Trending over at history.com tonight, October 29, 2022.

Pages

Saturday, October 29, 2022

Chevron - CVX - ExxonMobil - XOM -- Earnings -- Investors Risk Altitude Sickness -- Don't Tell Washington -- WSJ -- October 28, 2022

After a fast and furious ascent, ExxonMobil and Chevron’s CVX shares are reaching the part of the climb where investors might start feeling a bit queasy.

Exxon’s earnings grew yet again in the third quarter to a record $19.7 billion, nearly tripling from a year earlier.

That puts its profit just $1 billion shy of Apple’s.

Free cash flow of $24.4 billion was also a fresh record for the company, 59% higher than the number analysts were penciling in.

Wall Street was expecting a decline in both from the second quarter, not another increase.

Its peer Chevron also posted profits that were a fifth higher than Wall Street expectations. Exxon raised its dividend to $0.91 a share, up from $0.88, continuing its streak of 40 consecutive years of dividend increases.

Combined, Exxon and Chevron reported nearly $31 billion in profits.

Chevron - CVX - Growth Rate -- October 29, 2022

At the sidebar at the right, the question concerned the growth rate of CVX. Here's the answer, from below:

Arguably nothing is more important than earnings growth, as surging profit levels is what most investors are after. For growth investors, double-digit earnings growth is highly preferable, as it is often perceived as an indication of strong prospects (and stock price gains) for the company under consideration.

While the historical EPS growth rate for Chevron is 8.4%, investors should actually focus on the projected growth. The company's EPS is expected to grow 126% this year, crushing the industry average, which calls for EPS growth of 122%.

What Buffett Sees

Re-posting from October 4, 2022:

While Traders Were Dumping Oil ...

... Buffett bought another 5.99 million shares of OXY. And more CVX.

************************

What Else Warren Buffett Sees

Arguably nothing is more important than earnings growth, as surging profit levels is what most investors are after. For growth investors, double-digit earnings growth is highly preferable, as it is often perceived as an indication of strong prospects (and stock price gains) for the company under consideration. While the historical EPS growth rate for Chevron is 8.4%, investors should actually focus on the projected growth. The company's EPS is expected to grow 126% this year, crushing the industry average, which calls for EPS growth of 122%.

Is anyone paying attention?

And this analysis / article was written before the announcement that OPEC was going to cut production.

And, of course, if anyone needs a reminder:

- Russian exports will soon plummet;

- US shale cannot make up the shortfall that will be caused by the OPEC cut in production;

- China is about to "open up";

- as the Europeans begin to freeze this winter, they will start burning more oil to make heat.

What's Causing All The Deaths? October 29, 2022

Re-posting from yesterday, but now the last two observations and the question no one has answered much less asked.

********************

What's Causing All The Deaths?

From the CDC -- which "we" no longer trust.

Note:

in a note like this, I will make some typographical and some content

errors, which will be corrected as I find them, but I think intelligent

folks can sort out (and mentally correct) these errors.

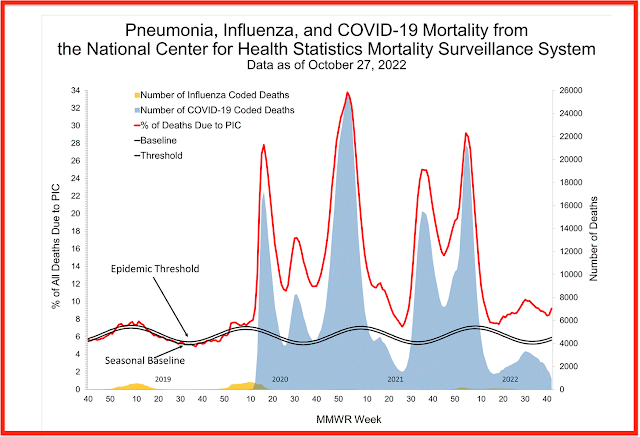

This graph is updated every week by the CDC. The chart starts in week 40 of whatever year the CDC chooses to start because that's when the "flu season" begins.

These are deaths from all "chest colds." It doesn't matter what: viral, bacterial, fungal. All respiratory deaths. "Seasonal flu," Covid, pneumococcal, tuberculosis, whatever.

Let's walk through the graph.

This is the per cent of all US deaths caused by "chest colds."

Or chest infections, if you prefer, short term (acute) or long term (chronic).

Red line: percent of all deaths in the US due to chest infections that week at that point in time.

"Yellow

lump" at bottom of graph: "seasonal flu." The number of all deaths due

to "seasonal flu." Not percent -- that comes later -- buy the raw number

of deaths (see y-axis at the right).

The seasonal

baseline for "seasonal flu" was running about 5% and the "epidemic

threshold" was just slightly above that. It didn't/doesn't take much for

the CDC to declare a seasonal flu epidemic. Maybe that's why folks like

me didn't get excited about Covid at first. An example of the CDC

crying "wolf" too many times? Every year the CDC said we were on the

verge of a seasonal flu epidemic.

So, in 2019, before Covid, the worst "seasonal flu" did was be

responsible for less about 5% of all deaths in the US -- the others being

cancer, heart disease, homicide, vehicular accidents, suicide,

unprovoked attack by a unicorn. About 5%.

Move to late 2019 -- week 50 and into early 2020 -- through week 5.

We still had that "yellow lump" (see above -- nothing changed).

But look at the red line.

The red line: deaths from all causes, trending trending toward 30 percent of all deaths in the US were from "chest colds," or chest infections. Had that been due to smallpox ... well, think about that for a moment.

That's what Dr Fauci, et al, were seeing. In 1920 we had just lived through the same thing, but no one knew the cause. In 2020, we knew the cause and it quickly became politicized. To my chagrin and embarrassment I fell into the politicization.

The blue shaded area is deaths from Covid-19. Some will argue the data was fake in 2020, that's fine. But by 2021, this was no longer fake. If you feel otherwise, quit reading.

So,

- the red line: before Covid, about 5% of all deaths in the US were due to chest colds;

- by early 2020 -- in just a couple of weeks, upwards of 30% of all deaths in the US were due to chest colds.

Now, there are two more data points / observations I want to make. But I will give you some time to see what you observe with regard to 2022. And one of the observations was noted as early as 2021.

The two most interesting observations lead to one question, which I cannot answer and no one else has even asked.First: go to the far right side of the graph. Note that the "blue shaded area," the number of Covid-19 coded deaths continues to drop. However the percent of deaths due to chest colds, the red line, is turning up, indicating a rising number of deaths due to chest colds.

But note, and this is the second observation: there is still no "yellow lump." There are no deaths attributable to "seasonal flu" yet -- or not enough to show up on the chart.

So, if deaths from all sources of chest colds are increasing, and neither deaths from Covid-19 or "seasonal flu" are increasing, what's causing the number of deaths -- the red line -- to increase as indicated by the red line?

California -- Peter Zeihan -- October 29, 2022

All typographical errors are mine.

Read this in the context of Saudi Arabia's new policy: "Saudi first."

This was written in 2016. Today, California gasoline runs $7 / gallon; in Texas about $3 / gallon, a $4-difference, close to the $5 - $9 spread suggested in this piece, and the Saudis have not yet put into place "Saudi first."

And remember: the US Congress has fast-tracked "NOPEC."

From Peter Zeihan, The Absent Super Power: The Shale Revolution and A World Without America, c. 2016; pp. 279 - 280.

Just as the United States is becoming the exception to global energy prices, California is becoming the exception to American energy prices. While California boasts a promising shale field in its Monterrey formation and while California has consistently ranked as the second-largest oil user in the United States, state-level regulations have equally consistently prevented a shale industry from arising within the state.This decision has a cost: California is nearly separate from the American energy complex. There are no oil pipelines that cross the Rockies from the Greater Midwest and Texas. There aren't even smallish pipelines that come in from Canada. Any crude produced iin North Dakota (or Canada) that is shipped to California must come by raiil (or a combination of rail to and then barge from the Pacific Northwest).

In a globalized world of open borders this is deserving of little more than the occasional comment or quiet snicker (the sounds from Texas are probably more guffawlike). After all, the Californians are quite capable of importing crude from elsewhere in the world to make up for what they refuse to produce locally, and an extra buck per gallon of gasoline is a price they are willing to pay for their politics.

But that price is about to increase substantially. Most of the oil "imported" into California comes from three locations, the first of which is Alaska. A quirk of American law allows petroleum produced in Alaska to be exported to the wider world independent of other laws that sometimes bar domestic energy exports. This will allow Alaskan crude oil to flow to what soon will be the highest-paying end-market in the world: Japan. Imports from the second source, Latin America, are likely to follow a similar logic. California will have to replace all these supplies from elsewhere.

That elsewhere is likely to be the remaining major current source of California's imports: the Persian Gulf. At the time of this writing (2016), California imports 450 kbpd from the region, nearly as much as the 550 kbpd it produces locally. When Iran and Saudi Arabia's conflict erupts, California wil suffer nearly as must as the East Asian states do in terms of supply disruptions and price. American shale will kick into overdrive, eliminating extra-hemispheric oil imports ... except those to California. The state will now be importing more Persian Gulf crude than the rest of the country combined. The spread between California gasoline prices and other Lower-48 prices can counted upon to increase from today's $1 barrel to something in the $5 - $9 range -- easily enough to hurl California into a protracted energy-induced depression.

But it isn't a depression without escape. The Californians have everything they need within their own state to fix the situation.

Nearly all of California's oil and natural gas production lies in a single county: Kern. Kern County also is home to the Monterrey shale. Though the Monterrey has been massively underexplored and underutilized, the lack of activity is not wholly due to regulations and restrictions out of of Sacramento. The Monterrey's geology is tangled; it's a series of stacked layers crisscrossed by a multitude fo fault lines. While locals may grind on about Sacrament's limiting of local industry, even if the Monterey were in Texas it wouldn't have been considered a world-class energy play.

Or at least it wouldn't have until recently. The Texans and Pennsylvanians and North Dakotans have been unlocking shale's secrets bit by bit during the past decade, but it wasn't until 2016 that true best practices started to form up. The same complex, stacked features that made the Monterrey difficult-to-impossible to develop in 2014 make it a mouth-watering play now. Microseismic and especially multilateral drilling are turning similarly complex shales like the Permian and the Marcellus into fabulous production zones. Kern may be lat to the party, but it will enjoy a distinct second-mover advantage.

Kern already has the capital, infrastructure, local regulatory structure, and workforce required to transform the Monterrey. Double (or more) the price of energy in California, change Sacramento's view of Kern -- and more important Sacrament's regulation of Kern -- and a California shale boom will happen almost overnight. The Untied States' Big4 shale plays are about to become the Big 5.

Nordstream -- October 29, 2022

Re-posting, from October 18, 2022:

A reader sent me this link.

6. Greenpeace? They would "take credit" if they had done it.My reply, not ready for prime time:

This had too have been a very, very, very well-planned operation by someone with the technology and very deep pockets (dollars).1. I can think of only three -- UK, US, Russia.2. Russia would have no desire to do this. It just doesn't make sense.3. This feels like a CIA operation.4. CIA - Brits did this.5. So, it's the Bourne Legacy (US - Matt Damon) and the Brits (007 -- Bond, James Bond, Daniel Craig) mash-up.

Steiff Lioness -- October 29, 2022

We bought this in Germany in 1984 or thereabouts.

Kept in pristine condition.

In September, 2022, sent to Laura and her boys.

Kiri had also wanted it but Laura asked first and her boys are now the right age.

It

would be nice if the boys could keep this "in the family" and give it

to one of Kiri's daughters if they have children. And so on.

I just checked the price for this plush toy over on Amazon: the price? Priceless.

Denbury CO2 -- New Agreement -- "Blue" Hydrogen -- October 29, 2022

I don't know if folks are paying attention but oil companies are used to planning twenty and thirty years into the future.

The best example, without question, the Keystone XL pipeline. Oil companies saw what was coming and knew the western Canadian heavy oil was critical for "affordable" oil. The EU, Saudi saw this coming and using "green" as their cover was able to shut the Keystone XL down.

Be that as it may.

The oil companies now see CO2-enabled fracking as the next big thing to maximize oil production from shale. That will be the fourth shale revolution. Peter Zeihan discussed the first three shale revolutions in his 2017 book.

Be that as it may.

But CO2 will be used for more than EOR fracking.

Denbury has just signed a 20-year agreement to provide CO2 transportation and storage services to Lake Charles Methanol in association with LCM's planned "blue" methanol project.

LCM’s world class facility will be located along the Calcasieu River near Lake Charles, Louisiana, approximately 10 miles from Denbury’s Green Pipeline.

The facility is designed to utilize Topsoe’s SynCORTM technology to convert natural gas into hydrogen which will be synthesized into methanol, while incorporating permanent carbon capture and sequestration.

The process is anticipated to deliver over 500 million kilograms of hydrogen per year as a feedstock to produce 3.6 million metric tons per year ("mmtpa") of "blue" methanol, while capturing approximately 1 mmtpa of CO2. This is a CO2 equivalent to removing the emissions of 200,000 cars from the road each year.

It's my feeling that Denbury is the world-class leader when it comes to "all-things CO2."

By the way, the purpose for "blue" hydrogen in Louisiana? See below.

That may be why XOM was so cautious with regard to its recent dividend hike.

For more on "blue hydrogen," for starters:

The New UK Prime Minister -- October 29, 2022

The new PM is a man of many firsts. At 42, he’s the youngest PM since William Pitt (the Younger), who took office in 1783 at the age of 24. Sunak, who was born in the United Kingdom, is the first PM of Indian heritage. He’s also the first former hedge fund executive, the first to have a Stanford MBA, and the first to have worked at Goldman Sachs.

Let’s take a closer look at some of those American connections. After graduating from Oxford in 2001, Rishi joined Goldman in London as an analyst, where for a time he sat next to the aforementioned Ann Berry.

“He was very smart, analytical, very articulate and a really pleasant character,” she says. “He was very focused, even then, on making sure that he was doing something that had a broader impact."

Sunak left Goldman and went to Stanford on a Fulbright scholarship where he received an MBA in 2006. There’s some color on his Stanford days in a biography of Sunak published in 2020 (how many 40-year-olds warrant that?) titled (one hopes not literally) “Going for Broke” written by Lord Michael Ashcroft, a 76-year-old billionaire businessman and Tory politician. Ashcroft writes that Silicon Valley dazzled Sunak, and that he once commented on how it was possible to take a 10-minute drive through the Bay Area and pass hundreds of businesses that have changed people's lives.

The book speaks to the rigors of Stanford, and one of his classmates, Maria Anguiano, told the author: “Rishi coped very well. He was always very positive.” Another student there at the time, Rashad Bartholomew, remembers serious partying, but noted that Sunak didn’t drink but did sometimes join some low-stakes poker games.

After graduating from Stanford's business school, Sunak worked at hedge funds in London including The Children’s Investment Fund (known as TCI), run by British billionaire Chris Hohn, described to me as “a fascinating guy who’s a massive risk taker,” by a British hedge fund manager. At one time Hohn was doing activist investing that included targeting American railroad CSX, which traces its origins to the Baltimore and Ohio Railroad (or B&O), the oldest in the United States. The stake in CSX ended up becoming a tangled affair and ended badly for TCI. Sunak worked on the CSX investment and his role was mentioned in litigation.

Sunak is extremely wealthy, the bulk of which comes from his wife, Akshata Murthy, a graduate of Claremont McKenna, whom he met at Stanford, and the daughter of billionaire founder of Infosys, Narayana Murthy. Akshata owns .93% of Infosys worth some $700 million, according to Business Today, an Indian magazine. Infosys’s primary business has been to outsource thousands of U.S. jobs to India, or replace jobs in the U.S. with foreign nationals. It has also repeatedly knocked heads with U.S. regulators.

But wait—there’s more Americana via the Murthys. Through Akshata and her family’s businesses, Sunak also has ties to companies that operate Wendy’s in India and a joint venture with Amazon in India, according to an investigation by the Guardian.

Finally, Sunak even had a U.S. green card at one point, according to the BBC. He still has a luxury apartment in Santa Monica.