NOTE: I will be off the net in a few minutes, bicycling. If I made a mistake in the note(s) below I will not be aware of it for several hours. I will take another look at these notes later this evening. Until then, even my disclaimer needs a disclaimer.

It sure seemed to take forever, but finally,

the Foreign Exchange Reserves in Saudi Arabia has finally been updated. I've been looking for this update for weeks; here it is:

There was a slight, almost imperceptible bump-up in May, 2016, but after that, the downward trend continued. The drop from August to September was quite remarkable given the events and the movement in the price of oil these past few weeks.

The decline month-over-month ranges from 3.35% to 0.0.24%. But one cannot simply suggest that a 1%

decline month-over-month can be used to forecast future drops. Saudi Arabia is using cash reserves to pay for a number of items, not least of which is internal security; a war with Yemen; and, to its civil servants. There is a fixed overhead cost the Saudis have to contend with. That fixed overhead cost is not a percent of their reserves; it is a "raw number."

A spreadsheet analysis:

- the y-axis is in "millions of SAR"

- the y-axis ranges from 2,050,000 million SAR to 2,450,000 million SAR (assuming I've counted all the zeroes)

- the raw delta month-over-month in this graph ranges from a low of 5,000 million SAR to 80,000 million SAR (excluding the one outlier, May, 2016). The average for the entire range in this graphic (including the outlier, May, 2016): 32,000 million SAR.

- the exchange rate: a SAR is about a quarter (27 cents) in US currency

- so, conservatively, let's say Saudi Arabia is moving about 27,000 million SAR out of its cash reserves month-over month

- if one sets up a spreadsheet, with October, 2015, as "month #1" one can see that using this reasoning, which might be completely fallacious and meaningless, but fun nonetheless, one finds that in the 90th month, things not looking so good for Saudi Arabia. The 90th month is January, 2023.

- it should be noted that OPEC cannot agree on a cut, and WTI is down almost $2.00 today, now below $47; Brent is probably showing the same trend.

Note: I often make simple arithmetic errors. I often make factual and typographical errors. The above is done for my own amusement. But if I don't place it here, I will place it somewhere else and then I will forget when I placed it. This is simply idle chatter. Don't make any financial, investment, travel, job, or relationship decisions based on what you read here. If this important to you, go to the source.

********************************************

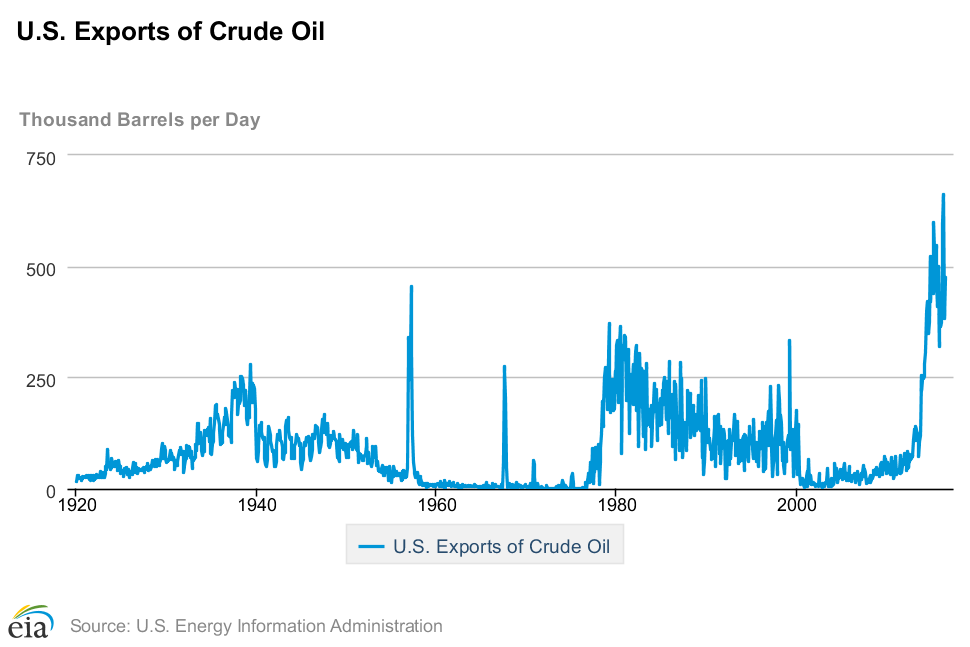

US Oil Exports

From Javier Blas over at Twitter: US oil exports rose in August to 657,000 bopd (2nd highest ever, below the 662,000 bopd of May). Exports reached twelve countries.

***********************************************

The book I'm starting this week:

Solving the Mystery of the Lost Colony Roanoke

Lee Miller

c. 2000

DDS: 975.617 MIL

My notes will be elsewhere.