For newbies, I live just a mile or so west of the Dallas-Ft Worth International Airport (DFW). We live right at the dividing line between Grapevine, TX, and Euless, TX. Our residential area would be considered upper middle class, I suppose.

Earlier today I mentioned that I was going to ride my bike down to Walmart just to check things out, not buy anything.

A beautiful day for a bike ride. At the gate outside our little hovel, if I turn right, I ride to Target in about two minutes (it takes longer to lock up the bike and find my mask than it is to ride there). If I turn left, I take a beautiful trail to Walmart about seven minutes riding time at most.

It was early, about 9:30 a.m. and the parking lot was not as full as I expected. I don't think I have been to this Walmart since before the Covid lockdown -- don't know for sure; can't remember, but it's been a long time. I was impressed with how clean and uncluttered the store appeared. I remember Walmart stores being cluttered with merchandise in the aisles but not today. It almost had a Target appearance: open, uncluttered, clean.

Whatever.

A casual observer might not have noticed, but it was clear that there supply chain issues. Some shelves were completely empty, but not particularly remarkable; lots of "gaps," as it were; and, often grocery items were not as deep back into the shelves as would be normal. But clearly, no one is going to go hungry in the US if they can afford to shop at Walmart.

McCormick spices has had significant problems; the CEO was interviewed on CNBC some weeks ago because of the "spice" problem. Since then it has gotten a lot better.

I was mostly interested in the price of turkeys and the price of bacon. From my note over at Schwa Nation:

Turkeys, just prior to Thanksgiving:- Butterball: $0.98 / pound (vs $0.99 / pound at Target)

- Honeysuckle: 87 cents / pound

Bacon:

- brand (52 cents / ounce) to store brand (28 cents / ounce)

- about $8 for a pound of a bacon; $10 for a pound and a half

In the toy section, I checked out Lego which seemed to be the hardest hit at Target (in the toy section). It was the same at Walmart. Almost completely out of Lego sets. Enough there to get a present or two, but very, very limited selection. If there are normally 500 Lego sets, it appeared there were less than fifty today.

But most interesting: Amazon never seems to be out of stock. Of anything.

Anyway, enough of this for now.

*******************************

Bull Market

The market was on fire today. The S&P 500 came within a point of hitting an all-time high. The Dow closed well below its high for the day but overall, an incredible day.

Generally speaking, the talking heads were remarkably bullish. I've posted my reasons why I think the bull market will go on for quite some time.

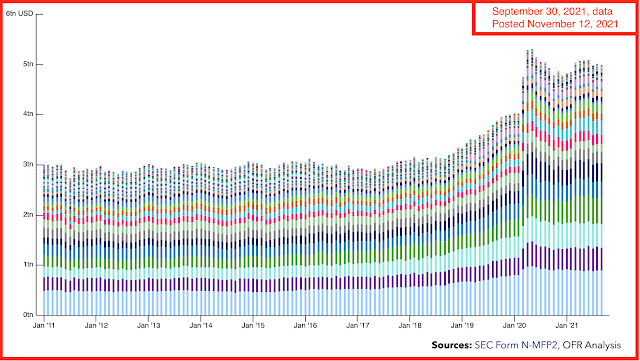

I've mentioned before about all the cash Americans have but no one else seems interested. I will post my favorite graphic later but here it is mentioned in this article: Goldman Sachs expects bull market to extend into 2022. Morgan Stanley is saying the same thing. But back to the linked GS article:

Households own half of the $28 trillion in U.S. cash assets, an increase of $3 trillion since before the pandemic. We expect households will shift some of this capital into equities over time," adds Kostin.

Here it is, my favorite chart.

**********************************

Stump Siri

I am quite disappointed in Siri, LOL. The following was on the radio earlier this evening. I was curious: would Siri recognize this song / did she have it on her playlist? She did not recognize the song. Are you kidding me?