Locator: 49852B.

WMB: raises dividend 5% from 50 cents to 52.5 cents. Payable on March 30, 2026; record date: March 13, 2026.

*********************************

Back to the Bakken

WTI: $62.28.

New wells reporting:

- Thursday, January 29, 2026: 48 for the month, 48 for the quarter, 48 for the year,

- 42034, conf, Slawson, Rebel Federal 3-32-17H,

- 39805, conf, BR, Mazama 1A,

- Wednesday, January 28, 2026: 46 for the month, 46 for the quarter, 46 for the year,

- 42035, conf, Slawson, Rebel Federal 6-32-17TFH,

- 40868, conf, Hess, GO-Dustin Brose-156-98-2932H-2,

RBN Energy: Venezuelan rebound would test Gulf Coast refiners' affection for Canadian crude. Link here. Archived.

Three words: Canada is screwed.

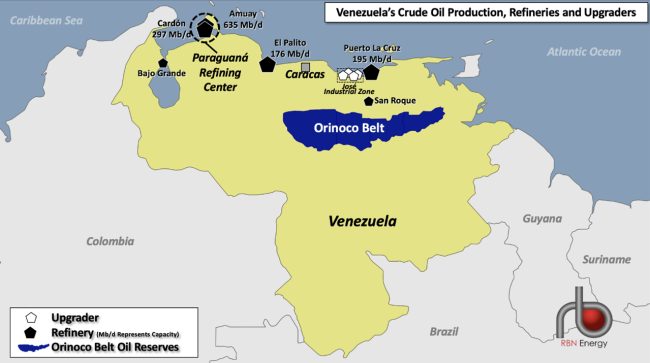

The evolving situation in Venezuela is rife with uncertainty, including concerns about short-term political stability, how much oil production could actually rebound, and whether there’s an appetite to spend the tens of billions of dollars needed for a long-term turnaround. But as the outlook for Venezuelan crude oil improves, it’s important to note that significant market issues are at play as well, including the potential for renewed competition with Canadian heavy crudes along the U.S. Gulf Coast. In today’s RBN blog, we look at the differences in Venezuelan and Canadian heavy crudes, including production methods, costs and quality, and how a revival in Venezuelan production could impact the flows and prices of Canadian (and other competing) heavy barrels.

As we noted in Take Me Money and Run Venezuela, the country was once a critical supplier of heavy sour crude to Gulf Coast refineries, providing more than 1.3 MMb/d in the late 1990s and early 2000s before Venezuelan production entered a long period of decline soon after Hugo Chavez came into power. Today, the country produces less than 1 MMb/d of crude oil, barely one-quarter of the level it reached in the late 1990s, around 3.5 MMb/d. Venezuelan crude is generally heavy, with API gravities ranging from 8.5 degrees to 25 degrees for varieties like Boscan, Merey, BCF 13 and 17, and Leona, although it also produces some lighter grades, with an API of 30-35 degrees. (API gravity is a measure of how heavy or light a petroleum liquid is compared to water — the lower the API, the denser the crude oil.) Venezuela’s benchmark heavy crude, Merey, comes from the Orinoco Belt (dark-blue-shaded area in Figure 1 below) and has an API of about 16 degrees. Sulfur content for the country’s heavy and light crudes ranges from 1.5% to 2.7%, which categorize them as sour crudes.