Pages

Tuesday, November 2, 2021

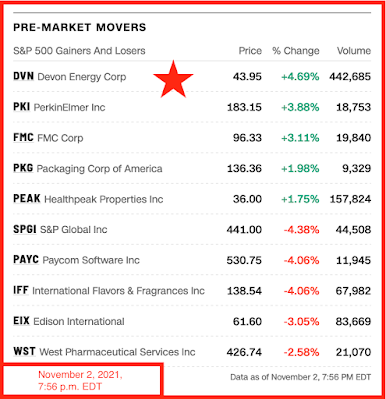

Devon -- Whoo-Hoo -- November 2, 2021

See this note from August 7, 2021. Over the course of 10+ years of blogging, I have posted, perhaps, five or six posts of which I'm really proud. That note of August 7, 2021, on Devon was one of them. My original note on Netflix was another one, but I digress.

I was on vacation on Flathead Lake, Montana, when I wrote that note on Devon. I had lots and lots of time to reflect.

Folks following Devon know it's had a good run. But I about fell off my chair when I saw this tonight over on CNN Business pre-market movers. Of the thousands of ticker symbols, who wudda guessed that Devon would have been at the very top! Just a few months later! Whoo-hoo!

Active Rigs In North Dakota -- November 2, 2021

Error on NDIC spreadsheet?

- NDIC shows 34 active rigs but the NDIC spreadsheet lists #37014 twice.

- if that's an error, then there should be only 33 active rigs, not 34.

Active rigs:

| $83.91 | 11/2/2021 | 11/02/2020 | 11/02/2019 | 11/02/2018 | 11/02/2017 |

|---|---|---|---|---|---|

| Active Rigs | 33 | 14 | 57 | 68 | 55 |

Note: in a long list like this there will be content and typographical errors. If this important to you, go to the source.

The operators:

- CLR: 10

- Hess: 4

- MRO: 3

- Oasis: 2

- Whiting: 2

- Others with one each: 12 -- Slawson, Enerplus, Petroshale, Kraken, Bowline (Nine Point Energy), Hunt Oil, KODA, Sinclair, Ovintiv (Newfield, Encana), Iron Oil Operating, True, Crescent Point Energy;

The rigs

- key:

- blue: rig off site since last update

- red: new site

- black: no change

- CLR, #38147, Flint Chips FIU 12-5H, Dunn,

- CLR, #38358, Dolezal FIU 7-5H, Dunn,

- CLR, #38496, Whitman FIU 9-34H2, Dunn,

- CLR, #38526, Thorp Federal 9-28HSL1, Dunn,

- CLR, #38613, Whitman 4-34H1, Dunn,

- CLR, #37908, Charolais South Federal 10-10H, McKenzie,

CLR, #37907, Charolais South Federal 9-10H1, McKenzie, - CLR, 37001, LCU Reckitt Federal 6-22H, Williams,

- CLR, #37002, LCU Reckett Federal 5-22H1, Williams,

- CLR, #37013, LCU Ralph 4-7H, Williams,

- CLR, #37014, LCU Ralph 3-27H1, Williams,

- CLR, 38293, Springfield 11-8HSL, Williams,

- Hess, #37141, BW-Rolfson-151-98-2116H-6, McKenzie,

- Hess, #38176, AN-Norby-LE-152-94-0409H-1, McKenzie,

- Hess, #37145, BL-Olson-155-96-0310H-3, Williams,

- Hess, #38004, CA-E Burdick-155-95-2932H-7, Williams,

- Hess, #30262, EN-Madisyn-LE-154-94-0705H-4, Mountrail

- MRO, 38539, Eliza 21-18TFH, Dunn,

- MRO, 38573, Austin 11-18H, Dunn,

- MRO, #37996, Christoph 41-4H, Dunn,

- Oasis, #38336, Soto 5097 12-3 5B, McKenzie,

- Oasis, #38335, Soto 5097 12-3 4B, McKenzie,

- Oasis, #38381, Swenson Federal 51-97 43-35 3B, McKenzie,

- Whiting, #38409, Kannianen 11-5TFHU, Mountrail,

- Whiting, #37411, Miller 31-15-2H, Williams,

- Slawson, 38454, Rainmaker Federal 5-25-36TFH, Mountrail,

- Enerplus, #35493, FB Leviathan 151-94-27A-34-19T2, McKenzie,

- Petroshale, #36889, Clark Federal 2TFH, McKenzie,

- Kraken, #38558, Maddie LW 10-15-22 #1H, Williams,

- Bowline (Nine Point Energy), #37944, Missouri W 152-103-4-8-13H, Williams,

- Bowline (Nine Point Energy), #37943, Missouri W 152-103-4-9-8H, Williams,

- Hunt Oil, #38519, Halliday 146-93-24-36H 1, Dunn

- KODA, #37798, Stout 3427-3BH, Divide County

- Sinclair, #38493, Grassalnds Federal 14-15-1H, McKenzie

- Ovintiv (Newfield, Encana), 38546, Wisness State 152-96-16-21-5H, McKenzie,

- Iron Oil Operating, #38462, Antelope 2-17-20H, McKenzie

- True, #37495, Northeren State 31-36, McKenzie

- Crescent Point Energy, #38557, CPEUSC Pankake 2-6-7-157N-99W-MBH-LL,

One New Permit; Stock Market On A Tear -- What A Great Country -- My Favorite Chart -- The Roaring 20s -- 33 Active Rigs -- November 2, 2021

To infinity and beyond. BED, BATH, AND BEYOND! Surges after hours. Up 65% after hours. $16.75 at the close; after-hours, up $11, trading at $28.

Avis, of course, did a whole lot better. Doubled today. No explanation but two thoughts by others (not me):

- short squeeze; and,

- Tesla connection.

My favorite chart:

The markets: record close for all three major indices and a huge close for the small-cap stocks, the Russell 2000. So explain this: don't fight the Fed, and yet, tomorrow everyone expects the Fed to announce the beginning of "the taper." It may be "don't fight the Fed" but right now it's all about earnings.

Pfizer: vaccine "approved" for "5-to-11-year-olds." PFE up after hours, but more interesting: "work-from-home" stocks are getting crushed. This might be a "leading indicator." Movers and shakers know that not only is the delta surge over, but there's no way the government will ever shut down the economy again. Period. Dot.

The Great Gatsby

Covid-19: local school district (both very large districts)

- elementary school: not one positive case in past three weeks (knock on wood)

- my hunch: most won't get their kids vaccinated

- high school: averaging about four new cases among students; and one staff member every two weeks.

CNBC: anyone who can take on Steve Liesman knows his/her stuff -- Melissa Lee is able to take on Liesman; she knows her stuff. Best three hours on CNBC: the calm Jim Cramer, David Faber, and Carl Quintanilla, 8:00 - 9:00 a.m. CT; the stock-picking panel with Melissa Lee, 4:00 - 5:00 a.m. CT; and, the manic Jim Cramer, but only from 5:00 - 5:10 p.m. CT.

DWAC: up almost 7% for the day; up $4.14; closed at $64.96.

ISO NE: $80 right now.

Lyft: Lyft surges after hours. Average revenue per rider -- $43. Ouch. I took Uber from PDX to our daughter's house on two occasions. Without an additional $10 tip which I paid for each trip, the first time the Uber ride cose $40; the second time $50. Very convenient. Very nice. Very expensive. Now, I take MAX or TriMet or Light Rail, whatever they call it. $2.50 for a 2.5-hour ticket, and then my daughter told me the "honored citizen" ticket costs $1.25 for the same 2.5-hour ticket. So, now the $50-trip costs me $1.25.

Zillow ads; I don't watch much network television any more, but a fair amount of cable networks and last month the Zillow ads dominated. So I don't know if others noted also, but last month Zillow commercials were shown incessantly throughout the day, over and over and over. This week: zero. None. I haven't seen one Zillow ad. Oh, that's right: Zillow is shutting down its home-buying unit.

Louisiana: leading America's LNG boom. FWIW.

******************************

Back to the Bakken

Active rigs, see updated list here:

| $83.91 | 11/2/2021 | 11/02/2020 | 11/02/2019 | 11/02/2018 | 11/02/2017 |

|---|---|---|---|---|---|

| Active Rigs | 33 | 14 | 57 | 68 | 55 |

Two operators each add one rig each:

- True Oil

- Crescent Point Energy

One new permit, #38633:

- Operator: Sinclair Oil & Gas

- Field: Lone Butte (McKenzie)

- Comments:

- Sinclair has a permit for a Grasslands Federal well in NESW 13-147-98, to be sited 1882 FSL and 2307 FWL

Three permits renewed:

- MRO (2): a Levi USA and a Kottke USa permit, both in Dunn County;

- Enerplus: an FB Leviathan permit in McKenzie County

Avis And Protein -- November 2, 2021

Avis earnings. You have to look at Avis -- it will blow your socks off. Shares doubled today. Was even higher before it pulled back. Avis sold for less than $7 during the year of the plague (2020); today, selling at $400.

I will leave you with this, the link sent to me by a reader.

*******************************

Protein

Store-bought rotisserie chicken:

- $4.99 - $8.99 per chicken

Chicken:

- 2020: $1.13 / lb

- 2021: $1.80 / lb

Salmon:

- least expensive price I can find at local grocers: $9.99 / lb; sometime on sale, down to $6.99 / lb

Retail ground beef:

- around $4.50 / lb but varies widely

Brisket:

- around $4.50 / lb but varies widely

Turkey:

- locally, today, Target, Butterball: 99 cents / lb

Turkey, major grocery chains, 2020, last Thanksgiving:

- Albertsons: 89 cents / lb

- Aldi: as low as 69 cents / lb for Shady Brook frozen young turkeys

- Costco: 99 cents / lb (that was last year)

- Kroger: 37 cents / lb; as low as 29 cents / lb for frozen, whole Kroger Tender & Juicy young turkeys

- Sam's Club: $1.19 / lb

- Target, Butterball: 99 cents / lb

- Trader Joe's: $1.99 for Trader Joe's brands; $2.99 for kosher, store brand

- Walmart: 98 cents / lb Butterball, or as low as 68 cents / lb for other brands

I'm going to be home alone for Thanksgiving but at 69 cents / lb for protein -- Kroger -- I'm going to cook a turkey and then freeze in small, individual packages. This is almost a no-brainer.

Another Day, Another Record -- November 2, 2021

At the open: wow, wow, wow -- all three major indices set intra-day records. Again. "Transports" at record high.

Later, 8:42 a.m CT: wow, wow, wow. They're reading the blog. They just saw the P/Es (see below). After being negative in pre-market trading, and negative yesterday, AAPL is now up 0.84%; up $1.28; back over $150.

P/Es:

- AAPL: 26

- EOG: 28

- COP: 48

- HES: 134

- really?

Zero Hedge: Sent to me by reader. Says earnings estimates still too high for 2022. The article begins:

Fundamentally speaking, there are more than a few indications that 2022 earnings estimates are still overly exuberant. However, the bullish optimism currently supports rising stock prices.

“Overall, 56% of the companies in the S&P 500 have reported actual results for Q3 2021 to date. Of these companies, 82% have reported actual EPS above estimates, which is above the five-year average of 76%. If 82% is the final percentage for the quarter, it will mark with the fourth highest percentage of S&P 500 companies reporting a positive earnings surprise since FactSet began tracking this metric in 2008. In aggregate, companies are reporting earnings that are 10.3% above estimates, which is also above the five-year average of 8.4%.”

But then this:

Earnings have indeed been impressive, but as we will discuss in more detail, this quarter will likely mark the peak of growth for a while. One particular reason is that while the outlook for earnings remains very bullish, economic growth and inflation trends are not.

My reply:

I scanned the article but may have missed it. Author does not mention the $1.5 trillion infrastructure bill.If the supply chain issue is resolved by mid-2022, all bets are off.

Moments after writing that, Bob Pisani over at CNBC provided data points that corroborate my view: 2022 is going to be a blow-out year for investors.

Bob Pisani: companies are reporting record earnings and yet they are -- across the board -- telling us their earnings would have been even higher had it not been for supply chain issues. Wow. Think about that. One of two things will happen in 2022 regarding the supply chain:

- it will get better;

- it will get worse.

Both mean that companies will report even better earnings. It's counterintuitive. But I know I'm right. LOL.

But look at that ZeroHedge article again. This is simply incredible;

“Overall, 56% of the companies in the S&P 500 have reported actual results for Q3 2021 to date. Of these companies, 82% have reported actual EPS above estimates, which is above the five-year average of 76%. If 82% is the final percentage for the quarter, it will mark with the fourth highest percentage of S&P 500 companies reporting a positive earnings surprise since FactSet began tracking this metric in 2008. In aggregate, companies are reporting earnings that are 10.3% above estimates, which is also above the five-year average of 8.4%.”

*********************************

Social Comments Worth Reading

One Third Of US Navy's Sea Wolf-Class Attack Nuclear Fleet Disabled -- November 2, 2021

Tiramisu: Ado Campeol has died at the age of 93. He was the owner of Le Beccherie in the city of Treviso, northern Italy, where tiramisu is said to have been "invented" in 1969. Link here. Most interesting: this wonderful dessert was not "invented" in the 1800s but very, very recently -- by the way, 1969 was the best year ever for music.

Roth IRA vs traditional IRA: agree completely. Barron's. Link here.

Supply chain surcharge: Walmart is hiring "supply chain associates" for $20.37 on average. Link here. Watch for new "supply chain surcharge" on retail sales slips.

Internet satellites: will be launched by Amazon next year.

Submarine hit uncharted "seamount": investigation concludes re: USS Connecticut. Data points:

- South China Sea

- occurred October 2, 2021

- damage to the forward section of the submarine: ballast tanks damaged

- required a week-long voyage on the surface form the SCS to Guam; limited maintenance, repair options

- nuclear reactor and propulsion system not damaged

- personnel from the Puget Sound Naval Shipyard and submarine tender USS Emory S. Land (AS-39)

- USS Connecticut: one of three Sea Wolf-class attack nuclear boats that were developed for deep-water operations to take on Soviet submarines in the open ocean

Apple: as predicted. iMac Pro coming in 2022 with M1 Pro / Max chips. Link here. And, yes, I will upgrade.

Apple: cuts iPad production by as much as 50% to meet iPhone 13 demand.

Divergence: finally, it appears the share price of oil companies is "disconnecting" from the daily ups and downs of the price of WTI. And to the good side.

Advertising: I've been asking the same question for years -- if demand exceeds supply, why advertise? Or at least, why not cut back on advertising? Or, perhaps, better targeting? Link to The WSJ.

Propane: US propane prices start winter heating season at 10-year high. Link to Charles Kennedy.

Most bizarre: why the Canadians keep voting this guy in office? Trudeau announces he will cap Canadian heavy oil emissions. I guess they all know he's joking. Link here.

******************************

Back to the Bakken

WTI: $83.70

Active rigs:

| $83.70 | 11/2/2021 | 11/02/2020 | 11/02/2019 | 11/02/2018 | 11/02/2017 |

|---|---|---|---|---|---|

| Active Rigs | 31 | 14 | 57 | 68 | 55 |

No wells coming off confidential list today or tomorrow.

RBN Energy: who certifies responsibly sourced natural gas, part 3.

In the past few months, there’s been a flurry of interest in certified responsibly sourced gas (RSG). RSG is natural gas — it still comes out of wells in the Marcellus, Haynesville, Permian, and other U.S. production areas. What distinguishes RSG is that its producers and pipeline companies have made efforts to significantly reduce the greenhouse gases — mostly methane — that are needlessly emitted along the value chain, and that an independent and respected outsider has certified the success of these efforts. RSG is still new to a lot of folks, including those in the natural gas business, so it’s reasonable to ask, who does the certifying, and what are the differences between them? In today’s RBN blog, we continue our series on RSG with a look at the different approaches taken by RSG certifiers: Project Canary and MiQ.

According to the International Energy Agency (IEA), emissions of methane (CH4) from the livestock industry, the oil and gas sector, and other human-related activity is responsible for about 30% of the global rise in temperature in the modern era. IEA also has claimed that it is technically feasible to prevent more than 70% of current CH4 emissions from oil and gas operations, and that about 45% of methane emissions could be avoided at no net cost because the value of the captured gas is higher than the cost of the abatement measures.

The Global Methane Pledge promoted by the U.S., the European Union (EU), and several other countries — sure to be a major topic at the United Nations Climate Change Conference (COP26) in Glasgow, Scotland, over the next few days — calls for reducing global methane emissions by at least 30% from 2020 levels by 2030 and ramping up the use of “best available inventory methodologies” to quantify CH4 emissions, with a particular focus on high emission sources like oil and gas production and pipelines. Also, the Biden administration will soon release new draft regulations focused on reducing methane emissions from these same sources, and Congress has been considering aggressive efforts to plug and remediate abandoned oil and gas wells and coal mines, again with the aim of minimizing emissions of CH4.

Ports Of Los Angeles, Long Beach -- Getting Worse, Not Better -- November 2, 2021

Before we get to that, the ports of Los Angeles, look at this: Sue Herera was back in the CNBC studio this morning -- about 9:30 a.m. CT -- with the regularly scheduled news break. Wow, so nice to see her back. She was given a big "retirement" send-off back in February, 2021 -- but apparently she will come back periodically. Here's that "send-off."

Now, back to the LA ports story.

Watch for CNBC transcript later today.

Something like 73 container ships still anchored off-shore. In other words, no movement since "the Biden speech."

"Let's go, Brandon."

Spokesperson for the port, with the "new" solution. Part of the reason for the backlog is that the port has no space for any more containers. No more space for any more containers.The port is now going to simply move those tens of thousands -- was it around 87,000 containers? -- off to the side, forget about them, and get to them when they can. These are not empty containers; they are full. They are simply containers with "stuff" the port authority feels are not particularly time-sensitive. For example, those containers with products destined for Halloween outlets ... well Halloween is over. There's no longer any need to get those "Halloween" containers to their destinations. Wow. Pretty soon Thanksgiving will be over.

One wonders who decides what containers are no longer time-sensitive or were never time-sensitive to begin with. But that's what they plan on doing. Simply move tens of thousands of filled containers and getting to them when they get to them.

Apparently the cut-off point is nine days. Containers that have been on the docks for more than nine days and not deemed "important" will be moved to the side and "forgotten."

Rumor: buyers for Dollar Store, Dollar Tree, 99 Cent are swarming to the southern California docks.

Also, you may have heard that some companies -- like Walmart? -- are buying / renting their own container ships. Doesn't help. The newcomers have no reservations and will fall in line well behind the other 73 container ships already in line. Berth slots are by reservation only.

Breaking -- The Stock Market Edition -- November 2, 2021

Updates

At the open: wow, wow, wow -- all three major indices set intra-day records. Again.

Later, 8:42 a.m CT: wow, wow, wow. They're reading the blog. They just saw the P/Es (see below). AAPL is now up 0.84%; up $1.28; back over $150.

Original Post

DWAC: down yesterday; down a bit today in pre-market trading; trading around $60.

Note: this was done quickly and on the fly. Very little proofreading. In a long note like this, there will be typographical and content errors. If this is important to you, go to the source. Everything should be fact-checked. Facts, factoids, and opinions are interspersed; often hard to tell the difference. Pretty much click bait. This is not an investment site. It's for my benefit and if folks want to read it, that's fine with me but I would recommend they find more worthwhile things to do. I'm inappropriately exuberant about the US and about the Bakken, which is not mentioned on this page at all, except to say it's not mentioned on this page at all.

Earnings calendar: here and at sidebar at the right.

Tickers of interest:

- Lucid: drops over 5% in pre-market trading.

- COP: beats. Up slightly.

- PFE: beats; shares up 2.5%. here; and, here. Apparently the dollars from the vaccine are incredible. Shares now up 3.3% at the opening. White House says there will be another 15 million doses for kids next week (not sure what "brand").

- ZG:

- shares "dive" after analyst highlights two-thirds of homes "underwater";

- shares fall further after report Zillow will sell 7,000 homes for $2.8 billion

- $2.8 billion / 7,000 = average of $400,000

- PSX: Morningside -- recovery is underway with higher earnings, lower debt, simplifies with buyout of PSXP;

- XLNX: up 2% back on October 28, 2021, when earnings announced; yesterday, surged; was the smart money right about XLNX?

Warren Buffett's: words of advice -- best sectors to be in during periods of inflation. Click bait. Not sure who said what. Buffett, the writer of the article, or someone else. Very, very old school. Whoever said this, said it a long time ago, BC: before cryptocurrency. But for the record, these companies mentioned: Nike, Apple, Levi Strauss.

PSX: Morningside -- recovery is underway with higher earnings, lower debt; simplifies with buyout of PSXP.

ON Semiconductor: Morningside -- impressive 3Q21 boosts our confidence in the company's ability to achieve long-term targets; FVE to $48.

********************************

There are so many companies reporting today, it's going to be impossible to keep up.

Hertz / Tesla: not so fast. No contract signed. Elon Musk tweets exactly what I was thinking. He saw Hertz getting an "unfair" deal compared to his other customers. He says Hertz was going to buy these vehicles at a discount. Musk: "Hertz deal has zero effect on his company's finances."

I looked at only a few ticker symbols yesterday -- maybe more on that later -- but this morning, I checked almost everything that interests me and I think I'm ready to get on the sidelines through the rest of the year. And maybe more on that later, also. Don't know. It's sort of like, "how can things -- for investors -- get any better?"

P/Es:

- AAPL: 26

- EOG: 28

- COP: 48

- HES: 134

- really?

To report today, at the opening:

- COP: up 0.35%; up 26 cents; trading at $74.80;

- BKH: down 0.46%;

- CHK: down 0.33%;

- DVN: up 0.19%;

- ZG: down 5.03%;

- PFE: up 0.64%;

- ONEOK: down 0.17%

- STE: flat, up maybe 0.02%

******************************

Colorado Covid

Updates

November 7, 2021: governor declares emergency; "ration care" goes into effect." Graphics here.

Original Post

Covid-19: Colorado

- most interesting Covid-19 story yesterday that caught my eye

- Colorado: 80% vaccine rate

- but, look at this: "hospitals in Covid-19 crisis"

- data and graphics here; many observations can be made

- hospital system ready to begin rationing care; can't cope with the surge

- and why is this happening, according to the governor?

“It’s the 20% who haven’t been vaccinated that are filling up our hospital wards,” Polis said at a news briefing in Denver.

“We would have none of these hospital capacity issues, or orders would be operative, if everybody was vaccinated.”

“This is particularly tragic now because it’s essentially entirely preventable,” Polis said.

The state may soon ask the Federal Emergency Management Agency to a Colorado has one of the highest vaccination rates in the U.S. though hospital bed occupancy in both intensive care units and medical-surgical units has been averaging about 90% in recent weeks, officials have warned.

Nearby Idaho, a state with one of the lowest vaccination rates in the U.S., is actively rationing hospital care.

On Sunday, Polis issued an executive order to allow hospitals to turn away new patients. The state has also placed limits on cosmetic surgery and is shifting monoclonal antibody treatment for Covid-19 out of hospitals to mobile clinics.

Buffy the Covid-slayer hospitalized. Kristy Swanson in ambulance ride with Covid-19. Resume: anti-vax actress and vocal anti-vaxxer. Response here.

********************************

Hello, Darkness, My Old Friend

Hello, Darkness, The Graduate