Updates

Later, 5:17 p.m. CT:

Later, 4:59 p.m. CT: ISO NE — renewables providing five percent and wind is supplying two percent of that, or 0.1 percent of total generated electricity. I’ve never seen it that low. It’s difficult to get less than 0.1 percent of anything.

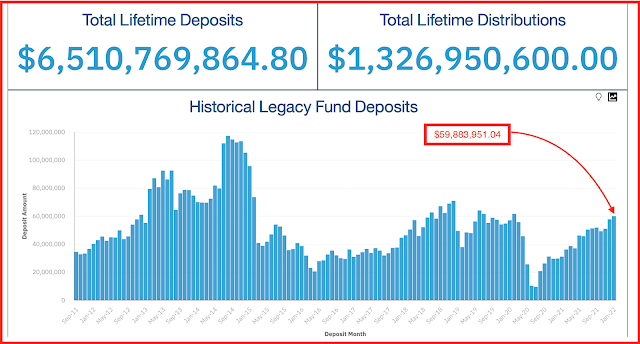

Later, 11:29 a.m. CT: Legacy Fund deposits posted for January, 2022. Increased month / month.

Later, 9:35 p.m. CT: for all the excitement about $100-oil, WTI is certainly struggling. WTI plummets in early morning trading, down 2.54%; down $2.16; and now trading at $82.98. As bad as it is, even worse when one considers war may break out in Europe; shouldn't that push oil higher? A Ukraine invasion could result in $100-oil -- Bloomberg. This suggests traders are finally looking at demand destruction / gasoline demand in the US as it collapses. Blamed on strong dollar.

Opening Comments

Connecticut: drops vaccine mandate for state employees. Says it reached its goal. I believe Buffalo Bills reached its goal also; record setting number of touchdowns in playoff game.

Jim Cramer: will be fascinating to watch this week.

Sports talk television: will be fascinating to hear them talk about Mahomes and the Kansas City Chiefs; one for the ages. How 'bout them Cowboys?

- three of four top ranked teams fell over the weekend

- none of the four, except Kansas City Chiefs, were Super-Bowl-worthy

- should be easy road for Chiefs, but ...

Investors:

- AAP: down -- pre-market; just dropped below $160; might we see $155 before the week is over?

- NFLX: down -- down another $14; trading around $350

- ARKK: down - trading below $70

- RIVN: down - pre-market -- on opening could trade below $60

- BITC: down - pre-market -- down 5%; could it drop below $30,000 this week?

- TSLA: down - wow, wow, wow -- pre-market, just went below $900;

- AMD: down -

- INTC: down -

- DWAC: down -

- DIS: down -

- MRNA: down -

- TOST: is toast;

Peleton: why was it not in the list above? Peloton is in a league of its own.

Pelosi's portfolio: Roblox, Disney, and GOOG.

Speaking of which: wow, wow, wow -- if one wants to jump in now, F will likely open below $20. I wasn't planning to do anything investing (not trading, I invest) today, but F at $19 and change seems to be a no-brainer. Thank goodness for CNBC crawlers; I would have completely missed that one. F now indicating a yield of almost 2%.

- Maybe another one to look at would be DE although compared to the rest of the market, DE seems to be holding up very well.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

Pre-market: with the market looking to be in free fall, tell me again that Jay Powell will still talk about raising rates four times this year.

Revenue stream: wow, wow, wow, those with a revenue stream -- what a great time to be looking at investing opportunities. They don't come around often.

Disclaimer: this is not an

investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

Gasoline, demand destruction: GasBuddy --

- weekly (Sunday - Saturday) gasoline demand:

- fell 6.4% last week;

- lowest weekly number since March 7, 2021 -- almost one year ago

- confirms EIA data; crickets

Flashback, Condoleeza Rice, on German TV in 2014: wrong on both --

- "Russia will run out of cash long before Europe runs out of energy" -- Condoleeza Rice

- holy mackerel: how wrong could one be? I might have thought the same regarding Russian cash, but no way did I think Europe would be just fine with energy. Wow.

- back in 2013, it was being predicted that Europe would be the first continent to be a net importer of energy (excepting Antarctica, of course); posted on the blog at that time.

Still waiting: Legacy Fund deposits for January, 2022, should be reported today.