Locator: 44838B.

North Texas / DFW: an incredible evening! On a scale of one to ten, an eleven. No wind. Minimal cloud cover; pink sky in the west. 77°F right now. On the patio / balcony. Listening to folks in the pool.

Focus on fracking: pending.

For me, stories I'm watching:

- the market: will it hold after the 700-point surge in the Dow to close out May, 2023

- tonight, futures look good

- oil: where is it headed? Tonight, looking good.

- Saudi makes unexpected announcement

- Tesla?

- Apple: WWDC -- keynote speech -- tomorrow, Monday, noon, CDT.

- AAPL: closed after reaching an all-time high last week;

- watch to see if AAPL trends toward $185 or falls back to $170

WTI:

What's the "next big thing"?

Trending on my twitter feed tonight: link here. This speaks volumes. From The Bismarck Tribune. I knew the "number" would be high but I did not expect 80%! Quick: name the outlier: Walmart, Target, Bud.

Huge surprise. Early reports apparently were wrong.

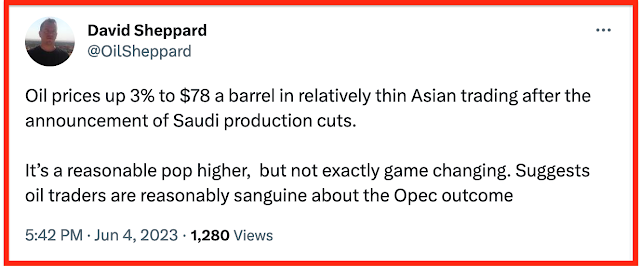

- I said earlier that OPEC+ had caved. Saudi Arabia, apparently did not cave. Will unilaterally cut?

Playing hardball, link here:

From the linked article:

Saudi Arabia said Sunday it would cut 1 million barrels of oil a day as part of a deal between OPEC and its allies after one of the most contentious production meetings in recent years amid concerns over slowing global energy demand.

Saudi Arabia said the output cut was for July and on top of previously announced curbs, which would be extended until the end of 2024. The United Arab Emirates and some other large producers also extended their previously announced cuts.

The Saudi announcement came soon after the Organization of the Petroleum Exporting Countries and its Russia-led allies said the group had agreed to stick to current production targets until the end of the year. Each member of the cartel, called OPEC+, is allotted a production quota, but sometimes members don’t hit that level.

A production cut of as much as 1 million barrels a day was on the table, delegates had said ahead of Sunday’s meeting. The broader 23-member group accounts for close to half of the world’s oil output. A cut in production was expected to prop up crude prices amid concerns that a slowing global economy would crimp energy demand.

More:

Hog wash: debt ceiling bill, link here. Oh, give me a break. With the DOD going woke, the department has bigger problems than a cap on spending.One word: Ukraine.

Sad story, link here.

************************

The Saudis

Playing hardball. Link here.

Today's one year view:

The five-year view is better and other time-spans also show how badly Saudi Arabia must be hurting.