A reader alerted me to this story from the EIA.

Several interesting graphs at the linked article.

It's all about

the bubble point This paragraph explains the phenomenon:

In tight oil formations like the Bakken and Three Forks—which have low

permeability—the gas-oil ratio tends to increase only gradually over an

extended period of time before reaching a certain point at which it

then increases significantly.

As producers extract hydrocarbons from a

rock formation, the pressure in the formation eventually falls below the

point at which natural gas naturally separates from the gas-saturated

crude oil—a threshold known as the bubble point.

More oil relative to

natural gas tends to be produced during the initial phases of

production, after which natural gas production can increase once

pressure in the formation reaches the bubble point.

If that's what is happening in the Bakken now, it helps explain the flaring problem that is now being reported by the NDIC and a problem that is being talked about at the national level (e.g., RBN Energy).

In this particular article, the EIA ends with this paragraph:

In previous years, insufficient infrastructure to collect, gather, and

transport North Dakota’s increasing natural gas production meant more

than 35% of the state's gross withdrawals of natural gas was flared rather than marketed.

In an effort to reduce the amount of flared gas, North Dakota's Industrial Commission established new targets in 2014 to limit flaring to 10%

by October 1, 2020.

Based on data from North Dakota's Industrial

Commission, the volume of flared natural gas has declined from more than

0.35 Bcf/d in 2014 to about 0.20 Bcf/d in 2017—about a 40% decline.

It is interesting that the EIA does not note North Dakota's current problem with flaring. Obviously the EIA cannot be unaware of that. By not mentioning it suggests to me that the EIA:

- sees North Dakota's flaring problem as a temporary event / an anomaly that will be resolved over time

- did not want to "muddy" the waters at this point in time; waiting to see how this would play out

The EIA mentioned that North Dakota has a target of less than 10% natural gas to be flared after 2020. These are the comments and data points

from the most recent Director's Cut:

Natural gas capture, getting "worse" and FBIR is major issue:

- statewide: 83% (previous -- 86% [trending down])

- FBIR: 71% (previous -- 77% [huge disappointment; was 82% previous to that])

- goal: 88% through October 31, 2020; then 91%

- comment: pending (previous - the trend has worsened -- large amount of flaring on BLM land)

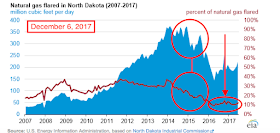

This is the EIA's graph on natural gas flaring in North Dakota. The EIA did not discuss the recent rise in flaring. The solid blue area represents how many million cfpd that North Dakota flares (x-axis on the left); the red line represents the percent of natural gas flared (x-axis on the right).

Note: the EIA did not comment on the recent increase in flaring as a percentage / actual amount -- the single circle to the right, emphasized with the arrow.