Locator: 48430B.

Keeping promises: Trump terminates Chevron's agreement with Venezuela. Great move. Keeping promises.

EU/Europe - Ukraine: FAFO. Best example ever.

RFK, Jr: remains cool, calm, and collected. A refreshing change. Link here.

- in the old days, this would have resulted in a speech from Barack Obama

Tulsi Gabbord: cleaning house.

Trans: Trump administration bans trans from military. That's the headline. Some exceptions.

Gene Hackman, wife, dog: dead in Santa Fe home. He was 95 years old. No foul play suspected.

***********************************

Back to the Bakken

WTI: $69.40.

New wells:

- Friday, February 28, 2025: 71 for the month, 116 for the quarter, 116 for the year,

- 40997, conf, Murex, MK-Grace Sophia 6-7H TF,

- 40996, conf, Murex, MK-Mila Kate 6-7H MB,

- 40952, conf, Empire North Dakota, Woodpecker 29-2H,

- 40914, conf, BR, Phantom Ship 7A,

- 40877, conf, Oasis, Barnes Federal 5202 43-11 5B,

- 40567, conf, BR, Burned Edge 1A-ULW,

- 40444, conf, Grayson Mill, Alfred South 20-22 2H,

- 40436, conf, Enerplus, Prowess 150-94-06B-18H,

- 40435, conf, Enerplus, Gallant 150-94-06A-18H,

- 40434, conf, Enerplus, Purpose 150-94-06A-18H,

- 40432, conf, Enerplus, Fearless 150-94-06A-18H-LL,

- 40368, conf, Enerplus, LK Erickson 147-97-11-2-7H,

- 40367, conf, Enerplus, LK Erickson 147-97-11-2-6H,

- 39975, conf, BR, Manchester 2A,

- 39831, conf, Hess, EN-Meiers-154-93-1324H-6,

- 25864, conf, Grayson Mill, Holm 150-98-5-8-3H

- 25863, conf, Grayson Mill, Holm 150-98-5-8-10H,

- 25862, conf, Grayson Mill, Holm 150-98-5-8-2H,

- Thursday, February 27, 2025: 53 for the month, 98 for the quarter, 98 for the year,

- 39953, conf, Hess, EN-Heinle-156-94-2536H-4,

RBN Energy: acquisition of Colex Terminal, Sinco Network, open up possibilities for Edgewater. Archived.

Edgewater Midstream, a relatively new player in the refined products storage and delivery space, acquired a pair of potentially valuable assets from Shell in the Deer Park, TX, area in December, 2024. It now owns the Colex terminal, starting point of the all-important Colonial Pipeline system, and the Sinco products pipe network, which could offer another pathway to Desert Southwest markets served by a dwindling number of California refineries. In today’s RBN blog, we will examine Edgewater’s new assets and the market opportunities they may open up.

Let’s start with a short primer on Edgewater Midstream, which private equity firm EnCap Flatrock Midstream owns. The Houston-based company was created in 2019, just before the pandemic. Throughout that period, the company sought potential assets to buy, including those focused on crude oil and refined products, to underpin its business. Negotiations for Shell’s Colex terminal and Sinco pipeline system began in Q2 2024, culminating in a deal that would give Edgewater its first physical assets. The Colex terminal on the Houston Ship Channel (HSC) and the Sinco system were historically operated in conjunction with the 340-Mb/d Deer Park refinery, once a joint venture (JV) between Shell (operator) and P.M.I. Comercio Internacional S.A. de C.V. (PMI), a subsidiary of Mexico’s state-owned PEMEX. That changed in 2022 when Shell sold its 50% stake in the refinery to PMI for $596 million, although it retained the Colex and Sinco assets.

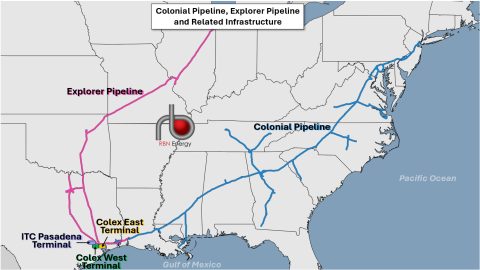

Let’s look next at Edgewater’s new acquisitions, starting with the Colex complex (see Figure 1 below), which includes both an East and West terminal. The complex is the starting point of the 1.5-MMb/d Colonial product pipeline system (blue lines), which transports products from Gulf Coast refineries to markets across the Southeast and East Coast. The Colonial network culminates at New York Harbor, a major market for refined products and delivery point of the NYMEX RBOB gasoline and ultra-low-sulfur diesel (ULSD) futures contracts.

A ransomware attack on the Colonial system nearly four years ago disrupted supply for retail businesses, for weeks in some states, and triggered panic buying across the Eastern Seaboard, underscoring how important the network is for the region’s fuel needs. Besides Colonial, the Colex site feeds directly into the Explorer system (pink lines), which serves the Midwest products market. An interesting tidbit: The facility got its name from cobbling together the first three letters of Colonial (Col) Pipeline and the first two letters of Explorer (Ex) Pipeline. The Colex site is also directly connected to the ITC Pasadena terminal (blue tank icon) along the HSC, which handles waterborne, railed, trucked and piped supplies of petroleum products, NGLs, LPG and liquid chemicals.

Figure 1. Colonial Pipeline, Explorer Pipeline and Related Infrastructure. Source: RBN