Locator: 46131B.

Personal investing:

- will buy today: DE

- at end of today, will be fully invested before the end of the month

AAPL: moving up nicely today. Up over 1%; has gained another $2 / share; now trading nearly $193.

NVDA / Nvidia: I can't get enough of this story.

- quick: name one company whose revenue more than tripled this past quarter

- most recent quarter: $18 billion

- projected revenue: likely to hit $25 billion / quarter

- Wells Fargo: raises target from $500 / share now to $675 / share this next year

- billionaire Ken Griffin loads up on two chip stocks — Nvidia and AMD (FOMO, MOJO, YOLO)

- my data point: Taylor Swift.

Taylor Swift: more records. One concert: 29 terabytes of data.

AT&T’s network alone moved 28.9 terabytes of data during the busiest day of Taylor’s three-day tour stop at AT&T Stadium in Arlington, Texas. Set 10 of 13 new records. The other records? NFL championship games.

The company estimates 1TB of data represents about 200,000 photos or 400 hours of video moving across its network. 28.9TB is a staggering amount of photo and video sharing. [Think cloud, AAPL, AMZN, MSFT, NVDA.]

That’s the most data AT&T’s network has moved at any stadium for any event this year — the average Cowboys game day at the stadium moves about 21 terabytes of data.

- Swifties also moved record amounts of AT&T data at various other stadium tour stops: 23 terabytes of data at Nissan Stadium in Nashville, 12 terabytes of data at Mercedes-Benz Stadium in Atlanta, and 8.6 terabytes at Raymond James Stadium in Tampa.

NFL MNF: hits 27-year-ratings high -- Philly vs Chiefs. Incredible. And then, of course, what Amazon is doing for TNF. Crude oil is so yesterday. It's now all about the blades.

Inflation: zero percent growth rate last month. If you know, you know. In big scheme of things, transitory. We’ll see that in new car prices this next spring.

WTI: crashing again. OPEC in deep do-doo. Saudi is upset that members are cheating. I’m shocked. Shocked.

- US production: trending toward 13 million bopd going forward and possibly increasing from there;

- Saudi production: most recently, dropped below 9 million bopd; probably at low for foreseeable future;

- Saudi can't meet budget with this volume x price;

Natural gas: the Bakken and Oneok.

Deere: crushes earnings.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly: there will be content and typographical errors. If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

GM: how bad is it for GM? The company announces it won’t be advertising during the Super Bowl. “High-water mark” for EVs.

Tesla: to increase fees at charging stations.

Tesla is using a new fee to encourage people not to charge their cars to 100 percent at busy Supercharger locations. In the US, the Supercharger Congestion Fee kicks in after a car hits 90 percent charge, at which point drivers will be hit with a $1 fee for each minute they continue to charge their vehicles. The company’s support page says the fee will apply at “certain Supercharging locations” when they’re busy.

Has anyone noted Tesla’s charging division now has near-monopoly status?

Gasoline prices: lowest since the pandemic. Analysis. But, OMG, still $3.26 / gallon and much more on the West Coast. The link? Clickbait: the “story” is one big ad. Disappointing that Barron’s would do this. My bad for linking it.

Flying: has anyone figured out why AA’s connecting flight from Nashville to Portland, Oregon, is Miami, Florida? I finally figured it out. I can die happy.

Travel is back:

Headlines: Re-Posting

Sam Altman; back in as CEO, OpenAI.

GM: won’t be advertising during Super Bowl.

Angus Bull Sales: it appears the “season” for Angus Bull Sales has begun. Link here.

Politics: more and more, it appears Trump’s candidacy is gaining more and more traction, not less, despite the ongoing court cases accusing Trump of wrongdoing.

State supreme courts, in state after state, are throwing out cases attempting to keep Trump’s name off state ballots for US president.

Tonight, it was announced that the last remaining US House seat was won by a Trump supporter in Utah, beating out a “moderate” Democrat. (Was there ever any doubt?)

Right now, the polls suggest Trump would steamroll into the White House in a race against the incumbent but those are just polls. How the election would actually unfold is a completely different story. There’s at least one wedge issue that might be key in a Biden upset.

Boston Red Line: nine slow zones eliminated

****************************

Back to the Bakken

WTI: $74.50.

Friday, November 24, 2023: 132 for the month; 132 for the quarter, 702 for the year

39773, conf, CLR, North Tareentaise Federal 3-18H1,

38782, conf, Oasis, Peregrine 5401 42-24 4B, south of Williston, tracked here;

38780, conf, Oasis, Peregrine 5401 42-24 2B,

Thursday, November 23, 2023: 129 for the month; 129 for the quarter, 699 for the year

39774, conf, CLR, North Tarentaise Federal 4-18H,

Wednesday, November 22, 2023: 128 for the month; 128 for the quarter, 698 for the year

39775, conf, CLR, North Tarentaise Federal 5-18H2,

39080, conf, Hess, RS-State D-155-92-0203H-9,

An example of the Oasis Peregrine wells:

- 38780, conf, Oasis, Peregrine 5401 42-24 3B, Todd:

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2023 | 23741 | 21881 |

| 8-2023 | 24660 | 22052 |

| 7-2023 | 21882 | 18979 |

| 6-2023 | 21276 | 17702 |

| 5-2023 | 3414 | 2728 |

RBN Energy: moving away from coal, can Michigan add renewables fast enough?

If it seems like the push for decarbonization has suddenly picked up the pace lately, Michigan provides proof. Home to the Big 3 automakers and for many the symbolic heart of U.S. manufacturing, its efforts to move away from fossil fuels have long been met with skepticism and resistance. But changing attitudes about climate change and renewable power — and full Democratic control of the state government for the first time in 40 years — have led to a swift about-face in the state’s energy policy. In today’s RBN blog, we examine Michigan’s plans to accelerate its transition away from coal-fired power and the long-term challenges that come with it.

This is the fourth blog in our series on the ongoing state-level efforts to decarbonize U.S. energy networks. So far in this series, we have looked at four markets that could hardly be more different; Hawaii, California, Texas, and New York. While developments are playing out very differently from state to state, based on any number of factors, one thing has become clear over the past couple of years as climate-related initiatives have gained momentum: Economic and logistical realities that may have been initially overlooked are being brought to the fore. Americans expect the energy industry to deliver fuel and power where they need it, when they need it, and for a price that everyday people can afford — what’s referred to as the trilemma of availability, reliability and affordability.

Today, we turn our eyes to Michigan, which now requires the state’s electricity providers 80% of their energy portfolio from renewables, nuclear, and natural gas with CCS by 2035 and that ramps up to 100% by 2040 — among the most aggressive timelines of any state. Before we get into the details of the changes coming down the line, let’s take a quick look at where things stand today.

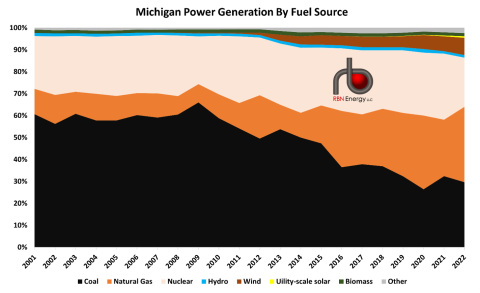

Figure 1. Michigan Power Generation by Fuel Source. Source: EIA

Michigan’s power generation has historically been dominated by coal-fired power (black layer in Figure 1), although its share has dropped from more than 60% of the mix in 2001 to about 30% in 2022. The decreases in coal have largely been made up for by natural gas (orange layer), whose share of power generation has jumped from about 12% in 2001 to more than one-third in 2022. Although wind power (dark-red layer) and other renewable sources have expanded significantly over the past several years, the percentage of power generation from fossil fuels has declined only modestly over the last two decades, dipping from 73% in 2001 to 65% in 2022. In addition, nuclear power’s share of the generation mix (pink layer) has varied little during that time. (Coal, gas and nuclear still account for a combined 87% of the mix, down from 97% in 2001.)

But all of that is about to change.