Locator: 46894INV.

Updates

February 25, 2024:

**********************************

What If?

Link here.

Form

the linked article -- it's been two years since the Fed starting

raising rates. Holy mackerel. Two years and the economy seems stronger

than ever.

Not so fast, Goldilocks.

The past few months have seen the soft-landing hypothesis surge from

behind and overtake recession as the consensus economic outlook.

Inflation has receded in the face of the Federal Reserve’s massive assault on interest rates.

Yet, paradoxically, employment has remained robust, with lots of new jobs created and layoffs near cyclical lows. Corporate earnings have been reasonably strong.

I know what the Goldilocks deniers are saying right now: Rate hikes

don’t work overnight. They take time to stifle the economy. But it has been 700 nights and counting since the first increase, in March 2022.

So, maybe Goldilocks deserves to take a bow (a victory porridge?) as

the soft landing seems to be all around us, with recession in the

rearview mirror.

That said, there’s another alternative, one that

is definitely not consensus but seems to be accumulating more and more

evidence in its favor. What if the economy—already defying economic

theory by surviving in the face of sharply higher rates—is actually

getting stronger?

That’s admittedly an odd thing to posit after two years of interest rate hikes. But as crazy as it sounds, evidence is starting to pile up for the acceleration hypothesis.

First, there are the “big” data points, like unemployment and the stock market. The change in nonfarm payrolls

in December’s report was the strongest since September. January’s was even stronger.

The stock market, widely seen as a mechanism that discounts future growth, is up over 20% from late October to mid-February.

And much more at the link.

I call this the "touch and go" scenario and have called it that for at least a year.

I'm like Harold Hamm. No time for negative talk. It's "damn the torpedoes and full speed ahead." LOL.

I better put in the disclaimer.

Disclaimer: this is not an

investment site. Do not make any investment, financial, job, career,

travel, or relationship decisions based on what you read here or think

you may have read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

Reminder: I am inappropriately exuberant about the US economy and the US market.

Original Post

See this post, also.

******************************

The Book Page

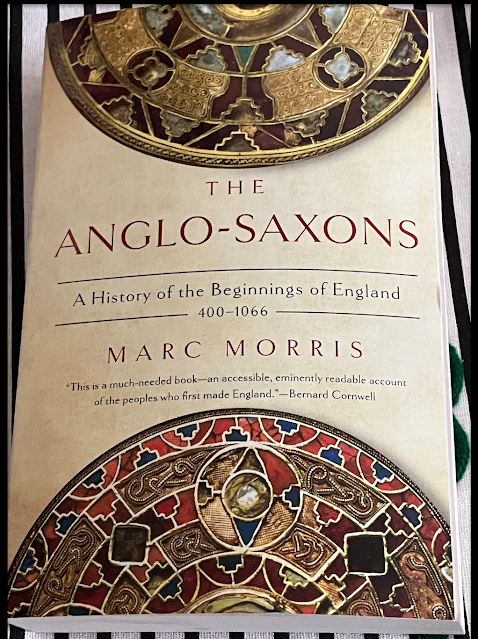

The book for the weekend:

The Anglo-Saxons: A History of the Beginnings of England, 400 - 1066, Marc Morris, c. 2021.

Timeline:

- 55 BC: Julius Caesar, first Roman military incursions into "Britain"

- 100 AD: Roman Britain established

- 200 AD: all the familiar hallmarks of Roman civilization introduced; London, the administrative hub

- Caerleon, Chester and York had been established

- 122 AD: Hadrian's Wall

- 360 AD: Picts from the north, and invaders from Ireland, the Scots and the Attacots, had started invading northern Britain

- 367 - 368 AD: key date; "the barbarians" winning / Romans losing

- 402 AD: last year in which Roman coins appear in Britain's archaeological record in any significant quantities

- 406: the Vandals, the Alans, and the Sueves cross the Rhine frontier; invade Gaul; cause alarm among the Britons, thinking they might be next

- 409: Romans no longer guaranteeing peace for the Britons, who revolt; Briton goes into free fall

- 410: most of the archaeological record of Britain disappears; period in which Hoxne treasure was hidden

- north Britain: invaders were Picts; southern and eastern Britain, the Saxons

- Romans had religion; first, their pantheon and then Christianity; the Saxons were pagans, and sacrificed 10% of all their captives to a watery end;

- no written history, but now, the Venerable Bede's Ecclesiastical History of the English People, who says the Brits asked for help to fend off the Picts and the Scots. The Saxons were invited in by the Brits but the Saxons came to conquer the whole country for themselves .... and the rest is history.

- Bede: written in the early 8th century, a full 300 years after the events he was describinng

- Bede's primary source: a written source by Gildas, an unknown author, The Ruin of Britain

- the most valuable account of the island's fifth-century history

- the main event -- ultimate cause of Britain's subsequent misery: the arrival of the Saxons

- Bede more concerned about historical accuracy; placed these events during the rule of the emperor Marcian, accession Bede dated as 449

- 449 AD: adopted by later writers as the date of Saxon arrival

- but more likely, 20 years earlier: around 430 AD

- another written source, The Gallic Chronicle of 452 suggests the same date, around 430 AD

- Saxon revolt, 441 AD: country divided in two -- the remaining Saxons in one area; the original Brits in another area

- commonly held: Saxons in the east; Brits in the west; but probably much more complicated

- then, in-depth archaeological history, pp 30 - 32

- then, the political and DNA history, pp 32 -- 37.

To be continued elsewhere.

My own copy:

*****************************

The Dust-Veil Event: 536 AD

Link here.

The volcanic winter of 536 was the most severe and protracted episode of climatic cooling in the Northern Hemisphere in the last 2,000 years.

The volcanic winter was caused by at least three simultaneous eruptions of uncertain origin, with several possible locations proposed in various continents. Most contemporary accounts of the volcanic winter are from authors in Constantinople, the capital of the Eastern Roman Empire, although the impact of the cooler temperatures extended beyond Europe. Modern scholarship has determined that in early AD 536 (or possibly late 535), an eruption ejected massive amounts of sulfate aerosols into the atmosphere, which reduced the solar radiation reaching the Earth's surface and cooled the atmosphere for several years.

In March 536, Constantinople began experiencing darkened skies and lower temperatures.

Summer temperatures in 536 fell by as much as 2.5 °C (4.5 °F) below normal in Europe. The lingering impact of the volcanic winter of 536 was augmented in 539–540, when another volcanic eruption caused summer temperatures to decline as much as 2.7 °C (4.9 °F) below normal in Europe.

There is evidence of still another volcanic eruption in 547 which would have extended the cool period. The volcanic eruptions caused crop failures, and were accompanied by the Plague of Justinian, famine, and millions of deaths and initiated the Late Antique Little Ice Age, which lasted from 536 to 560. The medieval scholar Michael McCormick wrote that 536 "was the beginning of one of the worst periods to be alive, if not the worst year."

Michael G. L. Baillie (1944-2023) was a leading expert in dendrochronology, or dating by means of tree-rings, and Professor of Palaeoecology at Queen's University of Belfast, in Northern Ireland. In the 1980s, he was instrumental in building a year-by-year chronology of tree-ring growth reaching 7,400 years into the past. Instrumental in documenting the dust-veil event of 536.

Died last year (2023) -- can't find any obituary in any major newspaper.

I find the temperature drop of 2.5 °C most interesting; it is essentially the same number of degrees that global warming advocates are concerned about but in the opposite direction. It appears the optimum temperature for humans is a +/- 2.5 degrees around a "norm."

Never quit reading.