error: I believe there are only 8 wells in that one location rather than 9 wells):