One would have to be living under the Geico Rock to not realize the surge in cost of commodities, lumber being particularly bad, but then platinum was mentioned yesterday. In fact, I think one can argue that every commodity seems to be surging in price.

Except one. [Actually two, but I'm going to ignore natural gas for now.]

Yes, the price of WTI has crept from $55 to $65 but it's been relatively orderly and not particularly alarming when it comes to historical surges in the price of oil.

That came to mind again today during the Buffett & Munger show (Berkshire Hathaway's annual meeting). I think it was Charlie Munger who mentioned it first -- the sudden surge in the price of commodities in general.

[By the way, when asked about "ESG" and Buffett opening a huge position in Chevron, Buffett said two things:

- he made no excuses for Chevron; he was very, very happy with Chevron; and,

- in fact, he said he would be happy owning the entire company.]

But relative to what we're seeing in lumber and in platinum, WTI seems to be a bargain. Here in north Texas, gasoline has gone from $2.09 / gallon to $2.59 / gallon in just the past few weeks but we've seen those price changes often over the years.

I mentioned the other day that pundits are suggesting the price of oil could rise significantly. Most notably, Goldman Sachs, $80 by the end of the year. Social media suggests GS was being too conservative; some see $80 by Labor Day.

And, then, of course this, which I first saw in The WSJ and now it's being reported by CNN.

By the way, predicting a shortage of anything almost guarantees that it will happen: folks will stock up if they perceive a coming shortage. Word to the wise if there might be regional and/or spot shortages of gasoline this summer: never let your car tank go below half full. If you are really concerned, don't let it drop below three-quarters full.

So, that flashed across my mind now and during the Buffett & Munger show.

I was going to post that regardless.

But look at this, just popped up on social media.

Patrick De Haan: "Boom."

Patrick De Haan: "Breaking. According to GasBuddy data, Friday US gasoline demand surged 5.8% from the prior Friday, 'barely' missing a new post-Covid Friday record by 0.48%."

The fly in the ointment: it looks like we're one step closer to moderating sanctions on Iran.

Irony:

- removing sanctions on Iran; but,

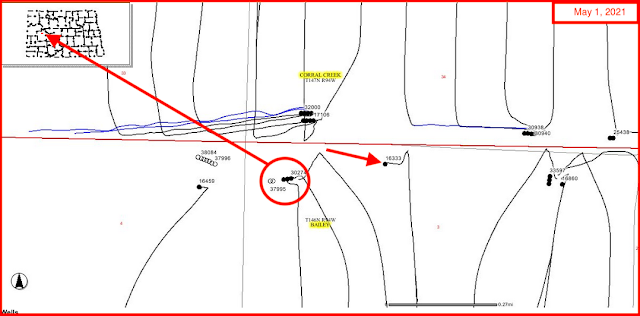

- sanctioning the Bakken (by shutting down the DAPL).