Top story of the week:

- Joe Biden is still president.

- Brent back to $70 (okay, $69 and change).

Top international non-energy story:

Top international energy story:

- To explore or not explore.

- World "turning against" oil companies.

Top national non-energy story:

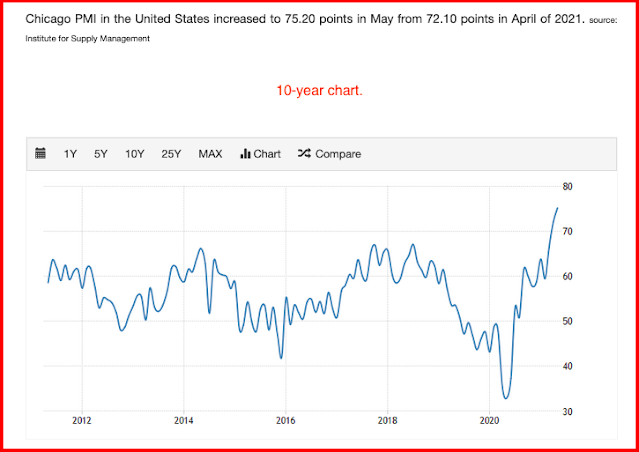

- PMI hits an all-time high?

- Covid-19 vaccination hesitancy continues to be a problem; and, here.

- Amazon acquires MGM catalogue.

- Fourteen percent increase in oil production month-over-month; and, here;

- Gasoline demand has a nice jump, but was it a one-off following the Colonial Pipeline shutdown?

- Cabot (Marcellus) and Cimarex (Permian) merge.

Top North Dakota non-energy story:

Top North Dakota energy story:

- Bakken production forecast to decline this summer.

- Quarterly lease sales reported.

- Record low number of wells coming off confidential list.

Geoff Simon's top North Dakota energy stories:

- Quick connects.

- Watford City airport work underway; runway expansion to be finished October 1, 2021

- $24 million project;

- replace the existing 4,400' foot runway with a new 5,800' runway

- comparison:

- Williston International Airport -- 7,510 feet x 150 ft

- Portland, OR (PDX): 11,000 feet x 150 ft

- DFW -- four runways

- longest (3): 13,400' long (required by former USAF pilots)

- shortest (1): 8,500' long (reserved for former US Navy pilots)

Operators:

- EOG with six new Liberty LR permits.

- EOG with first permits in the Bakken this calendar year.

- Whiting to add three Maki wells in the prolific Sanish.

- Slawson with additional permits in Big Bend.

- Scout Energy's Lodgepole Dinsdale just went over four million bbls crude oil cumulative.

- NP Resources to drill in the Bicentennial oil field.

- NP Resources to drill in Beaver Creek oil field.

- CLR proposed up to sixteen wells on one 2560-acre unit.

Operations:

- Petro-Hunt Charlson well with jump in production for the second time.

- Anticipating a halo effect southwest of Williston.

Fracking:

Pipelines:

- Capline pipeline reversal; DAPL implications?

- Has the requirement for a "revised" DAPL EIS become moot?

- North Dakota PSC approves Bridger pipeline.

- Response to the DAPL decision.

- Expansions continue apace.

Refineries:

Natural gas:

Bakken economy: