During the past couple of years, I have been surprised to see how many times I've seen Tennessee among the stop ten states for working, retiring, starting a business, etc.

As an example, the CNBC poll, "America's top states for business, 2021," posted July 13, 2021, Tennessee is ranked #5, right below Texas. Link here.

In the graphic above, the first column seems to be the most important variable. Among the top ten, Ohio was #2 when looking at the cost of doing business. What state was #1? #3?

Cost of doing business:

1. Oklahoma (#32 overall -- wow, what a disconnect)

2. Ohio.

3. Louisiana (#44 overall -- another huge disconnect)

4. Arkansas (#43 overall -- ditto)

5. Missouri (#25 overall)

Tennessee was a very, very respectable #8.

North Dakota was ranked #18 overall and also #18 for cost of doing business.

I was curious, and that's why I looked it up, when I saw that Smith and Wesson, after 170 years in Springfield, MA, announced it is moving lock, stock, and barrel (no pun intended, but truly perfect) to eastern Tennessee, specifically Maryville, TN, a suburb of Knoxville.

This is an incredibly beautiful part of the country, not just Tennessee. It includes Pigeon Forge.

Smith and Wesson Brands Inc is publicly traded, ticker symbol, SWBI.

- market cap: $1 billion

- operating cash flow: $340 million

- levered free cash flow: $350 million

My only question: why did it take so long for Smith and Wesson to make this decision? It certainly is not going to be particularly expensive to move.

Smith and Wesson says the project will cost $125 million and will create 750 new jobs.

Corporate tax rate:

- Massachusetts: 8%?

- Tennessee: 6.5%

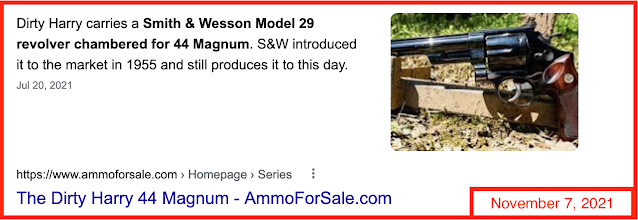

Did Dirty Harry carry a Smith and Wesson?

For all my European readers who have never seen a Smith and Wesson:

******************************

A Musical Interlude