Locator: 46961ENERGY.

Okay, we all agree that energy demand is going to surge in the US due to AI, cryptomining, data centers, EVs.

Link here.

A decade ago I was deeply concerned that we "would run out" of energy -- accessible, affordable energy.

No more. Things have changed.

We are never going to run out of energy.

What has changed is that the government will play a much, much bigger role in determining which energy we will use to generate electricity: nuclear, solar, wind, natural gas, coal.

Yesterday's eclipse reminded us about solar energy.

Texas, solar: at Reuters', the eclipse overshadowed Texas' solar power strength. Link here.

Texas wind: also from Reuters'.

LITTLETON,

Colorado, Feb 15 (Reuters) - Power generated by Texas wind farms

dropped by 22% in January 2024 from the same month in 2023 as low wind

speeds continue to stifle output across the main power system in Texas,

the largest power market in the United States.

Wind

generation in January was 356,000 megawatts (MW), compared to 455,000

MW in January 2023, data from the Electric Reliability Council of Texas

(ERCOT) shows.

As wind power is the second largest source of electricity behind natural

gas in Texas, the drop in wind output so far this year has forced

utilities to sharply increase generation from fossil fuels to balance

system needs.

Combined output from natural gas and coal was close to 50% greater in

January 2024 than in January 2023, underscoring the enduring importance

of fossil fuels within the ERCOT system despite the ongoing build-out of

renewable generation capacity.

But energy is now a regional story in the US. California will need nuclear.

But, and this is key: just 'cause we're going to need it, doesn't mean it's going to be a great investment.

Exhibit A: natural gas. Operators are paying others as much as $2.00 / MMBtu to take their natural gas away (in other words, natural gas has actually turned negative at times this year). But even at best, when natural gas is "positive," it's selling at well under $3.00 / MMBtu and that's not enough to make a meaningful profit. Oil E&P operators hate natural gas. It's actually a drag on their profitability.

With regard to energy, right now, investors are pretty much making money only with oil. But as an investment, the oil story is a story for another day.

The energy story today, energy (outside of oil): for investors, energy is now "dead money." If energy is not necessarily "dead money," there are so many other places to invest, outside of energy (again, I'm talking about all forms of energy outside of oil).

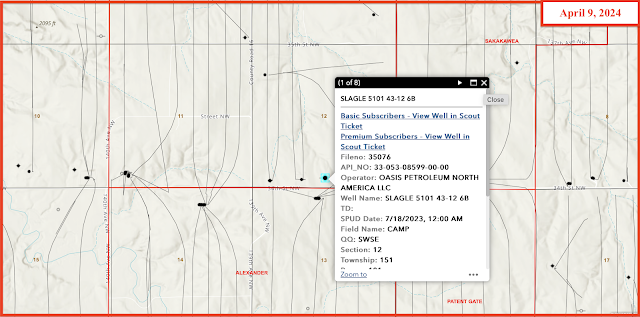

NOVI, Ted Cross, natural gas production in the Permian: link here.

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.

See disclaimer. This is not an investment site.

Disclaimer: this is not an

investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.