Locator: 48041POLITICS.

Updates

Later, 3:07 p.m. CDT: Dr Jill wins. Joe says he’s staying. The waffling is over. This will be fascinating to watch. Now, let’s see what the pundits have to say.

Later, 11:45 a.m. CDT: this is the problem "we" have now.

Americans do not like uncertainty or "what-ifs." Waffling -- Biden saying he is weighing options -- is a much worse situation for the Democratic Party as a whole, than just making a decision and sticking with it.

For Biden, who has probably already made up his mind, his waffling is not a problem. In politics, in fact, it is a fact that a politician doesn't not make a final decision until the last possible moment. So, for a lifelong politician, this waffling is not a big deal; it's part of the process -- a process he has been through a million times.

What I'm not seeing, because I don't watch television, is all the partisan ads (and news bites by right-wing outlets) looping videos of Biden at his worse. And that will only get worse and worse and worse while he is dithering. The opposition party sees blood in the water.

Obama --> "don't let a crisis go to waste" --> who's been on the campaign trail before? --> who would feel right at home on the presidential campaign trail? --> all roads -- or should we say, all presidential campaign trails -- lead to Michelle. Michelle doesn't need a platform. She would simply save the nation from Trump, just as Trump saved the nation from Hillary. Who comes out of this looking the best -- or has the most to lose -- Mr Obama, himself. If he hangs on too long in his support for Biden and it doesn't go well for Biden, then Obama loses his legacy. That's all Obama has right now: his legacy and, ironically, it's tied to the one man who Obama said, "don't underestimate Joe's ability to .... " Link here. To the extent this was apocryphal, I do not know.

Original Post

In politics, this is about as close as one gets to an official announcement:

- unless this was taken out of context, no politician admits "defeat" or starts to rationalize "defeat" or a "decision to step down;"

- The NYT would not have printed this story if the editorial staff had not already pulled their support;

- tipping point: running out of time

- two tracks:

- how to convince Jill to get on board; how to get Joe to step down;

- George S. could have the interview of a lifetime, but that interview won't be live

- right now, the individual quickly becoming the most-disliked political person? Jill Biden. For lack of a better word, she's looking more and more like a gold-digger.

- picking a replacement; lots of pressure on Michelle O. to run

********************************

Back to the Bakken

WTI: $82,84.

Friday, July 5, 2024: 7 for the month; 7 for the quarter, 343 for the year

40384, conf, Kraken, Wayne 11-14-23 2H,

Thursday, July 4, 2024: 6 for the month; 6 for the quarter, 342 for the year

40222, conf, CLR, Marshall 4-13H,

39892, conf, Hess, EN-Madisyn-LE-154-94-0705H-8,,

Wednesday, July 3, 2024: 4 for the month; 4 for the quarter, 340 for the year

40306

, conf, Stephens Williston, Cabot 15591-0112-5H,

RBN Energy: on-purpose propylene doesn't come easy.

Fast-rising NGL supplies during the early years of the Shale Era fueled

excitement about the potential for new petrochemical plants in the U.S.,

especially ethane-only crackers to make ethylene and other byproducts,

along with propane dehydrogenation (PDH) plants to make propylene. While

11 new ethane-fed crackers have come online in the U.S. since the

mid-2010s and the world’s largest — Chevron Phillips Chemical and

QatarEnergy’s 4.8-billion-lb/year facility — is under construction in

Texas, only three of the many PDH projects proposed over the same period

were actually built. In today’s RBN blog, we’ll look at why the initial

rush of new PDH project announcements resulted in so few new U.S.

plants. The Shale Revolution changed a lot of energy fortunes in the U.S.

Pre-shale, the U.S. had become heavily dependent on foreign crude oil

and was planning to import LNG to help meet natural gas demand, but with

shale, the U.S. is now the world’s largest producer of oil, gas and

NGLs and a significant exporter of all three. Plentiful domestic

supplies of NGLs and purity products like ethane, propane, butanes and

natural gasoline also helped revive the petrochemical industry and turn

the U.S. into a global supplier of both petchem feedstocks and plastic

resins.

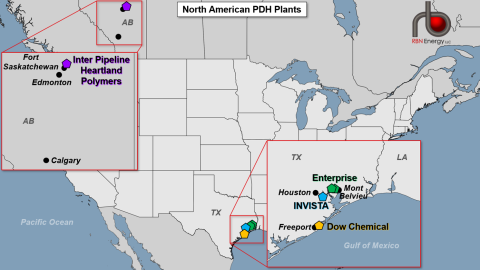

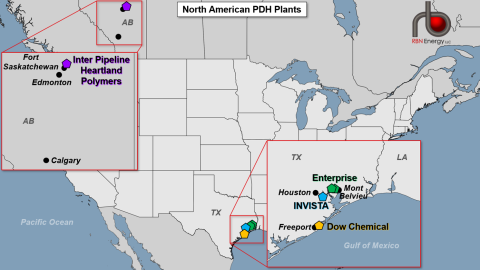

Figure 1. North American PDH Units. Source: RBN

Before 2015, the U.S. had a slew of mixed-feed crackers that were

built to “crack” different feedstocks such as ethane, propane, butane,

naphtha and gas oil to produce ethylene, propylene and other byproducts —

the building blocks of too many chemicals to count. INVISTA’s

Houston-area facility (blue pentagon in Figure 1 above) — built by

PetroLogistics LP in 2010 and later sold to Koch Industries — was the

only PDH unit in North America at the time as propylene demand was

largely met with enough “byproduct” production — propylene output from

mixed-feed crackers or refineries. There are now five PDH units

operating in North America (more on those later).