Locator: 45566B.

WTI: $87.58.

Monday, September 11, 2023: 77 for the month; 279 for the quarter, 524 for the year

None.

Sunday, September 10, 2023: 77 for the month; 279 for the quarter, 524 for the year

39673, conf, Hydra Services, SWD,

39030, conf, Liberty Resources, Temple 159-96-36-25-3MBH,

Saturday, September 9, 2023: 75 for the month; 277 for the quarter, 522 for the year

39067, conf, Hess, TI-Fossaa-158-94-1819H-2,

38901, conf, Whiting, Snowshoe Federal 31-30-2H,

38899, conf, Whiting, Snowshoe Federal 31-30-4H,

37927, conf, BR, Parrish 2C MBH,

Friday, September 8, 2023: 71 for the month; 273 for the quarter, 518 for the year

39613,

conf, Kraken, Gladys 29-20-17-3H,

37472,

conf, SOGC (Sinclair), Saetz Federal 3-36H,

RBN Energy: what about some Permian gas locally to make gasoline, SAF, and power?

Permian producers are churning out ever-increasing volumes of

associated gas, all of which needs to find a home. New or expanded

takeaway pipelines to Gulf Coast markets are an obvious option — and a

few projects are in the works — but locking in capacity requires

long-term commitments that many producers are loathe to make. As a

result, the balance between Permian takeaway capacity and the volumes of

gas that need to exit the basin is always on a knife’s edge, often

resulting in a Waha basis so ugly that producers are essentially giving

their gas away. But what if there was a way to put more Permian gas to

good, economic use within the basin, and ideally very close to

where it’s produced? Better yet, what if the producers could garner some

environmental cred in the process? In today’s RBN blog, we discuss a

trio of Permian projects — a couple of them involving top-tier E&Ps —

that would use local gas to make gasoline, sustainable aviation fuel

(SAF) and electricity.

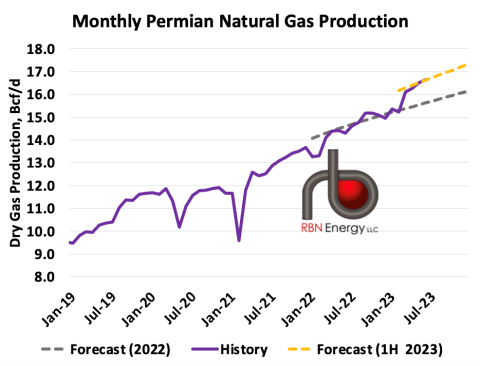

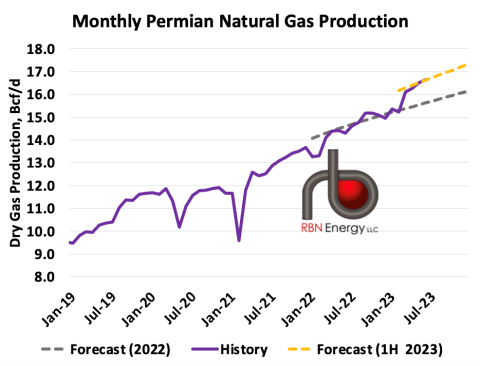

Back in January, we stuck out our collective neck and provided a 2023 outlook for Permian crude oil and natural gas.

It turns out — so far at least — that we were pretty much on target.

(Dashed gold line in Figure 1 shows 2023 Permian gas forecast and right

end of solid purple line shows actual year-to-date production.)

According to RBN’s latest Crude Oil Permian and NATGAS Permian

reports, August production is averaging 5.76 MMb/d and 16.8 Bcf/d,

respectively — on track for the 6 MMb/d and 17.25 Bcf/d we predicted for

year-end 2023. (Whew!) The point here is not to toot our own horn, but

to say that Permian production continues to grow and that gas-related

infrastructure in particular (gas gathering systems, gas processing

plants, gas and NGL pipelines, and LNG export terminals) will need to

continue to grow with it.

Figure 1. Permian Natural Gas Production and Forecast. Sources: RBN, Enverus

As we’ve discussed in a number of blogs over the past couple of

years, new gas infrastructure is being developed — lots of it, in fact.

By the end of this year, a 500-MMcf/d expansion of the 2-Bcf/d Whistler

Pipeline will be coming online, as will a 550-MMcf/d expansion of the

2.1-Bcf/d Permian Highway Pipeline (PHP). Then, in Q3 2024, the

2.5-Bcf/d Matterhorn Express pipeline is scheduled to start up. A couple

of additional pipelines are in the works (but not yet sanctioned),

including ONEOK’s planned Saguaro Connector (to the Mexican border) and

Energy Transfer’s proposed Warrior Pipeline from the Waha Hub to south

of Dallas/Fort Worth, as well as others in earlier stages of development.