Schools and Covid. Wow, our grandchildren are fortunate to live in a school district that has "handled" the Covid issue without the hysterics. It is amazing how well the school district is doing despite quite a surge in number of positive tests.

CNBC: there were (at least) four major business stories today, the last day before the three-day weekend.

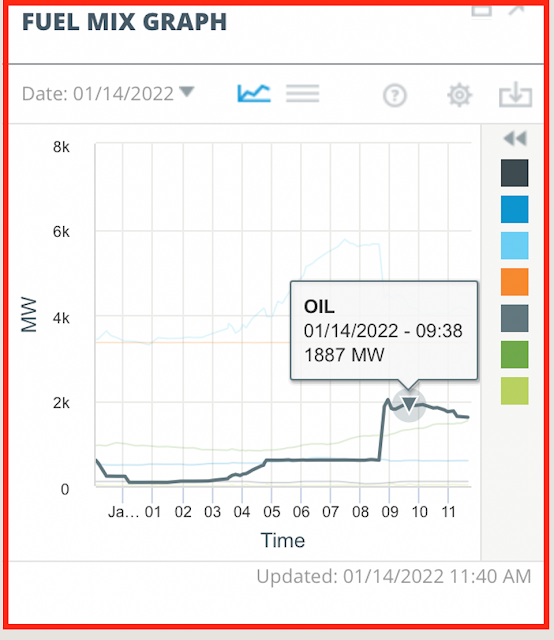

I didn't want much of CNBC today -- the weather was way too nice to stay inside -- but I watched enough to see that CNBC did not report on one of the top stories: the surge in the price of oil. Probably not a major business story today but certainly a minor story that needed some attention was Apple, Inc. And that was another company not covered at all.

CNBC isn't telling me so I will have to check another source, but it appears .... yes, there it is, WTI closed above $84 today and Brent closed above $86.

Peleton: gone from the NASDAQ. Wow. that's amazing. I did not even know the NASDAQ had listing requirements. LOL.Oh, that's it. Not the NASDAQ but the NASDAQ 100 -- Peloton will be replaced by Dominion Freightlines. But CNBC gave an analyst a lot of time arguing Peloton was at a "buy" point. Okay.

The story that is never discussed on CNBC is NE ISO which seems to be an incredibly big story. But when Boston is getting more electricity from burning oil than from renewables ... well, there seems to be a story there.

Is this the energy story to follow? Diesel. Apparently, according to Bloomberg, diesel prices are soaring around the world. Gee, I wonder why. I have a hunch. To the Bloomberg paywall.

Apple: is still looking for content. Wedbush is reporting that Apple is ready to spend billions on "live sports content." Numbers: willing to spend $7 billion annually; has $200 billion cash. Link here. Apple needs to negotiate the end of the "blackout" rule.

By the way, we're all watching and waiting for a "nor'eastern" to hit the East Coast this weekend. Already much of the eastern fringe of the midwest is already on a storm watch. The NFL playoff game in Buffalo, NY, will be one to watch. My hunch: it's postponed or moved to a new location.

Pickups: someday, I'm going to learn the preferred spelling. But for now, link here: rich people drive expensive cars. Really rich people drive pickups."

The F-150 is the most popular vehicle driven by millionaires. Most millionaires in America are self employed business owners — property owners, developers, plumbing & HVAC company owners. It’s a great truck and a business expense.

Netflix: will raise fees. Per household, the increase will not be noticed. We're talking a dollar or two per month. Households have a much bigger problem than price increase in Netflix: the price increase for electricity as more and more renewable energy comes on line.

Banks: one of the biggest "bank" stocks is Berkshire Hathaway. Apparently the US banks had a "bad" day on the market today; I didn't pay much attention. But BRK-B gained $2.87. Interesting, to say the least. I would not have expected that.

Inflation: more and more analysts suggest inflation is already peaking, which may explain why the banks apparently had a bad day today. Digging below the surface with regard to inflation suggests inflation is not exactly something about which I need to be worried. In fact, a moderate bit of inflation is very, very welcome. This has been discussed before.

Should we look at the Bakken oils?

- EOG: up $3.61 at the close. After hours, gaining more.

- HES: up $1.17.

- MNRL: up 3.5%.

- CLR: up almost 4%.

- ERF: up almost 5.5% at the close and gaining a bit more after hours.

- NOG: ditto; up almost 5% af the close and continued to gain a bit after hours.

Trainer refinery in Pennsylvania: whatever happened to that Delta refinery? It was a big story in the early days of the Bakken revolution. Well, glad you asked. That refinery operated at a profit for the second consecutive quarter as lower renewable fuel blending compliance costs supported refining operations. Think "jet fuel." Link here.

Enbridge: my favorite energy company? If not, it's on the top ten list. Enbridge announces that its hydrogen blending project is now operational, reducing the carbon footprint of natural gas delivery.

The project -- a joint venture between Enbridge and Cummins Inc -- serves the city of Markham, Ontario. Markham is the first big city northeast of Detroit, MI, about a four-hour drive through some incredibly beautiful country. Markham is directly across the lake, on the north share, from Niagara Falls. So, that's where the "falls" are. Never knew. It's not on my bucket list to ever visit -- I don't have a bucket list -- but if I'm ever in the Detroit area again, I will take a side trip to Markham.

Memories: decades ago I was hitchhiking across the US, from Williston, ND, to NYC, on my way to Europe for the summer. I hitchhiked without a map. SOP for males. I headed toward Detroit before I realized I was on the wrong "track." I stopped at a gas station to look at the map. Wow, was I disappointed. Had to back track a bit to get back below the lake and back toward Pennsylvania.

Nimble: is not a word that describes my investing ability. A while ago I bought a few shares of ARKK to diversity my portfolio, even though I was aware of some crazy talk from Cathie Wood. But, once ARKK turned south some days (weeks?) ago, I sold. I've never sold so fast. I sold before the end of the year as a tax-loss trade. Even so, my losses were minimal. But I learned a huge lesson: stick with my plan. Buying ARKK was never part of my plan. I got sucked in ...