Locator: 45584B.

Fossil fuel: quick look at headlines overnight suggests fossil

fuels are back; renewable energy, global warming issues facing

headwinds. Apparently some folks don’t like the idea of $7-gasoline. Overnight headlines;

- OPEC+ cuts offset by booming US oil production

- oil demand destruction in India won't happen at $100-oil

- court upholds order to expand oil and gas lease sale in Gulf of Mexico, the expansion Biden trieed to stop -- illegally -- he learned well from Obama, who actually went to law school

- Groningen finally closing for good -- well, except for emergencies for one more winter; link here.

- Goldman Sachs ignores activists' calls to "abandon" oil and gas investments

- Trans Mountain oil pipeline back on track; regulator, in what seems record time, approve the requested route change

- short sells scramble as energy stocks surge (whoo-hoo)

- energy fund manager predicts major upside for oil equities

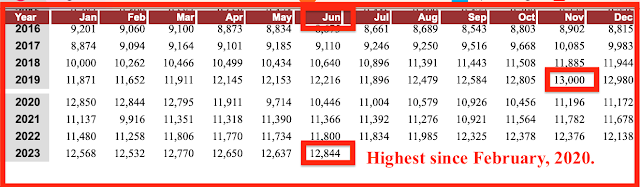

- OPEC+ cuts offset by booming US oil production: US production to hit 13 million bopd by the end of this month, matching the record output from November, 2019. Link here.

Ford halts construction of $3.5 billion EV battery plant in Michigan:

- why Barron's says this is a big, big deal; link here; link here, also;

- "Michigan" can't be happy

- how many union jobs lost or "put on hold"?

- Ford re-thinking this EV thing?

- UAW - Ford, GM, Stellantis -- circular firing squad

- UAW planned / plans for months (plural)-long strike and will gradually expand

Look at that Barron's article: every big name in EV battery will be affected -- link here, again:

- Ford licensed the technology from Chinese battery maker Contemporary Amperex Technology Co. Ltd (CATL -- we've discussed CATL before);

- the plant is slated to use lithium-iron-phosphate battery technology (CATL -- world's largest battery maker)

- also called LFP batteries -- iron is "Fe"

- LFP batteries less expensive than other chemistries -- and, as they say, you get what you pay for

- now folks are suggesting that maybe Ford doesn't need as many batteries as it thought

- EV sales have hit a wall

- the US EV penetration is about 7% (which I think is baloney)

- EV sales are up almost 50% in one year BUT Ford sales are up only 6% through August -- and isn't Ford second only to Tesla in the US

- Barron's with the understatement of the day: "Ford ha run into 'some' battery and manufacturing problems -- previously reported

- maybe investors will like this pause: it will save or slow billions in capital spending

- Ford investors actually aren't too upset -- ticker F is up 2% over the past five days

- meanwhile Tesla keeps moving along

- having said all that -- one of the poorest Barron's articles I've read in a long time; meanders all over the territory; the writer certainly didn't seem like he / she knew where the story was leading

- I think this is the big question: delaying the battery factory -- a minor speed bump or a decades-long detour and eventual re-route? I don't think anyone knows and the Ford board is probably greatly divided on this

Meandering -- just like this blog. LOL.

Oh, one more thing: