The link is to the WSJ:

The operator of Canada’s largest crude oil refinery, Irving Oil Ltd., said it has stopped importing Bakken Shale oil from the U.S. in favor of cheaper crudes from such producers as Saudi Arabia, reflecting a shift in crude costs affecting East Coast refiners during a global slump in oil prices.

The closely held company’s 320,000-barrel-a-day refinery in Saint John, New Brunswick, one of the biggest by volume in North America, has reduced purchases of Bakken crude shipped by rail to zero from a high of nearly 100,000 barrels a day two years ago, Irving President Ian Whitcomb said in an interview on Thursday.

“We’re not importing any Bakken crude right now,” he said.

The move reflects shifting economics in the energy industry even as the price of oil—including Bakken crude—has slumped to six-year lows.

A once-yawning gap, between the cost of oil produced in North America and overseas crudes priced at the Brent global benchmark, has narrowed since 2013. Refiners on North America’s east coast can now import crude shipped by sea for less than the cost of shipping it by rail from shale oil producers in North Dakota and elsewhere in the U.S.Even if Saudi Arabia (OPEC) were to raise their prices, or cut production, there's nothing to prevent Saudi from unilaterally keeping prices low enough to undercut Bakken oil that would have otherwise been shipped to these East Coast refineries.

Unless I'm missing something, this is a very significant development.

Okay, that was my knee-jerk reaction.

After thinking about it while watching a) the middle granddaughter at soccer; and, then b) the oldest granddaughter at water polo, I realized this was probably just a minor speed bump in the big scheme of things. First of all, it's probably been going on for quite some time, and if Saudi wants to keep giving their oil away at $40 / bbl (that must have been the Bakken price) that's fine with me. For Saudi, they need $100 / bbl in current dollars and for them it's an existential issue. The Bakken isn't going to go away.

So, it's a headline story, but that's about it. This, too, shall pass. That which does not kill us, will make us stronger.

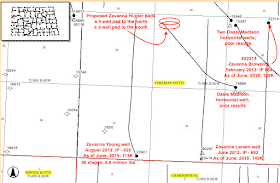

Seeing the new Zavanna permits put me in a great mood.