Enbridge Line 5, Enbridge vs Michigan back in federal court. Link here.

Pages

Wednesday, December 15, 2021

Enbridge Pipeline Case Back In Federal Court -- December 15, 2021

Re-Posting -- US Implied Crude Oil Demand -- 23.191 Million BPD: December 15, 2021

From today's EIA weekly report as compiled by G. Staunovoa: implied demand. Link here.

****************************

For The Archives

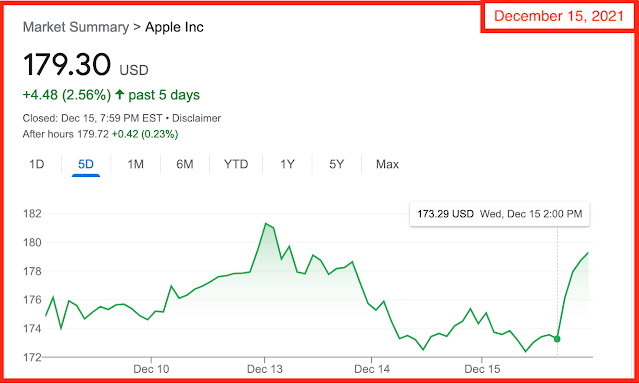

Wednesday, December 15, 2021, market close, AAPL.

A most-anticipated Federal Reserve announcement. See this note.

AAPL had been dropping for three consecutive days, and dropping quite significantly, though "significantly" is in the eye of the beholder.

At precisely 2:00 p.m. when the Fed released its announcement, AAPL started moving quickly, to the upside.

US Onshore Flaring: Lowest Level Since 2012; Six DUCs Reported As Completed; No New Permts But Fifteen Permits Renewed -- December 15, 2021

AMD/XLNX: is the deal dead? Link here. Best outcome now: the deal won't close before the end of the year but will eventually close. Worst outcome: deal won't close. That's fine. XLNX will do fine, long term.

Covid-19: it's baaaaccck. So much for all that optimistic talk about Covid being behind us. Not so fast. But again, the policies will be worse than the "disease." It looks like we're going to be seeing Brandon in his mask at all the DC Christmas parties.

Jim Cramer on Enbridge:

- dividend greater than 7%

- solar and carbon capture big part of their business

- interview with CEO

- incredible things said about environment and energy

- Cramer is excited about Enbridge

- pipeline challenges: there's going to be more pain before politicos willing to support pipelines

- natural gas is going to be a huge, huge deal in the Permian

- Enbridge is very, very well set up in the Permian to export LNG: locality (production); locality (terminals);

- has been in renewable energy for 20 years;

- comment: I know this very, very well; posted on the blog ten years ago about ENB getting into wind and solar farms in Canada; at the time, as an investor in ENB, I was not happy

- hydrogen projects, incubation projects

- Paris protocol: to be met CCS is critical; Enbridge positioned perfect for CCS

Do three of these four headlines not get you excited? The fourth is a non-story; I won't even click on it. From oilprice:

Note: I will post this again as a stand-alone but in the daily activity report below, there are certain things going on of which folks may not be aware:

- first and foremost: after telegraphing they were not interested in the Bakken any more now that they were in the Permian, EOG is getting quite active in the Bakken again;

- pad drilling is resulting in several DUCs being reported at the same time: those folks who suggest that the dropping number of DUCs is driving the production in the shale plays these days may be correct, but those folks are missing the bigger picture;

- CLR's reported IPs don't seem particularly great but reported IPs are very deceiving. Top three months -- production -- is of much more interest; so time will tell;

- CLR: in addition to aforementioned comment, even if the IPs are not as robust as we might help, for the investor / the owners, the money spent to drill and complete these wells is sunk costs; it's gone; it was spent six months to two years ago; now, that's history, and now we have free cash flow.

- twice as many active rigs year / year, going into winter months

- oh, I almost forgot, this does not show up in this post and I've not talked about it on the blog yet, but NOG announced a new dividend program rewarding owners of the company (anyone who owns shares, owns part of the company, often forgotten) -- this should remind folks we're in the manufacturing stage of the Bakken and not the boom; that's been true for several years but it seems some folks outside the Bakken don't understand that;

Santa Claus rally: I did not know this. I assumed the Santa Claus rally applies to market action between Thanksgiving and the end of the year. According to Jim Cramer, the Santa Claus rally does not traditionally / historically begin until later this week, around December 17th or slightly later.

Jim Cramer on Jay Powell: every investor should listen to Cramer's monologue on Jay Powell. Best I've heard from anyone on this one.

PFE: $50 billion in cash the past two years simply from vaccine sales. I think $50 billion is about one-four the amount of cash AAPL has. Fact-check necesito. That $50 billion is absolutely huge.

Flaring: US onshore flaring falls to lowest level since 2012 -- and this is with record amount of production, I assume.

- Onshore gas flaring in the U.S. has plummeted, falling to its lowest level since at least 2012.

- The most significant contributors to this steep decline were the Bakken and Permian plays.

- The contribution of privately-owned players to gas flaring totals has declined from a record high of 61.5% in April 2021 and sits at 52.3% as of September.

- “While the reduction in the Bakken was largely in line with expectations, based on our analysis of satellite data, the rate of change in the Permian is surprising. The decline in flaring activity across the board is a concrete sign that best practices are spreading beyond just large producers to small, privately-owned operators too, and this trend looks likely to continue in the foreseeable future,” says Artem Abramov, head of shale research at Rystad Energy.

*****************************

Back to the Bakken

Active rig report:

- NDIC reports 31 wells; I did not check for duplicates;

- one of the 31 wells is a SWD well; not oil and gas;

- Slawson with one rig

- Kraken not on the list but a reader says the Kraken rig is in Montana

Active rigs:

| $70.87 | 12/15/2021 | 12/15/2020 | 12/15/2019 | 12/15/2018 | 12/15/2017 |

|---|---|---|---|---|---|

| Active Rigs | 30 | 14 | 53 | 67 | 53 |

No new permits.

Fifteen permits renewed:

- Rimrock (9): Nosepress, Shifty, Amethyst, Citrine, Emerald, Ruby, Sapphire, Hammerhead, and Tiger, all in Dunn County;

- EOG (6): five Riverview permits in McKenzie County and one Burke permit in Mountrail County.

Six producing wells (DUCs) reported as completed:

- 37399, 1,374, CLR, Gale 8-32H1, Cedar Coulee, first production, --; t--; cum --;

- 38238, 1,600, CLR, Jenson 10-8H, Chimney Butte, first production, --; t--; cum --;

- 37374, 1,225, CLR, Gale 6-32H1, Cedar Coulee, first production, --; t--; cum --;

- 37400, 1,062, CLR, Gale 9-32H, Cedar Coulee, first production, --; t--; cum --;

- 36793, 1,359, Sinclair, Harris Federal 2-32H, Lone Butte, first production, --; t--; cum --;

- 38236, 584, CLR, Mittlestadt 10-17HSL1, Cedar Coulee, first production, --; t--; cum --;

Notes From All Over -- December 15, 2021

Stock picking:

- UBS named UPS the "2022 top stock pick."

Investing: unless the Fed really, really surprises me, I am thrilled with "everything" investing.

********************************

The Fed's Announcement

Disclaimer: done on the fly; not spell-checked; there will be typographical and content errors. Facts and opinions are interspersed; hard to tell the difference.

2:01 announcement: regardless of how the analysts see it and/or how the market reacts today, this was an incredibly dovish announcement. Investing? I'm all in.

2:05:

- Market reaction: none.

- moments later: Dow, which had been down, is now green, and solidly green

- Ten-year treasury: flat, at 1.475%. But CNBC anchor says TYT is surging, from 1.4whatever to 1.475%. But now, TYT is 1.460; now 1.467%.

- "Dots" yet to be posted.

- later: dots suggest -

- two or three rate hikes next year;

- two the following year

- Fed decision: anonymous.

- San (Rick Santelli): sees Jay Powell reacting to a "stagflation" environment.

- San: says the market has it right

- San: has the Fed just right with regard to tapering

- NASDAQ reaction will be the real signal:

- NASDAQ has gone from solidly negative to turning green.

- What am I going to look at? AAPL

- negative at the start of the day, has now turned green;

- negative at the start of the day, now up $2.26

- by the close, profit taking but that initial surge was very, very important to see;

- I just turned on CNBC at the announcement:

- talking heads generally seem a bit flummoxed

- trying to talk down the market, but,

- Melissa suggests we saw the "bottom" in the market this morning, but prior to the announcement

Likely:

- asset rotation, from high-flying meme stocks to solid stocks actually reporting profits

For all the hype: a "nothing burger" -- first glance, yet, but the fact that this is so dovish, and the market responded as such, this was huge.

Biggest problem the Fed has: the middle class can't take much more --

- Covid; high gasoline prices; house prices out of reach; hamburger doubling in price --

- can America's middle class actually handle higher interest rates. Wow. Think about that.

Next big question:

- is Fed only thinking about the dual mandate (inflation. job creation), or

- does the Fed have one eye on the equity market

- I don't think so. I don't think Jay Power is looking at the market when he makes his decision. At the end of the day, Jay Powell has an eye on the American middle class;

Steve Liesman saw the "silver bullet."

- I'm impressed. He got it exactly right. I'll come back to that later. Bullish, bullish, bullish. Irony: Liesman is generally bearish, bearish, bearish.

- The sentence that Liesman caught --

- The Fed will raise rates when the two targets are reached:

- inflation target has been reached, and was reached several months ago; that means the rates need to be increased, but ...

- the second of two mandates, unemployment was not meant. Powell says "we" are not yet at full employment and he won't raise rates until we are at full employment

- Powell did not define "full employment"

- in round numbers, there are about 10 million unfilled jobs in the US. Tell me again we are not at full employment.

- current unemployment rate: 4.2%

Definition of "full employment."

Frederic Mishkin: former Fed governor --

- very critical of the current Fed;

- how he reads the decision today; remains disappointed.

- Says we already are at full employment

- calls this very expansionary (very dovish, in other words)

Tapering:

- The Fed is buying $120 billion in government backed bonds each month — $80 billion in Treasury debt and $40 billion in mortgage-backed securities. -- November 3, 2021.

- The Fed has been dropping that $120 billion "buy" by $15 billion each month.

- Today, the Fed said they will double that taper, to buying $30 billion LESS each month

$120 billion / $30 billion = four months.

********************************

Q&A

Definition of unemployment / full employment / maximum employment: a judgement call. Many factors go into defining maximum employment.

Rates: will not raise rates until tapering has concluded next March. Will not answer question: how long the hiatus between concluding the taper March, 2022) and the first fed rate.

In other words, no rate increase until at least 2Q22. Currently at a "zero-percent rate" it appears, a quarter-percent rise each quarter in CY22.

- 2Q22: 0.25%

- 3Q22: 0.50%

- 4Q22: 0.75%

While Q&A going on, TYT: 1.468%.

Market:

- tech is surging again

- NASDAQ after being down a couple hundred points today is now up 50 points

- PFE: up $2.87

- WTI moving up.

Jay Powell:

- avuncular

- able to speak clearly to the average American

- not speaking from an ivory tower

- reminds me a lot of Louis Rukeyser and his panelists back in the late 1990s and early 2000s

*********************************

Melissa: 4:00 P.M.

Wow, Melissa thinks this was a hawkish announcement.

Wow.

Talk about misreading the event.

Weekly EIA Petroleum Report -- December 15, 2021

Updates

Later, 7:22 p.m. CT: implied demand.

Original Post

EIA's weekly petroleum report, link here.

- US crude oil inventories decreased by a fairly significant amount, down 4.6 million bbls.

- US crude oil inventories now stand at 428.3 million bbls, still 7% below the five-year average.

- US crude oil imports were down by 28,000 bopd (yawn); over past four weeks, crude oil imports have averaged about 6.5 million bbl/day, 15.4% more than the same four-week period last year.

- refiners are operating at 89.8% of their operable capacity; essentially no movement in either direction;

- distillate fuel inventories decreased by 2.9 million bbls; still 9% below the five-year average;

- and, the all-important jet fuel supplied: up 27.3% compared with same four-week period last year

The big question: how low could jet fuel "supplied" drop? It looks like we are a headline away from the NFL announcing that certain games will be postponed, or canceled.

US crude oil in storage: it's been a long time since we've gone below 430 million bbls in storage --

A Reader Responds To The "Cambo" Situation -- December 15, 2021

This was posted earlier today:

Oil: wow, there's been a lot of twitter noise about Shell pulling out of the Cambo oil field. I wasn't going to talk about it; I think it's a non-story but then Platts posted this: the demise of the UK's Cambo oil project could prove a pivotal moment for the country's offshore industry blah, blah, blah .... am I missing something here? What is the Cambo project? From an operator in the Cambo:

The Cambo Field would help to reduce the volume of imports required to meet energy demand in the UK, by delivering up to 170 million barrels of oil equivalent during its 25-year operational life. Cambo would also provide a further 53.5 billion cubic feet of gas – enough to power 1.5 million homes for a year.

Comment: If I'm reading that correctly, "... up to 170 million boe during its 25-year operational life ...." isn't that like, seven million bbls a year. The Bakken produces in excess of seven million bbls a week.

In response to that posting, a reader replied to a question on Quoro with this reply:

Interesting, Shell was only a 30% partner.

I’m surprised by the lack of interest in oil and gas development anywhere in Europe (except Russia).

The mindless opposition to fracking, dependence on Russia and the idiotic pursuit of energy from intermittent, unreliable wind and even more incredible installation of solar in such a northern location is “surprising.” What’s the UK average solar capacity factor? 10? It’s 30 here in sunny Cali, and solar here is dumb enough.

The Cambo oil field may not have been economical until recently (tough isolated environment and not huge). But in the new era, starting right now it is economical with permanent high energy prices. Remember: the cost of production doesn’t determine price, it’s competition. Oil and gas no longer has to compete with affordable coal, and the “cheaper than fossil fuels wind and solar” are anything but "cheaper" when “backup” cost is honestly included.

How bad is the Scottish political situation for investing in energy resources that actually work?

nsenergy

The Cambo oil field was discovered by Hess Corporation in 2002 and appraised by four appraisal wells as of 2012.

Austrian oil and gas group OMV became the operator of Cambo by acquiring four licenses in West of Shetland, UK from Hess in March 2014.

Siccar Point Energy completed the acquisition of OMV’s North Sea assets in the UK in January 2017 and drilled the fifth and the final appraisal well 204/10a-5 on the Cambo field in 2018.

Location and reservoir details

The Cambo field is located in approximately 1,100m-deep North Se waters, approximately 125km northwest of the Shetland Islands, Scotland, UK.

Notes From All Over -- The Snarky Edition -- December 15, 2021

Updates

Later, 9:31 a.m. CT: this is pretty amazing. Note PFE below. I just checked on the other two --

- JNJ: turned green at the opening and is now just "barely" green;

- but Moderna? Up $11 / share. Yes, I agree. It was way oversold and is now up $11 / share, up about 4%.

- As noted below, this is not rocket science.

Original Post

Break, break: link here. You will still owe taxes on the transfer.

Philadelphia cream cheese: your cheesecake is going to get very, very expensive this year. Memo to self: get to Target now. Link here.

Oil: wow, there's been a lot of twitter noise about Shell pulling out of the Cambo oil field. I wasn't going to talk about it; I think it's a non-story but then Platts posted this: the demise of the UK's Cambo oil project could prove a pivotal moment for the country's offshore industry blah, blah, blah .... am I missing something here? What is the Cambo project? From an operator in the Cambo:

The Cambo Field would help to reduce the volume of imports required to meet energy demand in the UK, by delivering up to 170 million barrels of oil equivalent during its 25-year operational life. Cambo would also provide a further 53.5 billion cubic feet of gas – enough to power 1.5 million homes for a year.

Comment: If I'm reading that correctly, "... up to 170 million boe during its 25-year operational life ...." isn't that like, seven million bbls a year. The Bakken produces in excess of seven million bbls a week.

Open book test for investors: of the three Covid-19 vaccines out there, it's my impression its the Pfizer vaccine that is #1 among equals. Moderna has myocardial risks for younger individuals, and I haven't heard much about the JNJ vaccine. And today there's this headline: JNJ vaccine loses antibody protection against Omicron in lab.

Covid-19 vaccination rate, according to CDC, fully vaccinated, over the age of five years:

- Miami County, no mandate: 84.2%

- NYC County, very strict mandate: 83.3%

- Florida: 71%

- New York: 80%

Retail sales:

- no one is talking how hard the auto industry has been hit

- everyone seems to be forgetting how expensive the transition from ICE to EVs

- November retail sales miss forecasts by a country mile, as they say

- my hunch: December retail sales will be huge

- on another note: in brick and mortar department stores, sales are incredible -- not "sales" but "sales" as in 50% off "sales."

- our go-to store? Southern jewel, Belk.

- The "holiday sales" are incredible. It's hard to find anything that is not at least 50% off many days, and then when you get to cashier, another 20% is taken off at point of sale. We're finding bargains much, much better than what we're finding on Amazon

************************************

Soccer Relief

"Club soccer" is over for the season. The team is "off" until February, 2022 ... unless Olivia's team's coach elects to have the team play in the Dallas Cup.

On the other hand, hgh school soccer continues. Olivia was one of three freshmen that made the varsity team last year and, of the three, we've always thought -- biased as we are -- she was #1 among equals.

The high school varsity soccer teams are now scrimmaging against area teams. Last night, Olivia was elated. There's a back story here which I cannot post, but Olivia was selected, as a sophomore to start, and, to be moved to the front on the field, where she was to be the offensive scorer for her team!

Last night, with that in mind, her team won! And Olivia scored a goal.

And, on top of that, the goal Olivia made was a very, very good goal -- according to unbiased accounts. LOL.

s/a bragging grandfather.