The RBN Energy story by Housley Carr down below was posted early on the morning of December 30, 2014. Later that afternoon

Reuters was reporting that

Excelerate Energy's Texan liquefied natural gas terminal plan has become the first victim of an

oil price slump threatening the economics of U.S. LNG export projects.

A

halving in the oil price since June has upended assumptions by

developers that cheap U.S. LNG would muscle into high-value Asian energy

markets, which relied on oil prices staying high to make the U.S.

supply affordable.

The

floating 8 million tonne per annum (mtpa) export plant moored at Lavaca

Bay, Texas advanced by Houston-based Excelerate has been put on hold.

The project was initially due to begin exports in 2018.

Excelerate's

move bodes ill for thirteen other U.S. LNG projects, which have also

not signed up enough international buyers, to reach a final investment

decision (FID). Only Cheniere's Sabine Pass and Sempra's Cameron LNG

projects have hit that milestone.

*************************************************

Spouse of the Rising Sun—No LNG Divorce Imminent, Despite It All

Monday, 12/29/2014

Published by: Housley Carr

It

would be an understatement to say that the worldwide market for

liquefied natural gas (LNG) is in flux. LNG production is up and heading

higher, oil—and LNG--prices are down sharply from a few months ago, and

Japan and other big consumers of LNG are more interested than ever in

mitigating price and supply risk. All this comes as Japan, a primary

target of prospective U.S. and Canadian LNG export projects, is

grappling with the need to restart dozens of idled nuclear units so it

can reduce the oil and LNG imports that have hurt its trade balance

since the Fukushima disaster nearly four years ago. Today we consider

recent developments and how they may affect Japan and its potential LNG

suppliers on the North America side of the Pacific.

Despite recent setbacks, Japan remains an undisputed economic

powerhouse, the third-largest economy in the world behind the U.S. and

China. But the island nation depends more than ever on imported oil and

natural gas (in the form of LNG) to run its power plants and factories

and to heat its businesses and homes. As we said in the

First Episode

of our “Spouse of the Rising Sun” series, Japan was already the world’s

leading LNG importer (accounting for about one-third of all LNG

imports) in March 2011, when a 9.0 earthquake triggered a tidal wave

that devastated Tokyo Electric Power Co.’s six-unit Fukushima Daiichi

nuclear station northeast of Tokyo. Within two months of the disaster,

most of Japan’s other 48 nuclear units were offline, and by September

2013 all of them were. Given that nuclear power had been providing 30%

of Japan’s electricity prior to Fukushima (with fossil-fired units

providing almost all the rest), the industry-wide nuclear shutdowns

forced wrenching change. Oil and LNG imports rose to fill the nuclear

gap and, as we said in

Episode Two,

the pace of nuclear-unit restarts is likely to be slow and the

heightened need for oil and LNG is likely to continue. What’s changed

over the past few months though, is that a lull in LNG demand (in Japan

and elsewhere in Asia) has created a supply surplus and a buyer’s

market. Also, as we know all too well, the price of oil has fallen

precipitously and shows no sign of a quick rebound. These changes (and

rising LNG production in Papua New Guinea, Australia and—soon—in the

U.S.) have given Japan the hope of reining in its fuel-import costs in

general, and its LNG costs in particular.

The very liquid worldwide market for oil enables Japan and other

Asian oil importers to take advantage of currently low oil prices. In

addition, because the vast majority of Asian LNG contracts index LNG

prices to a basket of imported oil known as the Japanese Crude Cocktail

(JCC - see “

Courtesy of the Red, White and Blue”),

LNG-importing countries also are benefiting from much lower prices in

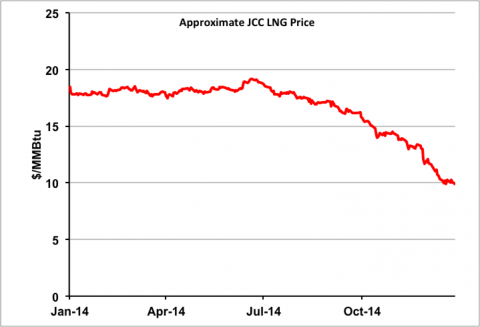

recent months. Figure #1 shows an approximation of the JCC based on

Brent prices since the start of 2014, falling from close to $20/MMBtu in

July to $10/MMBtu in December. Add to that the facts that demand for

LNG in Japan and South Korea this past summer and fall has been flat,

and that new LNG production expected online soon will add to market

supply (fully one-third of the output of Chevron’s mammoth Gorgon LNG

project in Australia—set to start exporting in mid-2015—is not under

long-term contract so will hit the open market) and you have yourself an

LNG price-sag of major proportions. In December 2014, spot LNG prices

in Asia (a better leading indicator than the JCC contract price) are

below $10/MMBTU and they could fall even more by the spring of 2015 if

it’s a mild winter and LNG stockpiles continue to build.

Figure #1

Source: RBN Energy (Click to Enlarge)

That’s great news for LNG importers, of course, but it’s a real

headache for companies trying to develop new LNG export facilities—and

for U.S. and Canadian natural gas producers hoping to lock in long-term

deals to sell gas for export as LNG. Consider a 20-year LNG contract

that a Portuguese utility, Energias de Portugal (EdP), reached in

December 2014 with Cheniere Energy’s planned Corpus Christi LNG export

facility. Under the deal, EdP will take up to 0.77 million metric tons

per annum (MTPA) of LNG (the equivalent of 108 MMcf/d of natural gas)

and pay Cheniere a liquefaction and LNG loading fee of $3.50/MMBtu plus

115% of the final settlement price for the Henry Hub natural gas futures

contract for the month in which the LNG shipment is scheduled. If a

Japanese buyer made an identical deal, and if the Henry Hub gas price

were, say, $4/MMBTU, the cost of gas delivered to Tokyo would be $4 (for

the gas) plus $3.50 (for the base liquefaction fee) plus 60 cents (15%

of $4, the supplemental liquefaction fee) plus $2 for shipping (roughly)

and plus $1 (again, roughly) for regasification in Japan. That comes to

about $11/MMBTU--a buck or more above the current LNG price in Asia.

Then (for the Japanese LNG buyer) there’s the risk that U.S. natural gas

prices could rise, putting U.S.-sourced LNG further out of the money in

a low-price LNG market. It’s all more complicated than this, of course.

For one thing, despite efforts by Japan, Singapore, China and others to

establish a liquid trading market for LNG, that goal has proved

elusive. For another, as part of Japan’s effort to mitigate LNG price

and supply risk, its utilities and other buyers have been actively

seeking U.S. (and Canadian) sources of LNG. Still, the current slumps in

oil and LNG prices (and in Asian LNG demand) are generally not good

news for companies trying to develop U.S. and Canadian LNG export

facilities.

That doesn’t necessarily mean, however, that Japan (and South Korea,

China and India) won’t commit to buying additional LNG from the U.S. and

Canada in the future. As we said, LNG buyers (Japan being a prime

example) want supply diversification, and adding a few gas-price-indexed

LNG contracts into their mix wouldn’t be a bad thing from a

risk-mitigation perspective. Also, it’s reasonable to predict that oil

prices will be higher four to six years from now than they are today,

and that’s the period in which most new Asia-focused LNG export projects

in the U.S. and Western Canadian projects (like Veresen’s Jordan Cove

project in Oregon; see “

New Kid in Town” and below) would come online.

Jordan Cove LNG

Source: Veresen (Click to Enlarge)

Then there’s the issue of Asian LNG demand—and, given the focus of

this blog, Japanese demand in particular. Sure there’s been some recent

softness in Japan’s demand for LNG (mostly tied to mild weather), but

LNG imports in the Land of the Rising Sun remain well above their

pre-Fukushima level (about 89 MTPA now, versus 71 MTPA in 2010), and its

likely they will decline only slightly–or even stay flat--as most of

Japan’s nuclear units are restarted over the next few years. (You may be

wondering if, with oil prices so low, Japan will ramp down its use of

gas-fired generation and ramp up its use of oil-fired generation. The

answer is, “Not to any significant degree.” Japan has been trying to

reduce its oil dependence for years, mostly with emission-reduction and

climate-change goals in mind. And all of the new, highly efficient

generating capacity being developed in Japan is fired by gas, not oil.)

The bottom line is that while all this is clearly a challenging time for

those interested in selling LNG at a solid profit to the Japanese,

Japan is not in any way inclined to end its long-time marriage to LNG.

As we said, LNG imports in the current Japanese fiscal year (FY2014,

which ends March 31, 2015) are expected to total 89 MTPA (according to a

December 2014 estimate by Japan’s Institute of Energy Economics), and

even with the oil price decline and LNG demand slump factored in, LNG

imports are only seen slipping to 85 MTPA in FY2015, which runs through

March 2016. So, as Japan’s older, oil-indexed LNG contracts roll off and

Japan seeks more supply diversification, there is probably room for a

few more LNG-supply deals with the U.S. and Canada. Patience may be

required though; the oil price collapse has everyone taking a deep

breath and a second—and third—look at everything we previously assumed

to be true in this market.