Locator: 45515FRACK.

Pages

Wednesday, August 30, 2023

Warren Buffett At The Top Of His Game -- CNBC -- August 30, 2023

Locator: 45513INV.

There's a lot buried in this post, and there's more to come. Do folks remember the Nancy Pelosi story?

The story "below the fold" was published in 2017 -- eight years ago. It begs the question.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

From 2017, link here:

From the linked article:

Jefferies analyst Mark Lipacis hiked his price target on Nvidia to 180 from 140 and increased Xilinx's target to 77 from 68.

Lipacis downgraded Intel to underperform from hold, while lowering its price target to 29 from 38. Nvidia stock rose 4.7% to 153.70 on the stock market today. Xilinx climbed 2.8% to 67.18.Shares in Intel fell 0.7% to 33.65, hitting a 52-week low intraday.

"With dominant market share in the data center, we think Intel has the most to lose as the industry shifts to a parallel processing/Internet of Things model," said Lipacis in a report. Nvidia stock is up 37% in 2017 but shares have retreated from an intraday high of 168.50 set on June 9. Intel stock has dipped 6% this year while Xilinx stock has climbed 8%.

No New Permits -- August 30, 2023

Locator: 45510B.

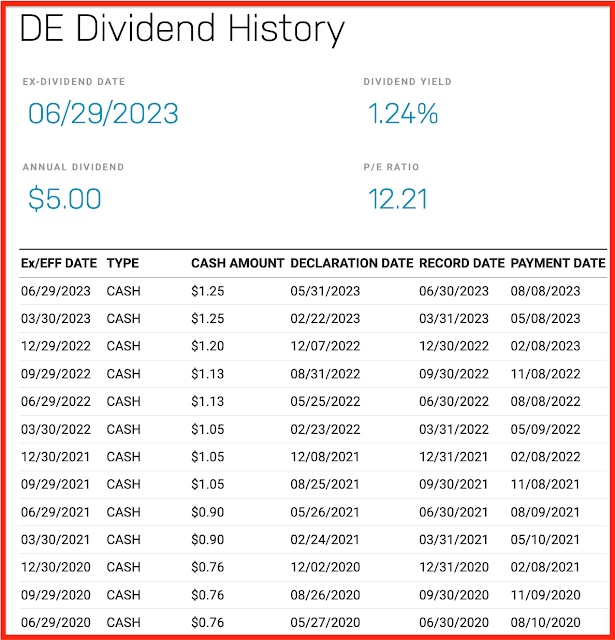

Laser-focused on dividends: Deere raises dividend to $1.35.

Gasoline demand: link here.

********************************

Back to the Bakken

WTI: $81.64.

Active rigs: 32.

No new permits.

Three producing wells (DUCs) reported as completed:

- 32202, 90, Petro-Hunt, Antelope 2B-28HS, Divide County,

- 35121, n/d, XTO, Prairie Federal 31X-30A, McKenzie County,

- 35123, n/d, XTO, Prairie Federal 31X-30B, McKenzie County,

*************************

Rock Climbing

For The Archives -- Second Reading GDP -- 2Q23

Locator: 45509ECON.

For those who are asking, this is in line with what GDPNow was estimating in "real time" back in that quarter.

Currently, GDPNow is estimating 5% for 3Q23.

The 2% for 2Q23 and 5% for 3Q23 suggests that we're probably not going to see a recession in 2023.

But everyone agrees that we will see a recession in 2024. Okay.

***********************

Obama And Wetlands

*********************

The Book Club

On J. D. Salinger. Link here.

Hearing Dockets -- September, 2023 -- IN PROGRESS

Locator: 45508B.

Thursday 09/28/23

Wednesday 09/27/23

September, 2023, hearing dockets posted, link here.

Link here. Won't load on Firefox. Use Safari or some other browser.

The NDIC hearing dockets are tracked here.

The usual disclaimer applies. As usual this is done very quickly and using shorthand for my benefit. There will be factual and typographical errors on this page. Do not quote me on any of this. It's for my personal use to help me better understand the Bakken. Do not read it. If you do happen to read it, do not make any investment, financial, job, relationship, or travel plans based on anything you read here or think you may have read here. If this stuff is important to you, and I doubt that it is, but if it is, go to the source.

These are cases, not permits.

Wednesday

September 27, 2023

8 pages

Cases, not permits:

- 30391, KODA Resources, five wells on each of two 1920-acre units;

- 30392, KODA Resources, five wells on each of three 1920-acre units; five wells on each of three 1920-acre units;

- 30393, KODA Resources, five wells one off four 1920-acre units

- 30394, KODA Resources,

- 30395, EOG,

- 30396, three wells on an existing 2560-acre unit

- 30397, Grayson Mill, four wells on each of two 1920-acre units

- 30398, NDIC

- 30399, Grayson Mill, twelve wells on a 1280-acre unit

- 30400, Grayson Mill,

- 30401, Dakota Energy, four wells on a 1920-acre unit

- 30402, Iron Oil Operating, pooling;

- 30403, Iron Oil Operating, pooling;

- 30404, EOG, pooling,

- 30405, EOG, pooling,

- 30406, EOG, pooling,

- 30407, EOG, pooling,

- 30408, Grayson Mill, pooling,

- 30409, Grahson Mill, pooling,

- 30410, Grayson Mill, pooling,

- 30411, Grayson Mill, ten wells on an existing 1280-acre unit;

- 30412, Crescent Point, commingling,

- 30413, KODA Resources, SWD,

- 30414, KODA Resources, SWD,

Wednesday

September 27, 2023

15 pages

Cases, not permits:

- 30330, Hess,

- 30331, Hess,

- 30332, Whiting,

- 30333, Grayson Mill, commingling

- 30334, Foundation Energy Management, a recomplete

- 30335, Foundation Energy Management, a recomplete

- 30336, Phoenix, five wells on aa 1920-acre unit

- 30337, Phoenix, five wells on aa 1920-acre unit

- 30338, CLR, five wells on aa 1920-acre unit

- 30339, CLR,

- 30340, CLR,

- 30341, CLR, five wells on a 1920-acre unit

- 30342, CLR, five wells on a 1920-acre unit

- 30343, CLR, five wells on a 1920-acre unit

- 30344, CLR,

- 30345, CLR,

- 30346, CLR,

- 30347, CLR, four wells on a 1920-acre unit

- 30348, CLR, four wells on a 1920-acre unit

- 30349, CLR,

- 30350, CLR,

- 30351, CLR,

- 30352, CLR,

- 30353, CLR,

- 30354, Kraken, commingling,

- 30355, Hess, pooling,

- 30356, Hess, pooling,

- 30357, Hess, seven wells on a 1280-acre unit;

- 30358, Hess, twelve wells on a 1280-acre unit;

- 30359, Hess, twelve wells on a 1280-acre unit;

- 30360, Grayson Mill, pooling,

- 30361, Grayson Mill, pooling,

- 30362, Grayson Mill, pooling,

- 30363, Grayson Mill, pooling,

- 30364, Oasis, pooling,

- 30365, Oasis, commingling,

- 30366, Oasis, four wells on a 1920-acre unit

- 30367, Petro-Hunt, pooling,

- 30368, Whiting, eight wells on a a 1920-acre unit

- 30369, Whiting, pooling,

- 30370, Whiting, pooling,

- 30371, Whiting, pooling,

- 30372, Whiting, commingling,

- 30373, BR, commingling,

- 30374, Hess, SWD,

- 30375, Phoenix, SWD,

- 30376, CLR, six wells on a 1280-acre unit;

- 30377, CLR, pooling,

- 30378, CLR, pooling,

- 30379, CLR, pooing,

- 30380, CLR, pooling,

- 30381, CLR, pooling,

- 30382, CLR, pooling,

- 30383, CLR, pooling,

- 30384, CLR, pooling,

- 30385, CLR, pooling,

- 30386, CLR, pooling,

- 30387, CLR, pooling,

- 30388, CLR, pooling,

- 30389, CLR, pooling,

- 30390, CLR, pooling,

Early Cases For October, 2023, Released

Locator: 45507B.

October hearing dockets posted, link here.

Link here. Won't load on Firefox. Use Safari or some other browser.

The NDIC hearing dockets are tracked here.

The usual disclaimer applies. As usual this is done very quickly and using shorthand for my benefit. There will be factual and typographical errors on this page. Do not quote me on any of this. It's for my personal use to help me better understand the Bakken. Do not read it. If you do happen to read it, do not make any investment, financial, job, relationship, or travel plans based on anything you read here or think you may have read here. If this stuff is important to you, and I doubt that it is, but if it is, go to the source.

These are cases, not permits.Early cases for October, 2023:

Tuesday 10/10/23 Supplement

Tuesday 10/10/23

Monday 10/09/23 Supplement

Monday 10/09/23

Results Of A Study On The Halo Effect In The Bakken Released -- August 30, 2023

Locator: 45506B.

Yes, there is something different about the Bakken compared to other shale plays.

Much more at the link.

Maybe more on this later, perhaps.

Monthly Utility Bill -- August, 2023

Locator: 45505TX.

Everyone has heard:- how hot it's been in Texas;

- how the grid may not hold;

- how expensive Texas electricity is.

Weekly Petroleum Report -- There's Still So Much Oil Sloshing Around -- August 30, 2023

Locator: 45504B.

Hurricane: WTI has given back all its gains from overnight. With regard to oil sector, this hurricane was a nothing burger but Weather Channel certainly got mileage out of it.

Earlier today, the WPR was released. The huge draw was due to refiners stocking their storage tanks in anticipation of a possible hit on oil deliveries following the storm.

- huge draw; five times what was expected; crude oil in storage declined by a whopping 10.6 million bbls; at 422.9 million bbls, US crude oil in storage is only 3% below the five-year average; the market is unconcerned;

- imports averaged 6.6 million bbls last week; decreased by 316,0000 bpd but still 12.1% more than the same four-week period last year

- refiners operating at 93.3% of their capacity

- distillate inventories increased by 1.2 million bbls but still remain 15% below the five-year average; again, nothing about which to be alarmed;

- jet fuel supplied was up 0.8% compared with same four-week period last year.

Energy Vs Tech: August 30, 2023

Locator: 45503B.

Updates

CMCSA up 32% so far this year; ATT down 20% or something like that. Flashed on the CNBC screen.

Later, 8:35 p.m. CT: of the ten semi-conductors tracked by CNBC this morning, seven are down. Two (Micron, TSM) are up slightly and NVDA continues to surge. Both AMD and INTC are down. AMD has a lot riding on their new chip. AAPL, not one of the ten, is also up a bit.

Original Post

Energy: I thought energy was the best performing sector so far this year. Liz is raining on my parade.

Let's check two ETFs, six months and one year:

Hurricane Hitting Landfall -- August 30, 2023

Locator: 45502B.

Hurricane: eye of the storm just about to hit the coast. Link here. First video on CNBC this morning, out of Gainesville: absolutely quiet. No rain, slight wind. But videojournalist says to keep watching his reports and CNBC because it's going to get so much worse. So much worse. He was upset to see folks out and about driving their cars. Peter Zeihan comes close to calling this storm a "nothing burger."

Apple:

- Apple, Qualcom and Globalstar;

- Globalstar up 23% yesterday; 11% today; for a stock selling less than $2.00

- Apple's iPhone 15 looks like a bargain -- Barron's.

- newest iPhone only $70 more than original iPhone, adjusted for infation.

Lego: sales increase while other toy makers struggle. Link here.

NVDA: funds punished for owning too few shares NVDA. Link here.

- BRK was one of them.

- so many story lines here.

Energy: five energy stocks with great dividends. The usual suspects, including KMI.

Chips: stocks are surging; why they might just be getting started. Link here.

HP: down 8%.

Say what? ND ANG, Hector Field, Fargo, soon to be home to a hypersonic missile data processing center for the US military. Another huge data processing center in North Dakota. Think Nvidia blades. More information needed. Link here. Direct to Bismarck Tribune story here.

Sky Range does not involve flights in local airspace. The U.S. Defense Department tests hypersonic vehicles in airspace over the open ocean. Unmanned aircraft operated from Grand Sky, adjacent to Grand Forks Air Force Base, will collect data from these tests, and the data will be processed in Fargo.

Hypersonic missiles travel from 1-5 miles per second, or between five and 25 times the speed of sound, and they’re a weapon that America’s adversaries, such as China and Russia, are also trying to develop, Hoeven said.

Bonds: readers know my stance on bonds. No way do I understand bonds better than the banks. Here's how the Bank of England is doing:

- Bank of England will face major losses on its bond purchases -- and it's set to get much worse.

TRICARE: cost-shares update.

- copayment;

- cost-share;

- annual deductible.

*****************************

Back to the Bakken

WTI: $81.68.

Friday, September 1, 2023: 53 for the month; 255 for the quarter, 500 for the year

37935, conf, BR, Boxer 3B MBH,

Thursday, August 31, 202: 52 for the month; 254 for the quarter, 499 for the year

None.

Wednesday, August 30, 2023: 52 for the month; 254 for the quarter, 499 for the year

None.

RBN Energy: MVP optimism spurs Williams / Transco Gas midstream expansions, part 2. Archived.

It took an “Act of Congress” and a decision from the highest court in the land — handed down by the Chief Justice no less — but it’s looking more and more like Mountain Valley Pipeline (MVP) will be completed as early as by the end of this year, opening up 2 Bcf/d of new takeaway capacity for the increasingly pipeline-constrained Appalachian gas supply basin. That’s shifted the industry’s gaze to bottlenecks downstream of where the bulk of the volumes flowing on the new pipeline will land — on the doorstep of Williams’s Transco Pipeline in southern Virginia. A number of midstream expansions have been announced to capture the influx of natural gas supply from MVP and shuttle it to downstream markets in the Mid-Atlantic and Southeast regions, and indications are that more will be announced and greenlighted in the coming months. These projects will be key to both enabling gas production growth in the Appalachia basin as well as meeting growing gas demand in the premium markets lying on the other side of the constraints. In today’s RBN blog, we delve into the details and timing of the announced expansion projects vying to increase market access to MVP supply.

In Part 1, we provided the latest developments on MVP, which, along with the growing demand for gas-fired generation in the Mid-Atlantic and Southeast, is the impetus for the other midstream projects we’ll dive into today. The biggest news, of course, is that the long-sought pipeline looks like it is finally happening. There are three main events that shifted the odds in favor of MVP in recent months just as it was looking like it would languish under the weight of endless legal battles. The first was the Fiscal Responsibility Act of 2023 (FRA), which was signed into law in early June and included a rare mandate from Congress to permit and complete MVP. As we detailed in Rescue Me, the provision stripped the U.S. Fourth Circuit Court of Appeals of jurisdiction, prohibited any further challenges to the state and federal permits, and, for those wanting to challenge the FRA provision itself, it restricted jurisdiction to the DC Circuit Court. The second was the Supreme Court decision to grant MVP’s emergency appeal and negate the Fourth Circuit’s ruling to stay construction even after the FRA was signed. And finally, the third was the lower court’s decision to dismiss pending petitions against MVP given the FRA took away its jurisdiction to hear them.