Locator: 45517ECON.

By the way: did you all see the mobile device used by JPow today at the press conference? An Apple iPad!! Whoo-hoo!!

I’ll finish this page tomorrow if I don’t wake up dead.

Covid: my wife and I each got the “new” Covid vaccine today.

The Moderna vaccine arrived yesterday; the Pfizer vaccine arrived today. It was just coincidental timing that we stopped by the pharmacy today. May also got her “seasonal flu shot.” I get my shots at least two weeks apart. Yet to go, for me: seasonal flu; RSV; and tetanus “booster” — it’s been way more than ten years. And then I’ll be completely done for the year.

Baked in: did anyone really expect the FED/JPow to raise rates today? 😂😂😂

The gift (graft) that keeps on giving. Link here. And here. Remember: it was President Trump that turned Moderna into the modern pharmacy company it is today.

American labor’s real problem: absenteeism. Link here.

UAW tea leaves / Fain’s crystal ball:

- the strike lasts longer than 30 calendar days;

- every day longer than 14 days and Shawn Fain’s future looks exponentially worse;

- the strike is just what GM and Ford needed;

- management is prepared to shut every US auto plant and blame it on the supply chain and Shawn Fain;

- in today’s high-inflation / high-paced / high-cost daycare environment, five days feels like two weeks for those on strike. And the spouses of those striking are telling that to their striking spouses every night. If not, workers are being paid more than enough. That’s the crystal ball, not “me.”

Market: today was another buying opportunity. JPow never lets us down.

Gasoline demand: drops again. Link here.

Must-read. Link here.

Personal: when do I close my twitter account?

***

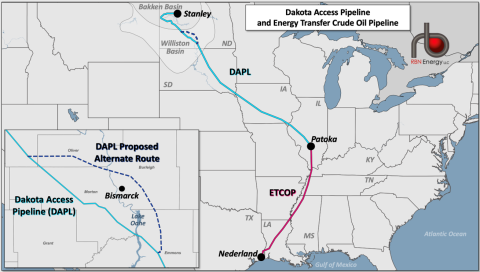

Back to the Bakken

Active rigs: 33.

WTI: $90.28. If shale operators can’t make money on $60-WTI, they won’t make money on $100-oil. They won’t need $100-oil; they will need a new CEO.

Eight new permits,

- Operators: Enerplus (7); KODA Resources

- Fields: Little Knife (Dunn County), Fertile Valley (Divide)

- Comments:

- KODA Resources has a permit for an Amber well, SESE 13-160-103,

- to be sited 310 FSL and 981 FEL;

- Enerplus has permits for three Olson wells and four Olsom (sic) wells, SWSW 34-147-97;

- to be sited between 508 FSL and 439 FSL and between 488 FWL and 655 FWL

Six producing wells (DUCs) reported as completed: Slawson (3); MRO (3) --

- 29283, 1,054, Slawson,

- 29285, 1,438, Slawson,

- 38842, 584, Slawson,

- 38040, 4,286, MRO,

- 38041, 3,101, MRO,

- 38042, 3,748, MRO,