| $48.30↑ | 9/5/2017 | 09/05/2016 | 09/05/2015 | 09/05/2014 | 09/05/2013 |

|---|---|---|---|---|---|

| Active Rigs | 56 | 33 | 75 | 196 | 186 |

RBN Energy: potential natural gas storage scenarios for the balance of injection season.

Hurricane Harvey has dissipated, but the affected areas, including energy infrastructure and operations, are still in recovery mode and will be for some time to come. In the natural gas market, production fell as low as 71.3 Bcf/d this past week, and has now rebounded to pre-storm levels near 72 Bcf/d.

But exports to Mexico, which were averaging near 4.4 Bcf/d in the 30 days prior to Harvey, were at 3.6 Bcf/d last Friday, still lagging 0.8 Bcf/d (18%) behind their pre-storm level, after dropping to as low as 2.85 Bcf/d last week.

Deliveries for LNG export are also down nearly 1.0 Bcf/d (47%) from the 30-day average to just under 1.0 Bcf/d last Friday and dropped to about 475 MMcf/d over the weekend.

Meanwhile, U.S. consumption — in the power, industrial and residential and commercial sectors — this past week averaged 62.8 Bcf/d, down 6.0 Bcf/d (9%) versus last year and also 1.6 Bcf/d (3%) lower than the five-year average for this time.

In another important market development, Energy Transfer Partners’ new Rover Pipeline began partial service on Friday and deliveries rose to more than 500 MMcf/d over the weekend. What will these shifts mean for the gas market balance and storage inventory? Today, we continue our analysis of the gas market balance, this time with a forward look at potential storage scenarios for the balance of injection season.Inventory:

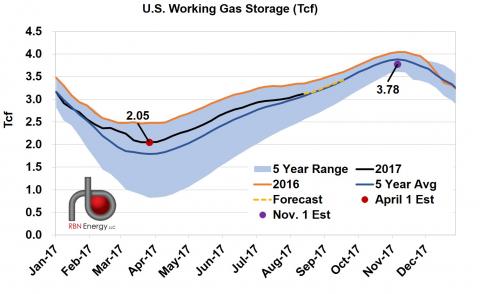

Figure 1 Source: RBN

As the graph shows, the 2017 storage inventory rose to well above the five-year average starting in February and stayed higher most of the summer, but in recent weeks that surplus has diminished and the inventory has converged with the five-year average line. It’s also remained below last year’s record levels, but that gap is narrowing.Summary:

- high end scenario: if we take maximum injections seen in the past five years, the inventory could end up peaking at a record 4,053 Bcf (6.0 Bcf higher than the previous record in 2016)

- low end scenario: if injections are kept low, inventory by early November would be around 3,764 Bcf (10,283 Bcf less than 2016

- middle-of-the-road scenario: peak at about 3,890 Bcf (151 Bcf lower than 2016)