Locator: 45877B.

Germany: link here -- let this sink in for a minute -- here at the blog, we've been predicting this for quite some time. This article is by Charles Kennedy -- so you know it's good and it's accurate.

Germany, the European Union’s largest economy, is set to see a significant drop in oil consumption for 2023 as economic output shrinks, crimping demand for industrial fuels.

With only Pakistan on track for a steeper decline worldwide, Germany is poised to lose 90,000 barrels-per-day of oil consumption.

“Oil product demand, which includes biofuels and direct crude burn, will fall by more in Germany than any other OECD country during 2023. Globally, we think only Pakistan will see a steeper annual decline.” -- Source at link.

Germany’s GDP fell slightly in the third-quarter, shrinking 0.1% compared to the previous quarter. At the same time, Germany's Q2 GDP has been revised to indicate 0.1% growth, while previous calculations had put it at 0%. Q1 GDP was also revised higher. Germany’s Q4 2022 GDP was down 0.4%.

*****************************

Back to the Bakken

NOG. Link here.

WTI: $83.03.

Wednesday, November 1, 2023: 83 for the month; 83 for the quarter, 653 for the year

34544, conf, MRO, Storedale 11-17TFH,

39597, conf, CLR, Brooks 5-9H,

39202, conf, Murex, PB-Paul Brian 1-12H MB,

39201, conf, Murex, PB-Gunner 1-12H MB,

None.

RBN Energy: fierce opposition, lack of regulatory framework squeeze CO2 pipeline projects.

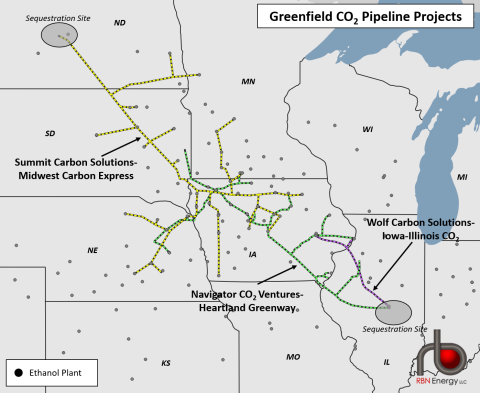

When Navigator CO2 Ventures decided to pull the plug on its long-planned Heartland Greenway project, a vast network that would have captured carbon dioxide (CO2) emissions from dozens of ethanol producers in the Midwest and Great Plains then piped them hundreds of miles for permanent sequestration, it was a significant setback for the Biden administration’s climate goals. More than that, it showed how large-scale carbon-capture projects face opposition from seemingly all sides and how the lack of a meaningful regulatory framework at the federal level only adds to the industry’s challenges. In today’s RBN blog, we look at the Heartland Greenway cancellation, what it says about the future of similar projects, and what regulatory changes might be needed at the federal level to make large-scale carbon capture and sequestration (CCS) a reality.

Ethanol plants are an obvious choice for carbon capture, given that the CO2 resulting from ethanol fermentation is highly concentrated, which makes capturing it more efficient (and less expensive) compared to many other industrial processes. That was the appeal of the Heartland Greenway project (dashed green line in Figure 1 below), which we first wrote about back in August 2021. One of three projects aimed at capturing emissions from ethanol production, it was ambitious in scope. It would have captured and permanently sequestered CO2 from a diverse group of industrial customers in five states: Illinois, Iowa, Minnesota, Nebraska and South Dakota. (Iowa is the top U.S. producer of ethanol, followed by Nebraska, Illinois, Minnesota, Indiana and South Dakota.) The project would have helped dozens of ethanol plants finance and construct their CO₂ capture equipment; transported the captured CO₂ over a newly built, 1,300-mile-plus pipeline network; and permanently sequestered up to 15 million metric tons per annum (MMtpa) of CO2 at a series of Class VI wells in south-central Illinois (gray oval to bottom-right of Figure 1).

Figure 1. Canceled and Planned Greenfield CO2 Pipeline Projects. Source: RBN

Much, much more at the link.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.